A semiconductor heavyweight is holding steady after a strong year-to-date run as it gears up for an important earnings report. A major bank topped profit forecasts but showed signs of margin compression. Meanwhile, an activist investor is shaking things up at a battered fintech name with strategic potential. Here's what traders are watching today.

Retina Tech Surge (Sponsored)

You know how AI is shaking up everything from finance to film?

Well, it’s making serious moves in healthcare too—and this under-the-radar tech company might be onto something huge.

They’ve developed a tool called Vision AI that can detect eye diseases like diabetic retinopathy in seconds.

No bulky equipment. No long wait times. Just fast, web-based diagnostics that could help stop blindness before it starts.

With chronic diseases on the rise and aging populations straining healthcare systems, early detection like this isn’t just nice to have—it’s game-changing.

The company is heading into FDA trials, expanding into Latin America, and already looking at major licensing deals.

If you’ve been looking for the next big thing in healthtech—this might be it.

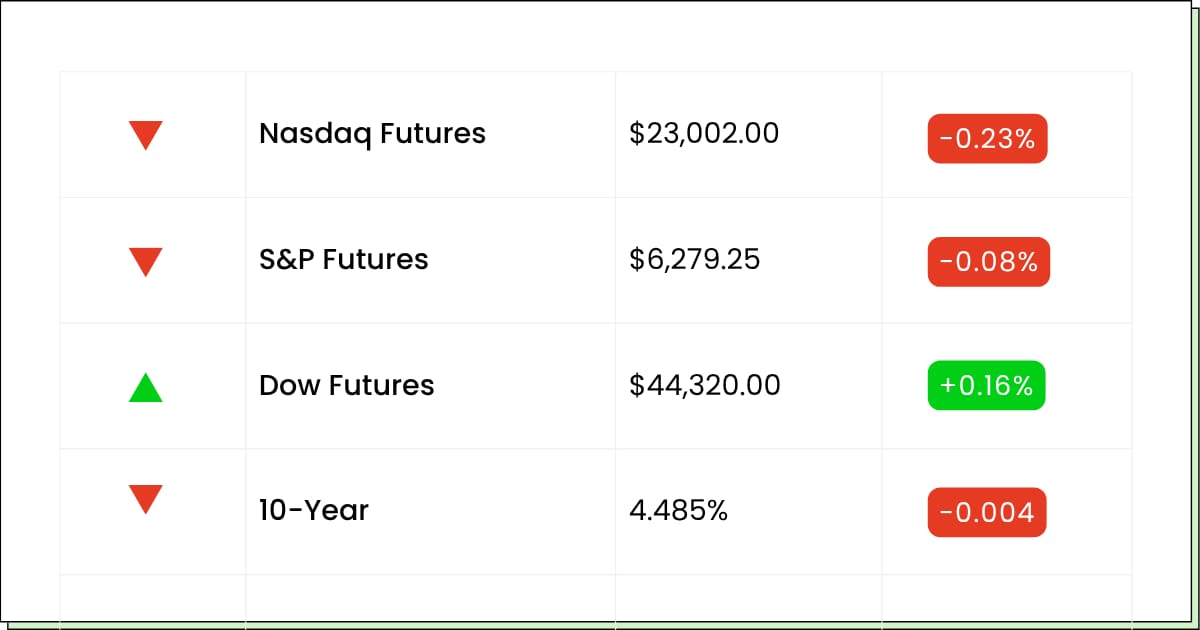

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Johnson & Johnson [JNJ]: Premarket

Bank of America Corporation [BAC]: Premarket

ASML Holding N.V. [ASML]: Premarket

Morgan Stanley [MS]: Premarket

Goldman Sachs Group, Inc. [GS]: Premarket

Progressive Corporation [PGR]: Premarket

Prologis, Inc. [PLD]: Premarket

PNC Financial Services Group [PNC]: Premarket

M&T Bank Corporation [MTB]: Premarket

First Horizon Corporation [FHN]: Premarket

Commerce Bancshares, Inc. [CBSH]: Premarket

United Airlines Holdings, Inc. [UAL]: Aftermarket

Kinder Morgan, Inc. [KMI]: Aftermarket

Rexford Industrial Realty, Inc. [REXR]: Aftermarket

Alcoa Corporation [AA]: Aftermarket

Synovus Financial Corp. [SNV]: Aftermarket

First Industrial Realty Trust, Inc. [FR]: Aftermarket

Home BancShares, Inc. [HOMB]: Aftermarket

SL Green Realty Corp [SLG]: Aftermarket

AAR Corp. [AIR]: Aftermarket

Banner Corporation [BANR]: Aftermarket

Monarch Casino & Resort, Inc. [MCRI]: Aftermarket

Triumph Financial, Inc. [TFIN]: Aftermarket

Great Southern Bancorp, Inc. [GSBC]: Aftermarket

South Plains Financial, Inc. [SPFI]: Aftermarket

Martin Midstream Partners L.P. [MMLP]: Aftermarket

Economic Reports:

Producer Price Index [June]: 8:30 am

Core PPI [June]: 8:30 am

PPI Year over Year: 8:30 am

Core PPI Year over Year: 8:30 am

Industrial Production [June]: 9:15 am

Capacity Utilization [June]: 9:15 am

Federal Reserve Governor Michael Barr Speech: 10:00 am

Fed Beige Book: 2:00 pm

New York Fed President John Williams Speech: 6:30 pm

Next AI Boom (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Semiconductors

AMD Shares Cool Off After Torrid 29% Run in 2025, Eyes Turn to Q2 Earnings

Advanced Micro Devices [NASDAQ: AMD] dipped slightly in premarket trading Wednesday, easing back after a 29% year-to-date rally fueled by investor enthusiasm around AI hardware and data center demand.

While the stock has been one of 2025’s tech leaders, the market is now turning its focus to Q2 earnings as the next major catalyst.

AMD is widely seen as the top contender to challenge Nvidia in the AI accelerator space, especially with its MI300 chips gaining momentum among hyperscalers and government partners.

Recent deal flow has been strong, and the company’s broader product roadmap continues to align with emerging compute workloads. However, its high valuation, with a P/E ratio above 110, means investors are demanding near-flawless execution.

Revenue growth in the data center segment will be the primary focus this quarter, alongside commentary on supply chain capacity, pricing trends, and competitive dynamics.

Analysts are also closely watching for any signs of margin expansion or indications that AI-related sales are translating into stronger bottom-line results.

While the long-term story remains intact, near-term volatility may persist if AMD’s results or guidance fall even slightly short of expectations. The setup heading into earnings is high-stakes, with plenty of upside if the company can outperform, but equally real downside if growth expectations are pushed out.

AMD remains a favorite among institutional tech funds, but in a market where AI optimism is being repriced daily, strong delivery is the only way to stay ahead.

Banking

Bank of America Tops EPS Forecast, But Margin Pressure Keeps Revenue in Check

Bank of America [NYSE: BAC] reported better-than-expected earnings for the second quarter of 2025, although softer-than-expected net interest income resulted in overall revenue being slightly below Wall Street estimates.

The report reflects a mixed quarter for one of the nation’s largest banks as it navigates a maturing rate cycle and increasingly cost-sensitive deposit base.

The bank reported earnings per share of $0.89, beating the analyst consensus of $0.86. However, total revenue came in at $26.61 billion, missing the $26.72 billion forecast. Net interest income, the bank’s core profit driver, slowed more than anticipated as elevated deposit costs offset loan yields.

Still, the company benefited from cost controls and steady fee income across wealth management, trading, and credit cards.

Bank of America’s trading division delivered solid results, capitalizing on higher volatility and client repositioning. Equities and fixed income revenue held up well, and credit card performance continued to support non-interest income.

CEO Brian Moynihan acknowledged the pressure on margins but emphasized that credit quality remains strong and consumer spending is healthy.

The earnings call will likely focus on forward guidance for loan growth and margin recovery. Analysts and investors alike will be watching for clues on whether NII compression has peaked and if the bank can reaccelerate topline growth in the back half of the year.

Shares were up about 1.4% in premarket trading as investors weighed the earnings beat against a backdrop of cautious optimism heading into a critical period for the banking sector.

Q2 Picks (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Fintech

Global Payments Pops as Elliott Stake Renews Hope for Strategic Shift

Global Payments [NYSE: GPN] surged more than 5% in premarket trading after reports confirmed that activist investor Elliott Investment Management has taken a sizable stake in the company.

The news arrives just months after GPN closed its controversial $24.3 billion acquisition of Worldpay, a deal that many shareholders criticized for poor strategic fit and lack of a shareholder vote.

The company, which provides payment technology and services to merchants, banks, and software partners, has struggled to convince the market of its post-merger strategy. Shares are down over 30% year-to-date, and sentiment has been hampered by integration concerns and limited clarity on cost synergies.

While Elliott’s intentions haven’t been disclosed, the firm’s track record of pushing for board refreshes, operational improvements, or spin-offs has generated speculation that GPN could see a more aggressive restructuring path emerge.

What makes the setup more compelling is valuation: GPN currently trades at less than 6x forward earnings, a steep discount to peers. The stock’s underperformance has drawn attention not just from Elliott but also from value-oriented investors seeking a recovery trade in the fintech sector. GPN’s core assets, including a sticky merchant base and recurring fee income, remain attractive.

The real question is whether management will be receptive to shareholder pressure and willing to reset expectations for capital deployment or divestiture.

In a payments sector that is increasingly bifurcating between consolidators and niche specialists, GPN could evolve into a more focused, efficient enterprise if the right changes are made.

Movers and Shakers

Brighthouse Financial Inc. [BHF] – Last Close: $47.32

Brighthouse Financial provides life insurance and annuity products in the U.S., operating with a lean structure after its 2017 spin-off from MetLife. The stock is down slightly for the year but jumped nearly 10% premarket after news broke that the company is in advanced acquisition talks with Aquarian Holdings.

Reports suggest a full buyout is on the table, with a deal possibly closing within weeks. Investors are responding favorably to the likelihood of a complete sale rather than a piecemeal asset divestiture. The sudden move has also sparked broader speculation around potential insurance sector consolidation, with private equity buyers circling undervalued annuity-rich platforms.

My Take: This could be the start of a rerating for niche insurers. If the deal closes at a premium, expect more M&A chatter in the space, and maybe more upside for BHF.

Ramaco Resources Inc. [METC] – Last Close: $21.94

Ramaco Resources focuses on metallurgical coal and is increasingly recognized as a unique domestic source for rare earth elements. The company is fresh off a 30% intraday rally last week and up another 9.4% premarket following the release of a positive economic assessment for its Brook Mine project in Wyoming.

The study showed a pre-tax NPV of $1.2 billion and a 42-year mine life, signaling long-term viability. Combined with momentum in the broader rare earth narrative, driven by government support for domestic supply chains, Ramaco could evolve from a coal story into a breakout name in critical minerals.

My Take: This is no longer just a coal company. If Ramaco can fund and develop Brook Mine as planned, it may gain a new following among rare earth investors.

Victory Capital Holdings Inc. [VCTR] – Last Close: $63.69

Victory Capital is a multi-boutique asset manager with more than $170 billion in AUM. Shares are up over 5% premarket after Barclays raised its price target to $68 ahead of Q2 earnings, noting improving AUM and gross sales momentum.

The company is coming off a record quarter for ETF asset growth, and integration of the Amundi US acquisition has doubled its fixed income footprint. Though net flows were impacted by two large redemptions, analysts are optimistic about margin resilience and ongoing share buybacks.

My Take: Victory’s fundamentals look solid, and its ETF and global platform story is underappreciated. With shares trading below the Street’s average target, there may still be room to run.

AI in Healthcare (Sponsored)

There’s a small AI company flying way under Wall Street’s radar—but that might not last much longer.

They’ve built Vision AI, a web-based platform that can detect diabetic retinopathy and other serious eye diseases in seconds.

It’s fast, scalable, and fits perfectly into the growing demand for early detection and preventative care.

The stock is still cheap—but the setup is intriguing:

✅ Potential FDA approval on deck

✅ Early traction in Latin America

✅ Global rollout and licensing opportunities on the horizon

As AI rewires entire industries, healthcare is next—and this stock could be an early mover in one of the most critical areas: disease detection.

Everything Else

UK inflation ticks up to 3.6%, renewing pressure on the Bank of England ahead of its next rate decision.

Facebook’s $8 billion privacy case heads to trial, with Mark Zuckerberg directly in the spotlight over targeted ad practices.

Nvidia plans to restart chip exports to China as CEO Jensen Huang signals support for AI development across geopolitical lines.

Rolls-Royce eyes expansion in South Carolina with a new $200 million facility focused on aerospace engine components.

ASML shares drop sharply after the company warned that sales growth could stall next year, spooking semiconductor investors.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.