A digital music firm is soaring on record user growth, a snack and beverage major is struggling with declining U.S. sales, a pharma giant is sliding on weak guidance, and an AI stock is surging after a strong earnings beat. Read on to find out more.

AI (Sponsored)

AI is moving fast. That’s why we started Mindstream, to help you stay on top of the rapid developments in the space and integrate AI into your work life successfully.

Don’t fall behind on AI - join 200,000+ daily readers in the Mindstream community.

The best part? It’s free.

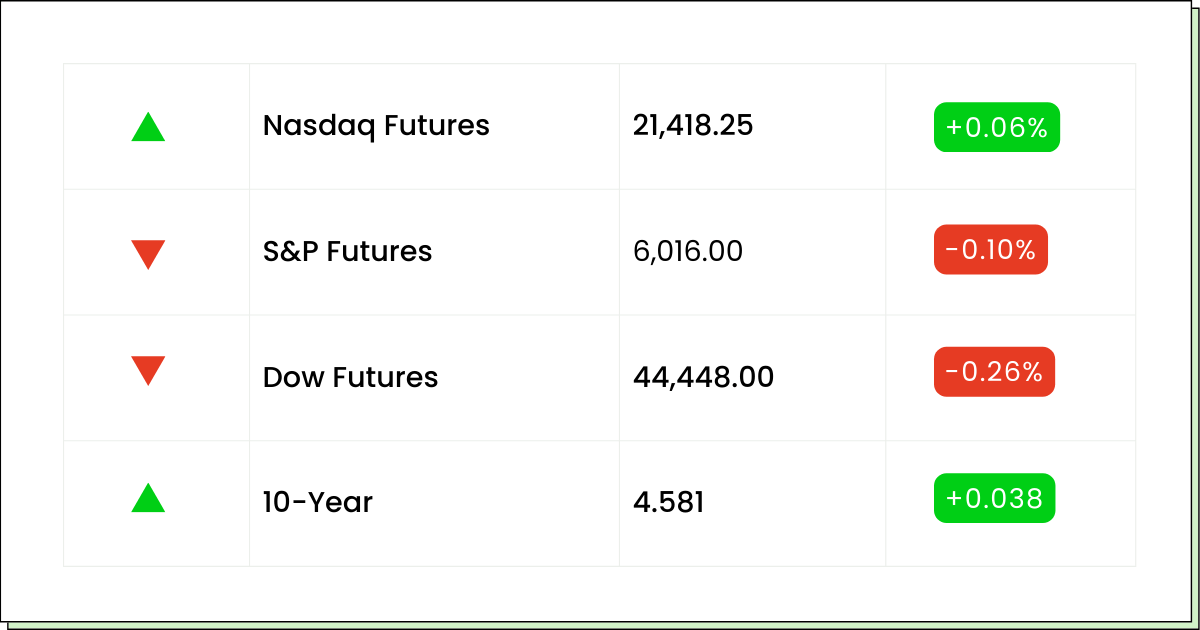

Futures 📈

What to Watch

Earnings:

Alphabet Inc (Google) Class C [GOOG]: Aftermarket

Advanced Micro Devices [AMD]: Aftermarket

Amgen [AMGN]: Aftermarket

Economic Reports:

Job openings [Dec]: 10:00 a.m.

Factory orders [Dec]: 10:00 a.m.

Pharmaceuticals

Merck Shares Plunge Over 8% After Q4 Earnings Miss and Weak 2025 Outlook

Merck & Co.’s [MRK] mixed fourth-quarter earnings are sending its stock down more than 8% in premarket trading today. The pharmaceutical giant’s adjusted earnings per share (EPS) of $1.72 is well below analyst expectations of $1.81.

However, revenue is higher than forecasts, reaching $15.6 billion compared to the projected $15.47 billion, marking a 7% year-over-year increase. For the full year 2024, Merck reported $64.2 billion in global sales, up 7% from the prior year. Excluding foreign exchange impacts, revenue grew by 10%.

The company’s top-selling cancer drug, KEYTRUDA, continued to be a major growth driver, with sales surging 18% to $29.5 billion. CEO Robert M. Davis highlighted strong performance across the company’s portfolio, including the successful launch of WINREVAIR and solid results in its Animal Health segment.

Despite these gains, Merck’s 2025 guidance is below Wall Street expectations, which is likely the cause behind the 8% decline in early trade today.

The company projects full-year adjusted EPS between $8.88 and $9.03, missing the consensus estimate of $9.21. Revenue is expected to range from $64.1 billion to $65.6 billion, also falling short of analysts’ projected $67.36 billion.

Adding to investor concerns, Merck has announced a temporary suspension of GARDASIL/GARDASIL 9 shipments to China starting in February 2025, which is factored into its guidance. While Merck remains optimistic about long-term growth, today’s outlook has weighed heavily on market sentiment.

Snacks and Beverages

PepsiCo’s Q4 Results Mixed as Snack and Beverage Demand Drops in US

PepsiCo’s [PEP] fourth-quarter earnings today are better than analyst expectations, but declining demand for snacks and beverages in North America continues to weigh on its performance.

The company’s adjusted earnings per share of $1.96 is higher than the projected $1.94. However, revenue is slightly below estimates, coming in at $27.78 billion compared to the expected $27.89 billion.

Net income is at $1.52 billion, or $1.11 per share, up from $1.3 billion, or 94 cents per share, a year ago. Organic revenue, which excludes acquisitions and currency fluctuations, increased by 2.1% in the quarter. Despite this, net sales declined 0.2%, marking continued struggles in the North American market.

Frito-Lay North America saw a 3% drop in volume as consumers cut back on snacks due to higher grocery prices and economic uncertainty.

The company’s North American beverage division also reported a 3% decline in volume, though brands like Gatorade gained market share, and Mountain Dew Baja Blast exceeded $1 billion in annual sales. Quaker Foods North America, still recovering from a December recall, posted a 6% volume decline but is expected to rebound in 2025.

For the full year 2025, PepsiCo forecasts a low-single-digit increase in organic revenue and mid-single-digit growth in core constant currency earnings per share. CEO Ramon Laguarta emphasized plans to strengthen international growth while working to improve North American performance.

PepsiCo’s stock is down by more than 2% in premarket trading.

Technology (Sponsored)

With Trump’s return, a $510 billion sovereign wealth fund just declared that the U.S. is about to enter “one of the best tech environments we’ve ever seen.”

And one company—flying under the radar—is perfectly positioned to capitalize on it.

This firm has already helped 45M+ users earn and save over $325M, turning smartphones into income-generating assets. With 32,481% revenue growth, it was named North America’s fastest-growing software company by Deloitte.

Now, with its Nasdaq ticker secured ($MODE) and shares available at just $0.26, early investors have a chance to get in before the market catches on.

The last time we had a pro-business administration, tech stocks like Tesla soared 1,200%+.

Could this be the next breakout winner?

Digital Music

Spotify Surpasses 675 Million Users, Shares Surge on Positive Outlook

Spotify [SPOT] stock is surging more than 8% in premarket trade today upon fourth-quarter earnings that are higher than expected, marking its first full-year profit.

The streaming giant posted a Q4 profit of €367 million ($379 million or $1.82 per share), a sharp turnaround from the previous year's €70 million ($72.2 million) loss. However, earnings are slightly below analyst estimates of €1.89 ($1.95) per share.

Monthly active users (MAUs) climbed by 35 million to reach 675 million, surpassing projections of 665 million and setting a record for Q4 growth.

The company projects 678 million MAUs in Q1 2025, also ahead of estimates. Gross margins expanded to an all-time high of 32.2%, reflecting Spotify’s aggressive cost-cutting measures and restructuring efforts throughout 2024.

Spotify has undergone a major transformation, including layoffs, leadership changes, and a strategic pivot away from podcasts. These moves have helped its stock rebound significantly, with shares up 150% over the past year.

The company has also finalized a multiyear distribution deal with Universal Music Group, which includes compensation for artists and enhanced access to exclusive releases. Analysts remain uncertain about the financial impact but suggest the agreement likely provides mutual benefits.

Looking ahead, Spotify expects Q1 gross margins to be 31.5%, slightly below Q4 but above Wall Street’s 31.2% forecast.

Pharmaceuticals

Pfizer Stock Rising Upon Stronger-Than-Expected Q4 Earnings

Pfizer’s [PFE] fourth-quarter earnings are higher than analyst expectations, driven by strong sales of its heart disease treatment and a smaller-than-expected decline in COVID-19 vaccine revenue. The pharmaceutical giant’s adjusted earnings per share of $0.63 are above the projected $0.47.

Total revenue for the quarter is at $17.76 billion, beating estimates of $17.36 billion. Despite this positive result, Pfizer continues to face investor skepticism regarding its ability to offset looming revenue losses as key drugs approach patent expiration.

Following the pandemic-driven surge in demand for its COVID-19 products, Pfizer has struggled to maintain growth momentum. Investors are watching closely to see if the company’s recent acquisitions and R&D investments will drive long-term returns.

Pfizer’s stock, which fell nearly 8% last year, is rising about 2% in premarket trading today. However, shares remain at less than half their peak value during the height of the pandemic.

As the company looks ahead, it must prove that its pipeline of new treatments and strategic investments will sustain growth beyond the COVID-19 era. While today’s earnings report provided a short-term boost, analysts remain focused on Pfizer’s ability to execute its long-term strategy.

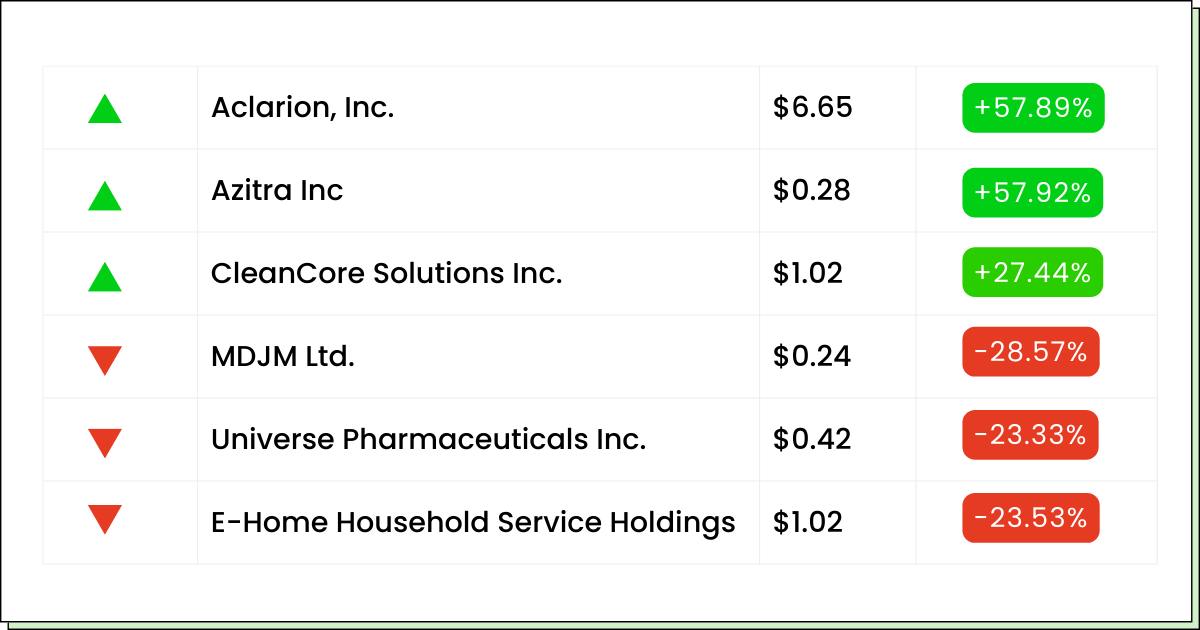

Movers and Shakers

Invivyd, Inc. [IVVD] - Last Close: $1.06

Invivyd is a biotech company developing monoclonal antibody treatments as alternatives to traditional COVID-19 vaccines. Its stock is surging 20% in premarket trading today, extending its massive Monday rally after the company reported positive clinical data for its latest candidate, VYD2311, in an ongoing Phase 1/2 trial.

My Take: The trial results are positive news for IVVD but keep in mind this is a tiny stock with high volatility, and as a clinical stage firm it has very little to show in terms of revenues. Keep it in wait and watch mode for now.

Palantir Technologies Inc. [PLTR] - Last Close: $83.74

Palantir Technologies offers AI-driven data analytics solutions for government departments and large enterprises. Its shares are surging by over 23% in early trading after it delivered a strong revenue forecast yesterday, fueled by rising demand for its AI and analytics software.

My Take: Palantir is riding the AI investment boom, but its high valuation (P/E 400+) suggests expectations are sky-high. This stock definitely needs to be on your radar.

ZenaTech, Inc. [ZENA] - Last Close: $4.34

ZenaTech is a technology company specializing in AI-driven drones, drone-as-a-service (DaaS), enterprise SaaS, and quantum computing solutions. Its shares are surging in premarket trade after the company announced its fifth land survey acquisition, reinforcing its DaaS expansion strategy.

My Take: ZenaTech’s DaaS model combines two hot ideas—AI and drone tech. However, its stock has been struggling recently (down 56% YoY) and profit margins have tumbled in the last three quarters. Keep a close eye on this one.

Tech Stock to Watch (Sponsored)

Trump’s pro-business policies could ignite one of the biggest tech surges in U.S. history—and smart investors are already making their move.

A fast-growing company has developed technology that pays Americans for their phone usage, already benefiting 45M+ users and driving explosive growth.

With a Nasdaq listing secured and shares at just $0.26, this stock could be one of the biggest breakout plays of the year.

Everything Else

Strong deal flow and asset sales drive KKR’s fourth-quarter earnings.

Google faces an antitrust probe as China targets more U.S. firms in the trade dispute.

Apollo sets sights on $1.5 trillion in assets as inflows drive a strong quarter.

PayPal beats revenue estimates but faces an earnings setback in Q4.

Ferrari’s earnings climb 21% with high-end models and customization driving sales.

Clorox reports higher profits but struggles with declining sales in key segments.

Chipmaker NXP beats earnings expectations but warns of slower growth ahead.

Healthpeak raises its financial guidance as healthcare real estate demand remains strong.

Gartner’s revenue forecast disappoints despite strong quarterly earnings.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

📧 Like newsletters? Here are some newsletters our readers also enjoy. Explore

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.

*Standard message/carrier rates may apply.

Legal Stuff: Stocks featured in this newsletter are for entertainment purposes only. You should not base any investment decisions on information contained in my newsletter. Stocks featured in this newsletter may be owned by owners/operators of this website, which could impact our ability to remain unbiased. Please consult a financial advisor before making any trading decisions. I may earn a small commission from links placed inside these emails.