Good morning. It's November 13th, and today we’ll look at why Spotify and space firm Rocket Lab are surging in premarket trade. We’ll also cover a tiny battery technology firm that is doubling itself in premarket trading today.

Previous Close 📈

Stocks took a pause on Tuesday from their recent postelection rally. The pullback is likely due to profit-taking after recent gains and cautious positioning ahead of key economic data releases, including the Consumer Price Index (CPI) report and retail sales data.

Futures

Futures are slightly lower today, with Dow futures down 68 points (0.1%), S&P 500 futures slipping 0.2%, and Nasdaq 100 futures down 0.1%.

Medical Cannabis

This NASDAQ-listed small-cap cannabis company is making a strategic move into Australia’s $94 million medical cannabis market, partnering with Canopy Growth Corp. in a new distribution deal.

Through this agreement, the company will distribute Canopy’s Storz & Bickel medical vaporizers across Australia, tapping into a market expected to grow at an impressive 33.6% CAGR through 2030.

Operating through its established Australian subsidiary, known for high-quality vaporization products, this company will supply Storz vaporizers to healthcare providers and clinics nationwide.

With 20,000+ global distribution points across 28 countries, this cannabis player aims to lead the NASDAQ small-cap market for international cannabis.

Analysts are optimistic, with ROTH MKM issuing a “BUY” rating and a $6.00 price target.

What to Watch

Tower Semiconductor (NASDAQ: TSEM) will announce its quarterly earnings before the market opens today, while StandardAero (SARO), Cisco (NASDAQ: CSCO), and NU Holdings (NYSE: NU) will do the same during aftermarket hours.

All eyes will be on the Consumer Price Index (CPI) for October, which will be released at 8:30 a.m. ET.

New York Fed President John Williams will deliver welcoming remarks at 9:30 a.m. ET, followed by Dallas Fed President Lorie Logan at 9:45 a.m. ET. St. Louis Fed President Alberto Musalem is scheduled to speak at 1:00 p.m. ET, with Kansas City Fed President Jeff Schmid speaking at 1:30 p.m. ET.

Additionally, the Monthly U.S. Federal Budget for October will be released at 2:00 p.m. ET.

Music

Spotify Gains in Premarket Trading as User Growth Remains Strong

Spotify shares are up 7.5% in premarket trading today despite the music streaming platform falling short of Wall Street’s third-quarter revenue expectations.

The company reported earnings per share (EPS) of €1.45 on revenue of €3.99 billion, trailing the projected EPS of €4.02 billion. However, Spotify’s monthly active users climbed by 11% to 640 million compared to the same period last year, signaling robust user engagement.

CEO Daniel Ek noted that Spotify remains on track to achieve full-year profitability, a significant milestone aimed at bolstering investor confidence. The platform, like many other streaming giants, has faced pressure to streamline operations, which led to a 17% workforce reduction last year, affecting 1,500 employees.

Earlier in 2024, Spotify raised subscription prices across several plans in the U.S., increasing the individual plan to $11.99 and the family plan to $19.99 monthly. In October, it also introduced music videos in 85 markets, offering premium subscribers an expanded visual experience.

Looking forward, Spotify has set an optimistic outlook for the fourth quarter, with projected revenue of €4 billion and an operating income target of €405 million. The company expects a net addition of 8 million premium subscribers, reaching 260 million, and monthly active users of 665 million, a net increase of 25 million, reinforcing its strong position in the competitive streaming landscape.

Space

Rocket Lab’s Stock Soars as Revenue Exceeds Forecasts, Neutron Deal Secured

Rocket Lab shares are soaring by more than 30% in premarket trading today following its third-quarter earnings report and announcement of a significant contract for its upcoming Neutron rocket yesterday.

The space infrastructure firm posted Q3 revenue of $104.8 million, marking a 55% increase from last year’s $67.6 million and surpassing Wall Street’s estimate of $102 million. However, Rocket Lab’s net loss widened to $51.9 million, though its loss of 10 cents per share was slightly better than the anticipated 11 cents.

The company forecasts Q4 revenue between $125 million and $135 million, putting its annual revenue projection around $430 million. Additionally, Rocket Lab secured its first launch contract for Neutron, set for two missions in 2026 with an undisclosed commercial satellite operator, maintaining its target launch price of approximately $50 million.

Rocket Lab’s Q3 growth was mainly driven by its Space Systems unit, which saw revenue jump to $83.9 million from $46.3 million the previous year. Its Launch unit, led by the Electron rocket, contributed $21 million in revenue. The Electron rocket, now the third most-launched orbital rocket globally, has set a company record with 12 missions this year, adding $55 million in new launch contracts to its backlog.

Technology

ZoomInfo Beats Q3 Earnings Projections But Stock Declines Upon Modest Revenue Outlook

ZoomInfo Technologies’ third-quarter revenue of $303.6 million is above analyst projections of $299.4 million. Adjusted earnings per share (EPS) are also above expectations, coming in at 28 cents versus the anticipated 22 cents.

However, despite this, the B2B search firm’s stock is falling 14% in premarket trade due to a 3% drop in year-over-year revenue.

The B2B search company added 12 new high-value customers during the quarter, closing with 1,809 clients generating $100,000 or more in annual contract value. Adjusted operating income stood at $111.7 million, reflecting a 37% margin but an 11% decline from last year.

Cash flow from operations totaled $18.2 million, with unlevered free cash flow reaching $110.7 million. ZoomInfo closed the quarter with $147.7 million in cash and cash equivalents and repurchased $242.1 million in shares during the period.

CEO Henry Schuck noted stable net revenue retention and growth in the company’s high-value customer segments. For the fourth quarter, ZoomInfo anticipates revenue between $296 million and $299 million, with an adjusted EPS range of 22 to 23 cents, in line with market estimates. The full-year outlook for revenue has been adjusted to $1.201 billion–$1.204 billion, with projected EPS revised upward to $0.92–$0.93.

Technology

This fast-growing AI startup is turning heads, delivering nearly 3.5X ROI to Fortune 1000 clients and attracting support from major investors, including the Adobe Fund and leaders from Google, Amazon, Meta, and Snapchat.

In just three years, its valuation skyrocketed from $5M to $85M, backed by over $35M in funding and 7,800+ investors who see its high potential.

Shares are now available at just $0.50, with an exclusive 10% bonus for new investors until November 21st!

This AI innovator is primed for major strategic buyouts, making it a potential game-changer in the tech industry.

This is your chance to get in early and grow with a company poised for significant impact.

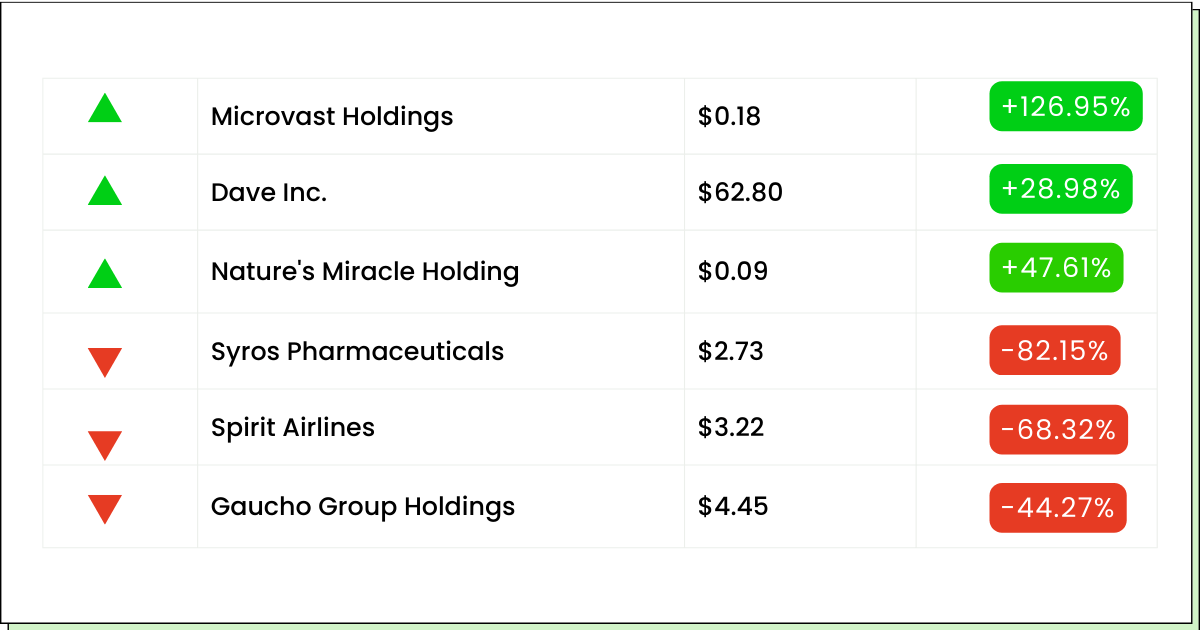

Movers and Shakers

Dave Inc. [DAVE] - Last Close: $62.80

Dave Inc.'s stock is trading up 47% in premarket trading today after reporting impressive third-quarter earnings.

The U.S. neobank saw revenue jump 41% year-over-year to $92.5 million, marking its fourth consecutive quarter of growth.

Net income improved by $12.5 million, reaching $0.5 million, while adjusted EBITDA rose significantly to $24.7 million.

Key metrics like a 23% boost in monthly active users and a 46% increase in ExtraCash originations reflect strong demand and effective customer acquisition.

Dave also announced plans for a new strategic fintech partnership, further strengthening its growth outlook for 2024.

My Take: The stock has already had a dream run on the markets, up 628% YTD. Given the strong performance once again, this stock is certainly one to keep your eye on.

Paymentus Holdings [PAY] - Last Close: $26.61

Paymentus Holdings is up 24% in premarket trading after posting a strong third-quarter report yesterday.

The company saw a 51.9% increase in revenue year-over-year, reaching a record $231.6 million.

With its cloud-based platform, Paymentus processed 155.3 million transactions, a 34.6% rise from last year, reflecting expanding demand from billers and consumers.

The company also reported net income of $14.4 million and a 58.2% increase in adjusted EBITDA.

My Take: Digital payments is a sector that has been heating up recently. PAY is already up 52% YTD and is looking good for growth. Keep this stock on your radar for sure.

Microvast Holdings [MVST] - Last Close: $0.18

Microvast Holdings' shares are up 119% in premarket trade today because the company reported better-than-expected earnings for the third quarter.

The battery technology company achieved $0.05 per share, beating analyst expectations by $0.09, and generated $101.4 million in revenue, surpassing the expected $99.7 million.

However, their fourth-quarter revenue projection was between $90 million and $95 million, which is below the analyst consensus of $111.7 million.

My Take: Their guidance for the next quarter's revenue raises questions on whether they will be able to continue this performance. It might be best to let the volatility settle down and put this penny stock on your wait-and-watch list.

High-Growth Cannabis Stock

As the cannabis industry gains momentum, one NASDAQ small-cap company is drawing attention for its strong position in the legal cannabis market and its recent strategic moves.

With a $6 price target and a clean balance sheet, this company aims to become a leading international cannabis player, distributing consumer goods, medicinal cannabis, and pharmaceutical products in all 50 states and across 28 countries, with 20,000+ distribution points worldwide.

With its CEO recently buying over 1 million shares, this stock has caught the eye of both investors and insiders.

Insiders buy for one reason: they believe in the company’s growth potential.

Everything Else

Spirit Airlines nears a bankruptcy filing after the Frontier merger collapse, and shares are plummeting 62% in premarket trade.

Just Eat offloaded Grubhub to Wonder for $650 million as shares surged 20%.

Musk and Ramaswamy will head the “Department of Government Efficiency” for the Trump administration.

Akash Systems secured a $18.2-million subsidy to expand advanced chip production in West Oakland.

Ivory Coast has partnered with African Development Bank to fund green projects and cut emissions.

Japanese 7-Eleven owner faces a $58 billion bid from founding Ito family.

Tencent’s gaming and AI investments boosted Q3 profits beyond expectations with a 47% rise.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.