Good morning. It's October 1st, and we’ll begin the month by looking at Boeing’s possible $10B stock sale, an AI chipmaker planning to go public, and a shopping center REIT that is surging in premarket trading.

Previous Close 📈

Stocks ended September on a high note, with the S&P 500 and Dow Jones both closing at record highs. The Federal Reserve’s half-point rate cut boosted investor sentiment, and all three major averages posted gains for the month and third quarter.

Futures

Futures are little changed this morning. Dow futures are down 27 points, or 0.06%, S&P 500 futures have dipped 0.06%, and Nasdaq 100 futures are just below the flatline. Investors are closely watching economic data releases and monitoring the possibility of a labor strike, which could disrupt shipments and impact markets.

Gold

Gold prices soared to a new peak of $2,687 per troy ounce following a bold 50-basis-point rate cut by the U.S. Federal Reserve.

Experts are predicting that this bullish trend may continue, making now the perfect time to enter the gold market.

Investors are increasingly turning to gold as a hedge against inflation and economic uncertainty. With rising demand, the opportunity to capitalize on climbing prices might not last long.

What to Watch

Paychex (NASDAQ: PAYX), McCormick & Company (NYSE: MKC), and Palatin Technologies (NYSE: PTN) will announce their quarterly earnings before the market opens today.

On the economic calendar, the S&P final U.S. Manufacturing PMI for September will be released at 9:45 a.m. Eastern, followed by the ISM Manufacturing Index, Construction Spending, and Job Openings for August at 10:00 a.m. Eastern.

Federal Reserve Governor Lisa Cook will speak at 11:10 a.m. Eastern, and later in the day, Richmond Fed President Tom Barkin, Atlanta Fed President Raphael Bostic, and Boston Fed President Susan Collins will participate in a joint panel about technology-enabled disruption at 6:15 p.m. Eastern.

After the market closes, Nike (NYSE: NKE), Lamb Weston Holdings (NYSE: LW), Cal-Maine Foods (NASDAQ: CALM), and Resources Connection (NASDAQ: RGP) will report their results.

Airlines

Boeing Shares Slip as Company Weighs $10B Stock Sale Amid Labor Strike

Boeing Co. shares are dipping during premarket trading today following a Bloomberg News report that the aerospace giant is considering a potential $10 billion stock sale.

According to sources familiar with the matter, the company is working with advisors to explore options but is not expected to move forward for at least a month.

The strike involving 33,000 workers in the U.S. Pacific Northwest is a key factor in the delay. Boeing is seeking to assess the financial impact of the labor action before finalizing any fundraising plans.

The workers, now in their third week of striking, have already rejected two pay proposals from the company, intensifying the pressure on Boeing's finances and production operations.

Boeing had recently offered a revised deal, including a 30% general pay increase over four years and enhanced retirement benefits, which the International Association of Machinists and Aerospace Workers District 751 rejected, calling the offer rushed and without negotiation. A mediator has been engaged to resolve the standoff.

As Boeing grapples with ongoing labor disputes, its credit rating hovers near junk status, adding further urgency to the company's financial planning. The reported stock sale would mark one of the largest by a public company since Saudi Aramco's $12.3 billion offering in June.

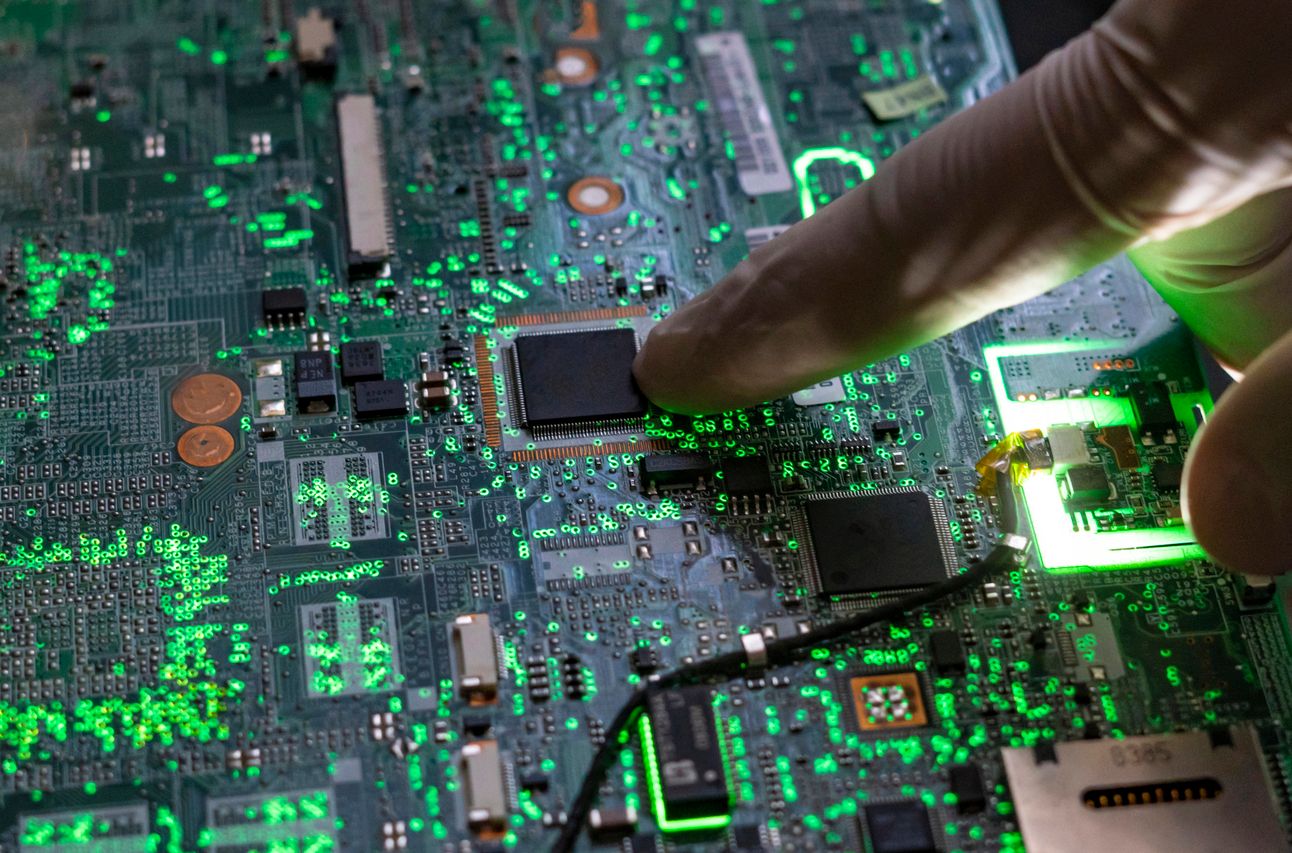

Semiconductors

Cerebras Systems Eyes Nasdaq Listing as Revenue Soars Amid AI Boom

AI chipmaker Cerebras Systems has reported a more than threefold increase in annual revenue for 2023, according to its U.S. IPO filing on Monday.

The Sunnyvale, California-based company, which specializes in AI processors and systems, revealed that revenue for the 12 months ending December 31, 2023, reached $78.74 million, up from $24.62 million in 2022.

Despite the strong revenue growth, Cerebras posted a net loss of $127.16 million for 2023, a notable improvement from the $177.72 million loss recorded in the prior year.

This IPO filing comes as the company looks to capitalize on the rising demand for AI technologies like ChatGPT, a trend that has already bolstered leading AI chip firms such as NVIDIA.

Cerebras has garnered support from prominent investors, including the Abu Dhabi Growth Fund and Coatue Management. Underwriters for the IPO include Citigroup, Barclays, UBS, Wells Fargo, and Mizuho. The company is set to trade on Nasdaq under the ticker symbol "CBRS."

This offering will be a key test of the market’s appetite for AI-linked stocks as investor interest in the tech sector remains cautious amid concerns of overvaluation. The size and terms of the IPO have yet to be disclosed.

Pharmaceuticals

Pfizer Sells $3.2B Worth of Haleon Shares, Lowers Stake to 15%

Pfizer Inc. will secure £2.4 billion ($3.2 billion) through the sale of shares in U.K.-based Haleon Plc, further reducing its stake in the consumer health company.

The U.S. pharmaceutical giant increased the number of shares sold to 640 million, up from an initial 540 million, as strong demand led to an oversubscribed offering. The shares were priced at £3.80 each, representing a 3.3% discount to Monday’s close.

Haleon, known for products like Panadol pain relief and Centrum vitamins, agreed to repurchase approximately £230 million worth of shares from Pfizer at the same price. This latest transaction reduces Pfizer’s stake in Haleon to 15%, down from 22.6%.

Pfizer has been gradually trimming its holdings in Haleon since March when it raised over £2.8 billion from share sales. Haleon was formed from a combination of Pfizer’s and GSK Plc’s consumer health units, with GSK also selling down its stake earlier this year, raising nearly £4 billion in total.

This move contributes to the more than $50 billion raised from new and existing share sales across European companies so far in 2024, according to Bloomberg data, reflecting a 2.3% increase compared to the same period last year.

NVDIA

The most successful hedge fund in history quietly sold 500,000 shares.

Here's what that means for your money.

Billionaire Wall Street investors are quietly offloading millions of shares. What do they know that you don't?

It's arguably the most popular stock in the world. Now, one 50-year Wall Street legend says its day in the sun could finally be coming to an end.

Last year, he warned of two stocks that went on to crash 60%.

Now he's just issued a warning for the most popular stock in the world: NVIDIA (NVDA).

Movers and Shakers

SITE Centers Corp. [SITC] - Last Close: $60.50

SITE Centers Corp., a real estate investment trust that invests in shopping centers, is surging by 55% in premarket trading following the completion of the spin-off of Curbline Properties Corp.

Curbline owns convenience shopping centers in high-traffic suburban areas with high household incomes. For U.S. federal tax purposes, it plans to operate as a real estate investment trust (REIT).

As part of the spin-off, SITE Centers shareholders received two shares of Curbline stock for every share of SITE Centers they held. The value of the SITE share was adjusted accordingly.

The strong market response reflects positive investor sentiment about the potential growth and value creation from this spin-off.

My Take: The premarket surge shows that the market believes there is a strong benefit in the spin-off. Keep this stock on the radar because it looks like it might have potential for growth.

Silexion Therapeutics [SLXN] - Last Close: $0.53

Silexion Therapeutics is rallying by nearly 55% before the market opens today.

It announced promising breakthroughs in its preclinical studies for SIL-204, a second-generation siRNA candidate targeting KRAS-driven cancers.

The company is planning to move SIL-204 into toxicology studies soon and aims to begin Phase 2/3 clinical trials in 2026, initially focusing on locally advanced pancreatic cancer.

The strong premarket response highlights investor confidence in Silexion's potential to deliver breakthrough treatments in oncology.

My Take: Despite the breakthrough, Silexion stock does not have a very strong track record. It might be best to keep this in your wait-and-watch bucket for now.

AgEagle Aerial Systems Inc. [UAVS] - Last Close: $0.09

AgEagle Aerial Systems is up by 110% in premarket trading.

The company announced a $6.5 million public offering. The offering consists of 26.9 million units, each containing one share of common stock or a pre-funded warrant and two series of warrants (Series A and Series B) for additional shares.

The proceeds will be earmarked for repaying outstanding debt and for general corporate and working capital purposes.

This capital raise comes as the company continues to focus on developing and delivering drone-based solutions for various industries, including agriculture, energy, construction, and government sectors.

My Take: This is a very tiny stock coming off a downtrend with moderate volatility. It might be best to keep a cautious approach if you wish to invest here.

Government Reports

When the government releases key data, it can trigger significant market movements—whether the news is good or bad.

These moments offer unique opportunities to capitalize on major shifts.

A well-timed trade could lead to impressive returns, with the potential for substantial gains up to +383% overnight.

Position yourself ahead of these announcements and take advantage of the upcoming market moves.

Everything Else

Inflation in the Eurozone dropped below 2%, prompting increased speculation about further ECB rate reductions.

South African manufacturing activity rebounded in September as PMI rose to 52.8, signaling growth.

ThaiBev is considering an IPO for its beer unit, aiming for a third-quarter launch as market conditions improve.

Mulberry turned down Frasers Group's cash offer, choosing to focus on recovery plans instead.

TPG Rise Climate fund secured its largest deal yet with a $7.5-billion acquisition of Techem, supported by a GIC investment.

Essex-based cable manufacturer XLCC received £87 million in backing from the U.K. Infrastructure Bank to boost clean energy capacity.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.