A construction supplier is defying headwinds with stronger-than-expected results and a bullish forecast, a crypto miner turned AI player is rallying on buyout buzz, and a global sportswear brand is turning the corner after a rough stretch. Here’s what’s moving the market this morning.

U.S. AI Surge (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

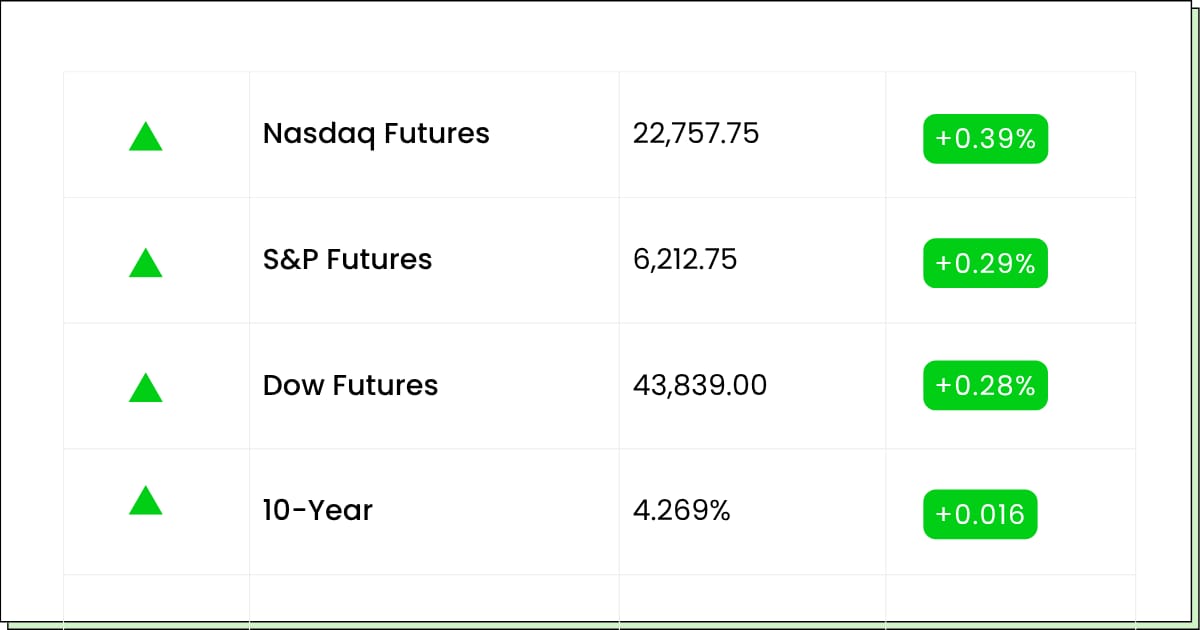

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Apogee Enterprises, Inc. [APOG]: Premarket

Cineverse Corp. [CNVS]: Aftermarket

Economic Reports:

Personal Income [May]: 8:30 am

Personal Spending [May]: 8:30 am

PCE Index [May]: 8:30 am

PCE (Year-over-Year): 8:30 am

Core PCE Index [May]: 8:30 am

Core PCE (Year-over-Year): 8:30 am

Consumer Sentiment (Final) [June]: 10:00 am

Free Gold Guide (Sponsored)

A quiet shift is happening in the financial system — and most investors haven’t noticed.

Starting this July, major banks will be allowed to treat physical gold as cash-equivalent assets. Behind the scenes, many are already taking action.

Meanwhile, millions remain locked into paper assets that continue to swing with volatility.

One respected economist recently said gold is now “the only money banks trust.”

A free Wealth Protection Guide is now available, showing how to legally reposition assets before this shift takes hold — using a method that avoids taxes or penalties.

[Click here to access the guide]

P.S. Every day of delay gives the insiders more ground. The window is closing — act before July hits.

Industrial Manufacturing

Apogee Climbs 16% After Raising Full-Year Forecast

Apogee Enterprises (APOG) surged almost 16% in premarket trading Friday after delivering stronger-than-expected fiscal Q1 results and raising its full-year outlook.

The architectural products maker posted adjusted earnings of $0.56 per share, well ahead of the $0.49 consensus estimate. Revenue climbed 4.6% year over year to $346.6 million, topping forecasts of $331.1 million.

The company credited strong performance in its Architectural Services and Performance Surfaces divisions, with the latter boosted by its recent acquisition of UW Solutions.

Despite softness in Architectural Metals and Glass, Apogee raised its fiscal 2026 guidance across the board. It now expects revenue between $1.40 billion and $1.44 billion and adjusted EPS between $3.80 and $4.20, up from prior ranges.

Tariff headwinds remain a concern, with an anticipated $0.35 to $0.45 per share impact, mostly frontloaded in the fiscal year.

But management remains confident in margin recovery as the year progresses. Backlog in key segments remains healthy, and despite a dip in adjusted EBITDA margin, Apogee continues to execute well in a mixed macro environment.

Crypto

Core Scientific Soars 33% on Buyout Buzz from CoreWeave

Core Scientific (CORZ) jumped 33% on Thursday following a Wall Street Journal report that AI infrastructure heavyweight CoreWeave is in advanced talks to acquire the bitcoin mining and data hosting firm.

The deal, which could close in the coming weeks, would mark a significant milestone in Core Scientific’s dramatic pivot from bankruptcy to AI infrastructure powerhouse.

The two companies have an existing partnership valued at over $10 billion in revenue commitments, with Core Scientific repurposing parts of its mining operation to host compute-heavy AI workloads.

The potential acquisition comes about a year after CoreWeave’s earlier bid was rejected, which was an offer that valued the company at less than a quarter of its current market capitalization of $5 billion.

Core Scientific’s stock was briefly halted on the news before ripping to its second-best trading day since rejoining the Nasdaq in early 2024.

The rally underscores investor enthusiasm for companies pivoting from crypto mining to AI data centers, a trend gaining traction across the sector as firms chase higher-margin growth.

Analysts remain cautious, however, noting that AI demands often require purpose-built infrastructure beyond simple mining retrofits.

The stock is up another 7% in premarket trading.

Investor’s Edge (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Retail

Nike Surges on Q4 Beat Despite $1B Tariff Hit

Nike (NKE) posted better-than-expected results for its fiscal fourth quarter, helping shares jump nearly 10% in premarket trading as the company works through a multiquarter reset.

While quarterly revenue fell 12% year over year to $11.10 billion, that still beat consensus estimates of $10.72 billion. Earnings per share came in at $0.14, just ahead of the $0.13 forecast.

The quarter marked the steepest impact from Nike’s ongoing turnaround plan, with profits plunging 86% from the prior year. Still, management struck a more optimistic tone on the road ahead, forecasting moderating sales and profit declines for the coming quarters.

Stores remained a bright spot, with physical retail sales up 2%, despite a 26% decline in digital revenue and a 9% drop in wholesale.

Tariffs will remain a headwind, as Nike expects to incur an additional $1 billion in costs this year, but plans to offset them through price increases, supply chain adjustments, and renewed wholesale partnerships.

The company is also expanding distribution through Amazon and fashion retailers like Aritzia and Urban Outfitters, while refocusing on performance innovation and athlete-first product lines.

Nike’s leadership emphasized that the worst is likely behind them, as they look to restore momentum in North America and reignite growth in China and apparel.

Movers and Shakers

Atlantic Union Bankshares Corporation [AUB] – Last Close: $31.43

Atlantic Union Bankshares is a regional financial institution providing commercial and retail banking services across the mid-Atlantic. It has been expanding steadily, with a solid dividend yield and a strong balance sheet.

Shares are up 9.3% in premarket trading following an upgrade from Raymond James, which cited stabilizing net interest margins and improving loan growth in key markets. The firm also highlighted AUB's lower credit risk relative to its peers and its strong deposit franchise as positives in the current rate environment.

My Take: AUB is quietly outperforming among regionals, and its fundamentals look increasingly attractive. With rates stabilizing and investor appetite returning to financials, this may be one to watch for continued upside.

Cipher Mining Inc. [CIFR] – Last Close: $4.19

Cipher Mining is a Bitcoin mining company focused on operating high-efficiency data centers powered by low-cost energy sources. It is one of the better-capitalized names in the crypto infrastructure space.

The stock is up 3% in premarket trading as Bitcoin prices edge higher and mining economics improve. The recent rally in AI-linked hosting companies has also spilled over into crypto miners, some of which are pivoting toward hybrid models that serve both markets.

My Take: With a $1.4B market cap and room to scale, CIFR is a potential breakout candidate if crypto momentum continues. It’s still a volatile name, but its infrastructure-first approach could set it apart from weaker miners.

AeroVironment, Inc. [AVAV] – Last Close: $272.37

AeroVironment develops unmanned aircraft systems and tactical missile systems, serving defense and security clients worldwide. The company has seen a rise in demand for its drones amid heightened global tensions.

Shares gained 4.6% in premarket after the Pentagon confirmed a $250M contract extension for tactical systems, with analysts highlighting AVAV’s growing role in international drone sales. The company has also recently reaffirmed its strong full-year guidance, citing a robust order flow.

My Take: AVAV continues to benefit from the defense-tech renaissance. With solid revenue visibility and a long tailwind from global military demand, it’s one of the more stable growth names in the sector. I’d keep your eye on this one.

Crypto Rotation (Sponsored)

Bitcoin is breaking records. But behind the scenes, a different story is unfolding — one that could catch many investors off guard.

Altcoins are quietly staging their own rally:

→ 100%, 300%, even 1,000%+ moves in some cases

→ Inflow records from major institutions

→ Policy changes accelerating mainstream crypto adoption

A new report reveals how to navigate the current setup — and how to potentially position ahead of what could be a massive rotation into select altcoins.

This updated crypto guide includes:

✔ The signals behind explosive altcoin moves

✔ A simple approach to identifying pre-run momentum

✔ The #1 altcoin setup right now — revealed as a free bonus

Access to this complete research package is just $5.60, but only for the next 48 hours.

[Get instant access here]

Everything Else

China and the U.S. finalize a London trade deal aimed at cooling tensions and stabilizing global markets.

Investors pile into Xiaomi as its EV launch sends shares surging and buzz grows around its second model.

Exelon raises its guidance on the back of renewable momentum and grid expansion efforts.

Xiaomi undercuts Tesla again with the debut of a lower-priced EV for Chinese drivers.

Santos enters exclusive talks with an ADNOC-led group over a potential multibillion-dollar takeover.

Markets drift globally as oil slips and traders await key inflation data.

Nvidia rockets to $3.8 trillion in market value after a 63% rebound from this year’s low.

HDB’s $1.5B India IPO sells out fast as wealthy investors crowd in.

Alibaba reshuffles leadership, promoting its e-commerce chief and streamlining its executive team.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.