A chipmaker is charging higher after spinning out its robotics arm, a lithium heavyweight is back in the spotlight following an earnings beat, and a golden-arches icon may be ripe for a breakout after a fresh analyst upgrade. Here’s what traders are watching heading into the session.

Expert Stock List (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

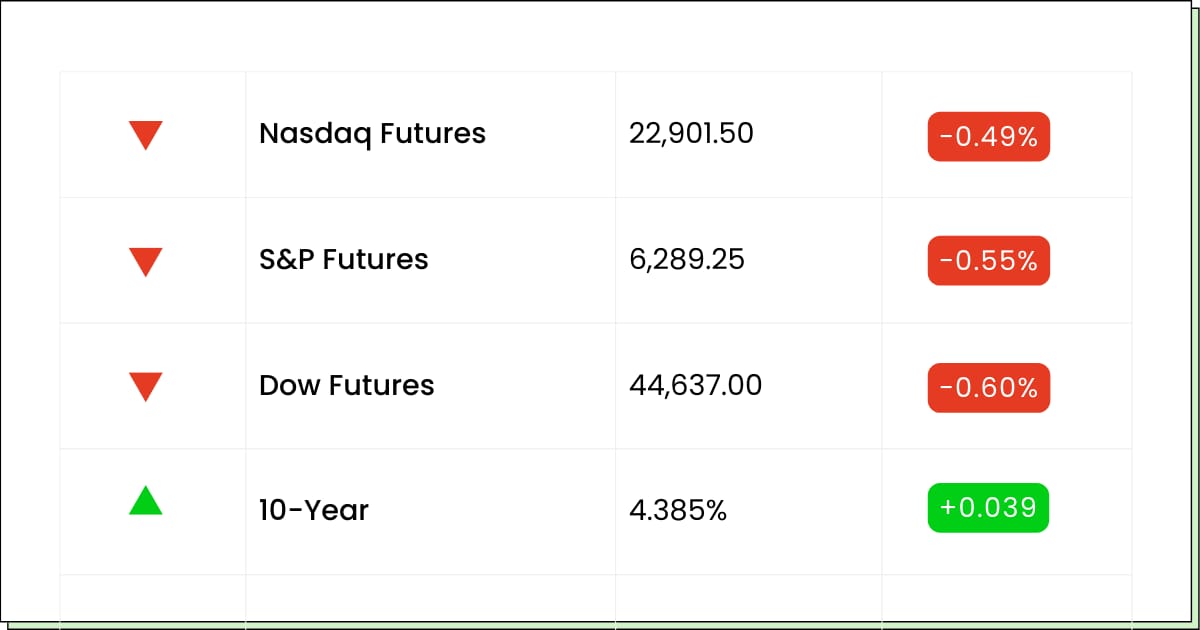

Futures 📈

Want to make sure you never miss a premarket alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Hingham Institution for Savings [HIFS]: Time Not Supplied

Unity Bancorp, Inc. [UNTY]: Time Not Supplied

GoldMining Inc. [GLDG]: Time Not Supplied

FingerMotion, Inc. [FNGR]: Time Not Supplied

TRX Gold Corporation [TRX]: Time Not Supplied

Lexaria Bioscience Corp. [LEXX]: Time Not Supplied

Economic Reports:

U.S. Federal Budget [June]: 2:00 pm

Future of AI (Sponsored)

It's lifting Artificial Intelligence to a new level — answering follow-up questions, admitting mistakes, challenging incorrect premises, rejecting inappropriate requests, and more.

That’s why this Special Report names and explains 5 tickers to lead the way.

Among them is a “Sleeper Stock” that is still cruising under Wall Street’s radar.

All 5 have exceptional profit potential. There couldn’t be a better time for this investor briefing.

Click here now to claim your copy FREE

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Technology

Intel’s Robotics Exit Could Spark Long-Term Upside for Undervalued Stock

Intel Corp. [INTC] is carving out a new lane in AI robotics, announcing Friday the spinout of its RealSense unit, an automation-focused venture backed by $50 million in fresh funding. The stock is down about 1% in premarket trading.

The move underscores Intel’s efforts to streamline operations and reposition itself within high-growth sectors after a rough 12-month stretch, where shares fell nearly 29%. Still, the stock is up 17.8% year-to-date, suggesting early signs of recovery and potential room to run.

RealSense, which develops 3D vision tech and automation hardware for robotics, will be led by Intel VP Nadav Orbach and counts MediaTek and Intel Capital among its Series A backers. The unit, now independent, aims to meet rising global demand from partners like Eyesynth and Unitree Robotics.

This comes as Big Tech players, including Nvidia and Amazon, place major bets on physical AI and humanoid automation, with some forecasts pegging the space as a $5 trillion market by 2050.

Intel still holds a minority stake in RealSense and continues to restructure, shedding non-core assets like Altera and trimming costs to better compete in the AI-driven chip space.

While challenges remain, today’s spinout gives investors a fresh narrative and a potential buying opportunity in a bellwether name trading well below last year’s highs.

Consumer Discretionary

McDonald’s Gets a Lift as Goldman Turns Bullish on Menu Momentum

McDonald’s Corp. [MCD] shares rose more than 2% Thursday after Goldman Sachs upgraded the stock to “Buy,” pointing to the company’s relative strength in an increasingly pressured fast food environment. It’s flat to slightly lower in premarket trading today.

Analyst Christine Cho held a price target of $345, implying nearly 18% upside from recent levels. With the stock up just 2% year-to-date and still trailing the broader S&P 500, McDonald’s may offer a rare entry point for investors looking for defensive exposure, steady dividends, and scale-driven growth.

Cho cited McDonald’s advantage in marketing, digital infrastructure, and menu agility as reasons it may outperform competitors amid cooling consumer demand.

One standout example: the return of the beloved Snack Wrap and additions like the Daily Double burger on the value platform, both of which are expected to boost traffic and same-store sales. Goldman sees early signs that these changes are helping McDonald’s gain share from smaller rivals, especially in the U.S.

The firm also noted McDonald’s has delivered more consistent mid-single-digit sales growth compared to other burger chains, many of which are slipping into stagnation or decline.

Combined with its 2.37% dividend yield, cost efficiencies, and global brand strength, McDonald’s looks well-positioned for a second-half rebound in 2025.

While the fast food industry faces headwinds from inflation and shifting consumer habits, McDonald’s scale and innovation engine may offer a buffer and a bargain.

For income investors and long-term holders, this blue-chip burger name could finally be heating up again.

Gold Trust Shift (Sponsored)

A quiet shift is happening in the financial system — and big banks are already making their move.

They’re now able to treat gold as a cash-equivalent asset, and they’re acting fast behind the scenes.

Meanwhile, millions remain heavily exposed to volatile paper assets. One economist recently warned that gold is now “the only money banks trust.”

There’s still time to take steps using a legal, IRS-approved strategy — one that avoids taxes or penalties while rebalancing toward more stable assets.

A free Wealth Protection Guide explains how to do exactly that.

[Click here to get your free copy]

P.S. Every day of delay gives institutions more time to get ahead. Take action while the window is still open.

Basic Materials

Jefferies Stays Bullish on Albemarle as it Looks to Recharge Momentum

Albemarle Corp. [ALB] popped more than 7% earlier this week after reporting stronger-than-expected earnings, with an EPS loss of just $0.18, well ahead of Wall Street’s projected $0.62 shortfall.

The stock is dipping in premarket trading about 3.3%, but the broader setup is intriguing: ALB remains down nearly 13% year-to-date and over 24% in the past 12 months, even after this rebound.

With a dividend yield of 2.18%, a lowered but still bullish $84 price target from Jefferies, and signs of operational progress, the stock could be setting up for a long-overdue breakout.

Investor optimism is being fueled by multiple signals: first, a narrower-than-expected loss in the most recent quarter, and second, strategic upgrades in lithium production technology that analysts believe may boost both margins and long-term output.

Jefferies reaffirmed its Buy rating, citing Albemarle’s leadership position in the global lithium supply chain, a critical industry as EV demand continues to expand globally.

Even amid pricing pressure and profitability challenges (e.g., a negative EBIT margin), Albemarle still posted $5.38 billion in trailing revenue and maintains a positive return on equity. The company’s next earnings report, due at the end of July, may serve as a catalyst if it confirms continued improvement or guidance revisions.

With lithium prices stabilizing and the basic materials sector gaining traction, ALB could attract value and income-focused investors looking for a high-quality, underperforming name to add to their rotation. After months in a downtrend, this name may finally be ready to turn the corner.

Movers and Shakers

Alaska Air Group Inc. [ALK] – Last Close: $54.18

Alaska Airlines has underperformed in 2025, but the tide may be turning. The airline is expected to post $3.66B in Q2 revenue, up 26% YoY, and its +3% Earnings Surprise Prediction from Zacks suggests a beat is likely. Analyst revisions have inched higher, and management has signaled improving demand for premium routes and summer travel.

The stock is slightly green in premarket as traders start to position ahead of the July 23 earnings report. Shares still sit well below their 52-week high, making ALK a potential rebound story if it can deliver even modest upside.

My Take: If Alaska clears the earnings bar and guides confidently, the rerating could be sharp. This is an intriguing play in the airline space, so watch for a post-report move.

Ford Motor Co. [F] – Last Close: $11.91

Ford is doubling down on hybrids and affordable EVs, with CEO Jim Farley hinting at a new low-cost model that could be the “Model T of EVs.” While the company’s EV unit is losing money, its truck-based hybrid dominance and commercial push are helping reshape the narrative. Ford commands 80% of the hybrid pickup market, and 25% of all F-150s sold now include hybrid systems.

Shares have cooled slightly in premarket after a 10% pop earlier this week, but analysts like Freedom Capital still have a $17 target on the stock. If Ford can deliver on its promise of a sub-$30K EV and lean further into hybrid demand, there could be significant upside left, especially with a 5% dividend for patient holders.

My Take: Ford isn’t chasing the EV hype, it’s building a smarter roadmap. With hybrids gaining traction and an affordable EV in the pipeline, F could be a dark horse winner in the next auto cycle.

Etsy Inc. [ETSY] – Last Close: $58.16

Etsy is regaining its groove. The handmade and vintage goods platform has seen an uptick in revenue and user growth, with Truist and Cantor both raising price targets in recent weeks. June card data shows marketplace revenue pacing ahead of expectations, while app traffic hit a 22-month high, reflecting improved discoverability and product quality.

Shares are up another 1.1% in premarket as momentum builds heading into Q2 earnings. Etsy also just priced $650 million in convertible notes, earmarking $175M for buybacks, a clear signal of confidence. If growth trends continue, ETSY could be setting up for a breakout.

My Take: With user engagement rebounding and ad efficiency improving, Etsy has quietly put together a solid turnaround. Still below its 52-week high, this could be a stealth winner in e-commerce.

AI (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Everything Else

Goldman’s AI pilot quietly marks a milestone as its autonomous coder starts shipping real software.

Trump’s latest move? A 35% tariff on Canadian imports, targeting key industries ahead of the election.

The Brazilian real tumbles while bitcoin holds near highs as markets weigh fresh trade risk.

BP flags a Q2 miss as weak oil and gas prices cut into earnings.

Dallas Morning News’s stock explodes 200% on takeover news, signaling renewed interest in local media.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.