Good morning. It’s September 6th, and today we’ll cover the escalating semiconductor war between the U.S. and China, Broadcom’s plunge after reporting disappointing earnings, and Apple’s latest woes in China.

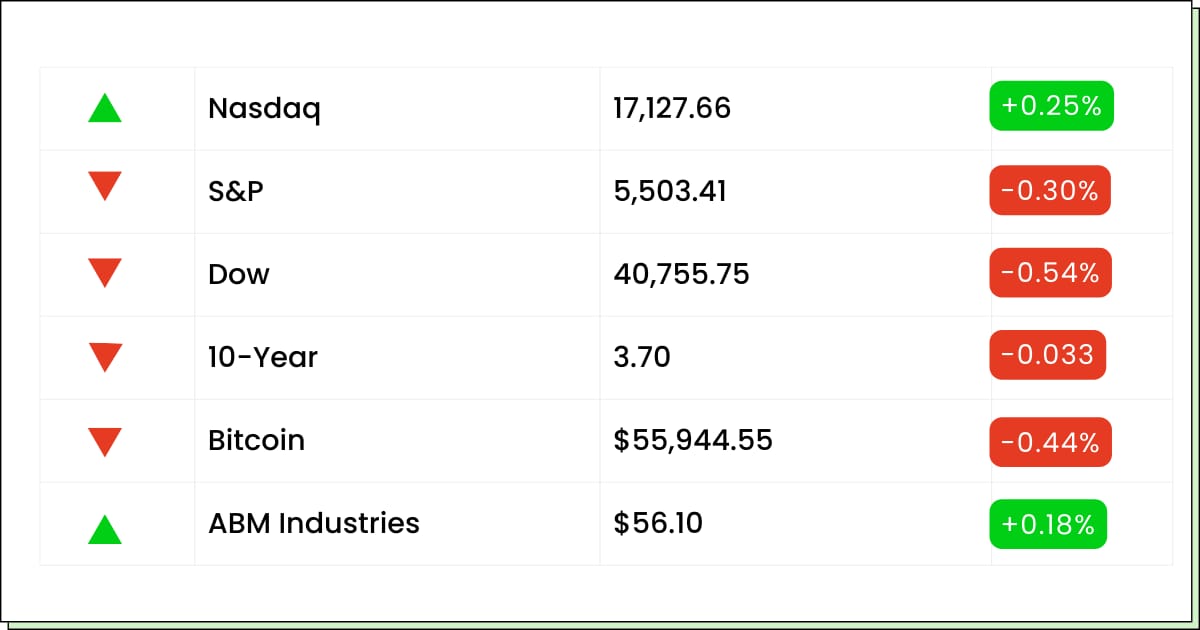

Previous Close 📈

The three key indices might be heading into Friday looking at a losing week. Nasdaq is already down 3.3%, and the S&P 500 is also in the red by 2.6%. The Dow is down by 1.9% as well.

Futures

Stock futures are declining today as investors await the key August jobs report for more insights into the health of the U.S. economy. While futures linked to the S&P 500 index are down 0.6%, Dow Jones Industrial Average futures are falling by 118 points, and Nasdaq 100 futures are dropping by 1.1%.

What to Watch

The key numbers to watch out for today will be the U.S. employment report for August, which will be released at 8:30 a.m.

A little later, at 8:45 a.m., New York Fed President Williams will give a speech, followed by another speech from Federal Bank Governor Christopher Waller at 11:00 a.m.

Three firms, ABM Industries (NYSE: ABM), Brady (NYSE: BRC), and Genesco (NYSE: GCO) will also release their quarterly numbers before the market opens for trade.

For too long, hedge funds and pre-IPO opportunities have been reserved for the ultra-wealthy, making it nearly impossible for accredited investors like you to access them. Missing out on these high-potential investments can limit your portfolio's growth and diversification.

Now, you can finally break through those barriers. This platform provides easy access to exclusive hedge funds and alternative investments, giving you the opportunity to grow your wealth and secure your financial future.

Semiconductors

Broadcom's Revenue Forecast Disappoints Despite AI Chip Boom

Broadcom shares are falling by nearly 9% in premarket trading after the chipmaker's fourth-quarter revenue forecast came in slightly below Wall Street expectations.

Despite a notable increase in demand for its artificial intelligence (AI) chips, the company faces sluggish spending in its broadband segment, which has dampened overall financial performance.

The California-based semiconductor firm projected revenue of approximately $14 billion for the upcoming quarter, slightly below analyst predictions.

This cautious outlook has sparked concerns among investors who have set high expectations for AI-linked companies like Broadcom, hoping for substantial growth driven by AI technology and chips.

However, Broadcom's results indicate a mixed picture. While the company raised its forecast for annual AI revenue from $11 billion to $12 billion, buoyed by rising orders for its custom chips and AI networking equipment, other segments performed poorly.

On a post-earnings call, executives reported a 49% decline in broadband revenue and a 41% drop in non-AI networking revenue, highlighting a disparity in growth across different business units.

Technology

iPhone 16 Launch in China Lacks AI Feature, Boosts Competitors Like Huawei

Apple's upcoming iPhone 16 launch faces significant competitive challenges in China, with analysts pointing to pressure from local smartphone makers like Huawei and uncertainty over the availability of its Apple Intelligence feature in the region.

The launch, scheduled for September 9, California time, comes just hours before Huawei’s event on September 10, where the Chinese tech giant is expected to unveil a new “tri-fold” smartphone.

Apple has seen its sales dip in the Chinese market, falling out of the top five smartphone vendors by shipments. The launch of the iPhone 16 could face further hurdles due to questions about whether Apple can introduce its Apple Intelligence feature in China.

The AI feature relies on OpenAI's GPT models, which are restricted from commercial availability in the country due to local regulations.

China maintains tight control over which generative AI models can be deployed domestically, only approving those developed by local companies.

Unlike Samsung, which partnered with Baidu for AI integration, Apple has not disclosed how it plans to bring its AI capabilities to Chinese users, potentially putting it at a disadvantage.

Semiconductors

Biden Administration Aims to Block China's Tech Advancements With New Export Curbs

The Biden administration is gearing up to impose new export restrictions on critical technologies, including quantum computing and semiconductor components, in a strategic move to limit technological advancements in China and other perceived adversarial nations.

The new rules, which target quantum computers, advanced chipmaking tools, and cutting-edge semiconductor technology like gate-all-around, also cover exports worldwide.

However, the U.S. Commerce Department announced that countries that adopt similar restrictions, such as Japan and the Netherlands, will receive licensing exemptions.

The U.S. seeks to align with key allies, encouraging them to join its initiative by offering more lenient license approvals. This move is part of a broader effort to curtail China’s access to advanced technologies essential for artificial intelligence and other high-tech sectors over concerns that these could be used to enhance Beijing’s military capabilities.

ASML Holding NV, a key supplier of chipmaking equipment, revealed that it would now seek approval from the Dutch government instead of the U.S. for shipping certain types of machines.

Taiwan has also indicated it will likely follow Washington’s lead on the new export controls, as stated by its Minister of Economic Affairs, Kuo Jyh-huei.

Responding to these developments, Chinese Foreign Ministry spokeswoman Mao Ning criticized the U.S. for turning trade and technology into political issues and "weapons," arguing that such moves disrupt global economic cooperation and supply chains, which benefits no one.

Looking for stocks that pay you just for owning them? While the S&P 500 offers under 1.5% yield, there are hidden gems with yields of 5% or more.

Sure Dividend has compiled a free spreadsheet of 200+ high-yield stocks, packed with essential metrics.

Movers and Shakers

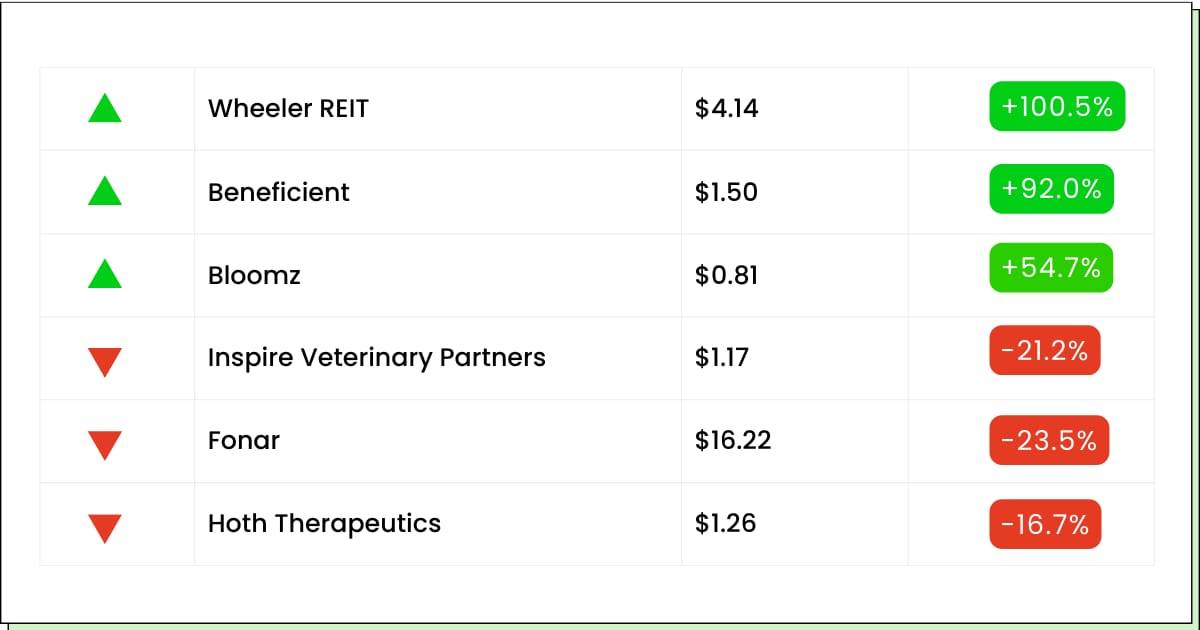

BloomZ Inc. [BLMZ] - Last Close: $0.81

BloomZ is up by 55% so far in premarket trading.

The company announced a strategic alliance with CrossVision, a digital entertainment company specializing in Web 3.0 technology, yesterday.

This partnership will enhance fan engagement through interactive content, live events in the metaverse, and digital item ownership, opening up new revenue streams.

Investors are viewing this alliance as a significant step towards leveraging blockchain to connect fans with their favorite animations and VTubers.

My Take: The stock was listed earlier this year, and after the initial IPO hype, there hasn’t been much to talk about. Exercise caution if you wish to buy this one.

Wheeler Real Estate Investment Trust, Inc. [WHLR] - Last Close: $4.14

Wheeler REIT stock is surging close to 100% in premarket trading.

A lawsuit filed by Cedar Realty's preferred stockholders against Cedar, Wheeler, and Cedar's former board of directors has been rejected by the court.

The lawsuit alleged breach of contract and fiduciary duty related to Cedar's preferred stock terms and included tort claims against Wheeler, which acquired all of Cedar's outstanding common stock in 2022.

The appellate court dismissed the case, stating that the plaintiffs failed to prove any legal violation and were simply unhappy with the terms they had agreed upon.

My Take: The REIT stock was trading at above $1,000 at one point but has had a precipitous fall and is struggling right now. I would put this one on my wait-and-watch list.

Argan, Inc. [AGX] - Last Close: $71.38

Shares of Argan are up nearly 20% before the opening bell today.

The company reported strong second-quarter financial results that exceeded expectations yesterday.

Argan posted earnings of $1.31 per share, beating analysts’ estimate of 92 cents per share.

The company's quarterly sales came in at $227.015 million, surpassing the expected $183.550 million. These better-than-expected results have driven a sharp rise in the stock price.

My Take: Argan is already up by more than 50% on YTD and the latest financial returns only confirm its long-term potential. This is an exciting one to keep on your radar.

Jeff Brown’s previous AI predictions have given everyday folks the chance to:

Double their money…

Triple their money…

Make five times their money…

And more.

To get his latest forecast—including why you should NOT pour all your money into NVIDIA right now...

Everything Else

A U.K. watchdog raised concerns about Google's advertising practices, citing unfair competition.

ASML faces export restrictions as the Netherlands blocks the shipment of chip-making machines to China.

Pavel Durov criticized France's charges against him and pledged stronger action against illicit activities.

Seven & i dismissed Couche-Tard's $38.6 billion acquisition bid.

Macron appointed Barnier as the French PM amid political impasse.

Brent crude nears $73 as concerns over demand overshadow the OPEC+ decision.

Toyota revised its EV output strategy amid sluggish sales momentum.

Germany rejected €18 million in carbon credits over Chinese green fraud.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.