An energy giant is rallying after a legal win cleared the path for a $53 billion acquisition, a power producer is charging higher on a multibillion-dollar infrastructure deal, and an offshore driller just gained partial court approval to revive a long-dormant pipeline. Here’s what traders are watching this morning.

Next AI Boom (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

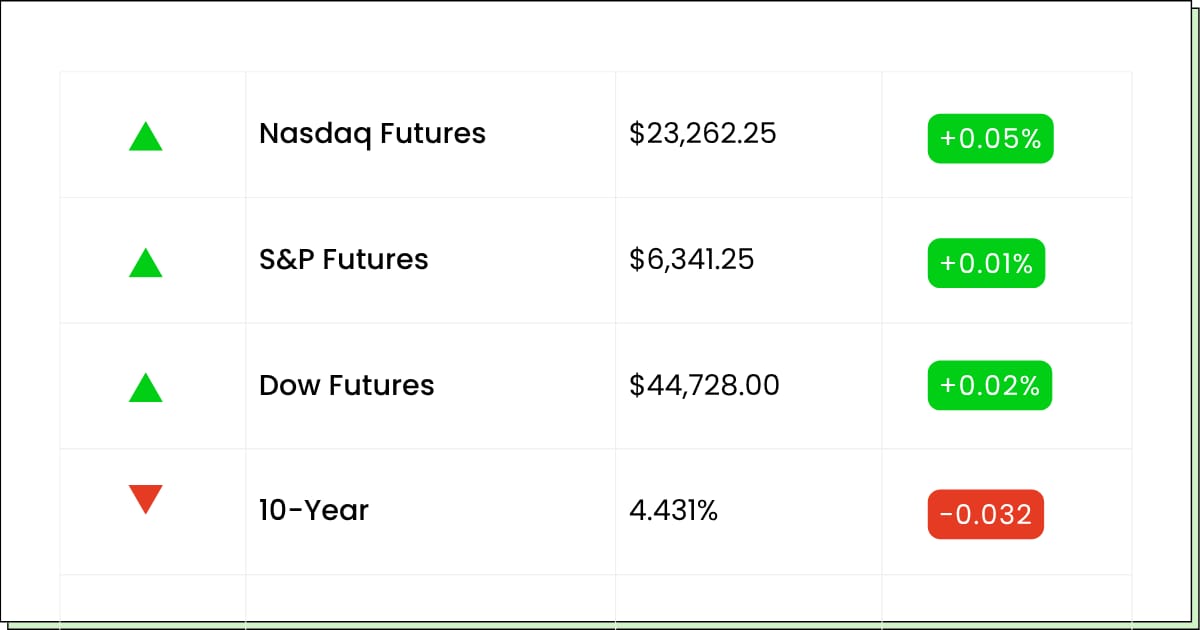

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

American Express Company [AXP]: Premarket

The Charles Schwab Corporation [SCHW]: Premarket

3M Company [MMM]: Premarket

Truist Financial Corporation [TFC]: Premarket

Schlumberger N.V. [SLB]: Premarket

Huntington Bancshares Incorporated [HBAN]: Premarket

Regions Financial Corporation [RF]: Premarket

Ally Financial Inc. [ALLY]: Premarket

Autoliv, Inc. [ALV]: Premarket

Comerica Incorporated [CMA]: Premarket

Veritex Holdings, Inc. [VBTX]: Premarket

Sify Technologies Limited [SIFY]: Premarket

Economic Reports:

Housing Starts [June]: 8:30 am

Building Permits [June]: 8:30 am

Consumer Sentiment (Prelim) [July]: 10:00 am

Exit the Chaos (Sponsored)

Markets don’t wait for calm—especially when political chaos takes center stage.

With Trump and Musk locked in a growing public feud, the fear of market volatility is very real.

While the headlines escalate, institutions are quietly stockpiling gold to shield against the blowback.

This free Gold IRA Survival Guide outlines a fully legal way to reposition your savings now—without taxes or penalties.

Get ahead of the next wave before the damage becomes irreversible.

[Get the Gold Protection Guide Free]

Energy

Talen Energy Charges Ahead 17% on AI-Driven Deal

Talen Energy Corp. [TLN] is lighting up the tape, climbing more than 17% in Friday’s premarket session after unveiling a major $3.5 billion acquisition that positions it at the center of the energy-AI convergence.

The company announced it will purchase two natural gas-fired power plants, Moxie Freedom in Pennsylvania and Guernsey Power in Ohio, from Caithness Energy and BlackRock. The deal is expected to boost Talen’s annual energy output by nearly 50%, from 40 to 60 terawatt-hours.

More important than scale, though, is strategy. Talen is clearly gearing up to meet the surging electricity demands of AI data centers, which require uninterrupted, dispatchable power.

These newly acquired facilities are situated within the PJM Interconnection, the largest U.S. power grid, and are powered by the Marcellus shale region, providing operational and economic benefits. Management noted the assets were secured at a discount, costing only 50–65% of what equivalent new-build projects would require.

Talen already has a power supply agreement with Amazon, and this deal expands its ability to meet similar high-demand contracts.

The move follows a string of power sector acquisitions as utilities race to align with AI growth trends. CEO Mac McFarland likened the deal to “adding another nuclear plant” to the portfolio, without the construction timeline or regulatory hurdles.

With sentiment strongly bullish and shares already up over 24% year-to-date (before the premarket move), investors will be watching whether the deal closes on time and what additional AI-linked contracts Talen might announce in the coming months.

Oil & Gas

Hess Clears 7% Higher as $53B Chevron Takeover Gets Green Light

Hess Corp. (HES) shares are up more than 7% in Friday’s premarket session after an international arbitration panel ruled in favor of its $53 billion acquisition by Chevron, removing a key legal obstacle that had delayed the deal for months.

The dispute centered on ExxonMobil’s claim to a right of first refusal over Hess’s stake in the Stabroek block, a highly valuable offshore project in Guyana. The International Chamber of Commerce determined that the clause did not apply to the sale of Hess’s entire business, allowing Chevron’s acquisition to proceed.

The decision resolves strategic overhangs that had pressured Hess’s valuation and Chevron’s execution timeline since late 2023.

Chevron had previously warned it would walk away from the deal if the ruling went against Hess. With the legal barrier cleared, investors are now anticipating deal closure in the coming months, along with potential synergies from Hess’s growing Guyana operations.

The decision also marks a setback for ExxonMobil, which had sought to maintain tighter control over the Guyana asset.

The arbitration victory reinforces Chevron’s positioning in one of the world’s fastest-growing energy regions and paves the way for the integration of Hess’s long-term offshore growth pipeline.

Hidden Asset (Sponsored)

While banks quietly shift toward gold-backed assets, most Americans remain exposed to high-risk paper investments.

One leading economist says gold is now “the only money banks trust.”

There’s still time to position yourself—using an IRS-approved strategy that protects your savings without triggering taxes or penalties.

This FREE Wealth Protection Guide reveals how to make the move before it’s too late.

P.S. Every day you wait, the insiders keep gaining ground. Get informed before the next big move.

Energy

Sable Offshore Pipeline Hope Propels 28% Rally

Sable Offshore Corp. [SOC] surged more than 28% Thursday and gained another 6% in early premarket trading Friday after securing a partial legal victory tied to its long-idled Las Flores Pipelines. The California court ruling grants the company permission to begin key preparations for a potential restart, without allowing actual operations just yet.

The pipelines, connected to the Santa Ynez offshore platforms, have been offline since a 2015 oil spill. In 2024, Sable acquired the assets, sparking both investor interest and environmental lawsuits.

The new ruling lets Sable move forward with permit applications and infrastructure readiness, provided it gives 10 days’ notice before resuming flows. While the court acknowledged environmental concerns under CEQA and other regulations, it allowed limited activities to proceed, marking the first meaningful progress in years.

The Las Flores infrastructure is viewed as a key unlock for Sable’s broader offshore strategy. With oil prices recovering and U.S. energy policy pivoting toward fossil fuel security under the Trump administration, the company may have regulatory tailwinds to work with.

However, legal risks remain: the court declined to dismiss challenges entirely, and a full restart will require more approvals.

Still, the market cheered the direction of travel. The ruling signals judicial openness to compromise and gives Sable a roadmap to proceed.

With SOC trading near its post-IPO highs and investor chatter spiking, the focus now shifts to how fast the company can execute and whether more legal clarity arrives in the weeks ahead.

Movers and Shakers

CRISPR Therapeutics AG [CRSP] – Last Close: $55.09

CRISPR Therapeutics is a leading player in gene editing, developing transformative medicines using CRISPR-Cas9 technology. Its pipeline includes treatments for blood disorders, cancer, and rare genetic diseases. Despite mixed sentiment from analysts regarding the commercial viability of its lead therapies, the stock is gaining momentum due to renewed investor confidence.

Shares are up almost 5% premarket after Director Simeon George disclosed a $51.5 million insider buy, acquiring nearly one million shares. The move comes just days after a clinical update on CTX131, a treatment targeting blood cancers, and may signal growing belief in the platform’s long-term potential.

My Take: Large insider buys like this are often seen as bullish signs, especially for early-stage biotech firms with promising but unproven pipelines. CRSP looks like a speculative buy with asymmetric upside if it can translate scientific leadership into commercial breakthroughs.

Interactive Brokers Group, Inc. [IBKR] – Last Close: $59.43

Interactive Brokers is a leading electronic trading platform recognized for its low fees, robust technology stack, and global reach. It serves retail, institutional, and professional traders with services ranging from equity execution to margin lending.

The stock is up over 5% premarket after reporting blowout Q2 earnings. EPS came in at $0.51, topping the $0.46 consensus, while revenue jumped 20% year-over-year to $1.48 billion. Net interest income rose 9%, customer accounts increased by 32%, and margin balances ended the quarter at $65.1 billion, indicating strong client activity and improved trading engagement.

My Take: With strong pretax margins (75%) and rising customer equity, IBKR appears well-positioned to benefit from any pickup in trading volumes or volatility. The retail engagement story is very much alive, and this name could keep climbing into Q3.

Snap-On Inc. [SNA] – Last Close: $337.80

Snap-On manufactures and distributes tools, diagnostics, and repair equipment for professional technicians, particularly in the automotive and aviation sectors. Known for its high-margin industrial products, the company operates with impressive consistency and brand strength in a niche market.

Shares rose nearly 8% post-earnings after the company beat expectations with adjusted EPS of $4.72 versus the $4.63 estimate. While earnings declined from last year’s $5.07, revenue held steady at $1.18 billion, beating Wall Street’s forecast. Analysts at Barrington and Longbow maintained bullish outlooks with price targets between $350 and $400.

My Take: SNA may not be a high-growth tech stock, but it delivers reliable profits and strong cash flow. With recent analyst upgrades and solid execution despite economic headwinds, it could attract value-oriented investors looking for stability with upside.

Q2 Picks (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Everything Else

U.S. drugmakers rush to import Irish meds as tariff fears grow.

Honda looks to sidestep tariffs by ramping up U.S. car production.

Pinnacle outperforms on earnings but misses revenue expectations in Q1.

FB Financial matches earnings expectations but misses slightly on revenue in Q1.

Kestra’s stock dips after it projects a major sales jump but reports a $21.8 million net loss.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.