The longtime middleman for mortgage scores suddenly got bypassed, and rising fraud headlines added insult to injury. What was once steady tollbooth money now looks like it’s stuck in a traffic jam. Here’s what that means for you.

Breakouts Are Near (Sponsored)

Your portfolio might be doing fine.

But why stop at fine when you could aim for game-changing gains?

Our analysts have just released a new special report, highlighting 5 stocks with the potential to double.

These aren’t random picks.

They were hand-selected because they combine:

Proven fundamentals with long-term staying power

Technical strength suggesting momentum is building now

Past reports have pinpointed stocks before huge runs of +175%, +498%, even +673%.¹

This exclusive report is yours free—but only until midnight tonight.

[Click here now to download your copy instantly]

Why settle for average when extraordinary is on the table?

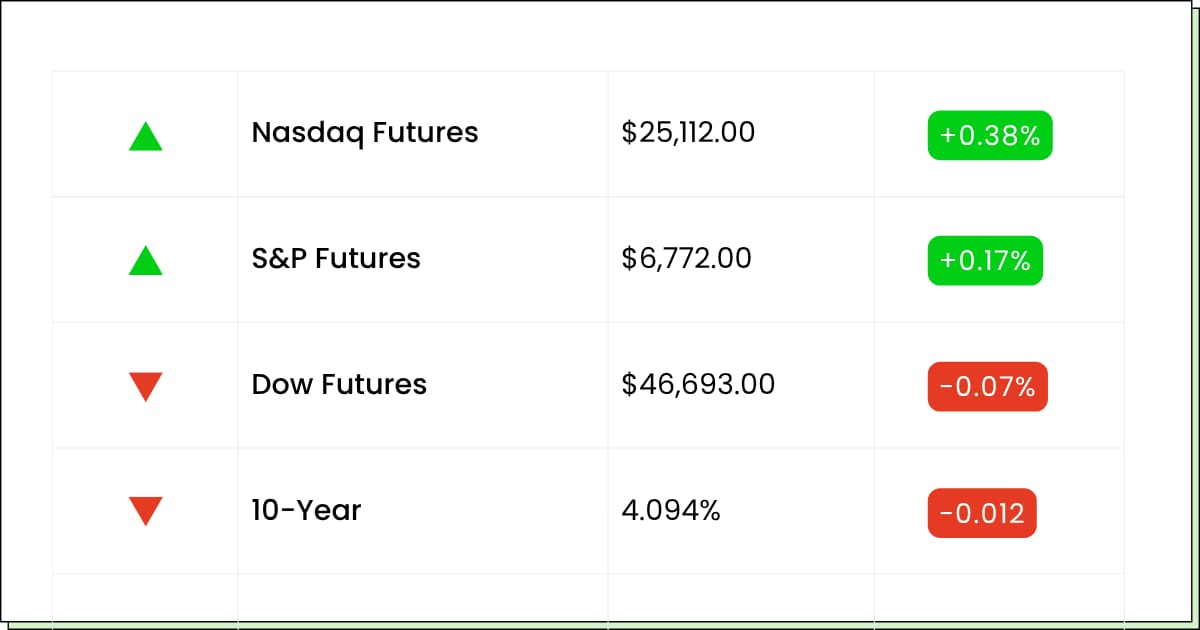

Futures at a Glance 📈

Futures are split this morning, with the S&P and Nasdaq inching higher while the Dow drifts lower. Traders are brushing off the shutdown drama, but the real snag is a data blackout that leaves the Fed flying blind into its next rate cut decision.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

AngioDynamics Inc. [ANGO]

No Specified Time Earnings:

Kodiak AI Inc. [KDK]

Smart Share Global Ltd. [EM]

HomesToLife Ltd. [HTLM]

Economic Reports:

Initial Jobless Claims [Sept. 27]: 8:30 am

Factory Orders [Aug.]: 10:00 am

Dallas Fed President Lorie Logan Speech: 10:30 am

Tech Real Estate

Fermi’s IPO Powers Up Like a Data Center on Caffeine

Fermi just pulled off one of those IPOs that makes you wonder if Wall Street secretly runs on Red Bull. The Texas-based data center REIT listed at $25 and instantly blasted higher, raising nearly $700 million.

That is not bad for a company that was literally founded in January by Rick Perry, his son, and a financier buddy. Yes, the same Rick Perry who once forgot which federal agencies he wanted to shut down.

The plan is bold. Fermi wants 11 gigawatts of power available for data centers by 2038. That means everything from natural gas and solar to nuclear will be on the menu. Right now it is running at a net loss, about $6 million through June, but nobody buys an IPO like this for today’s cash flow.

Buyers are chasing the narrative that AI needs power and data centers are the tollbooths of the future.

My Take For You: If you like volatility, this one has plenty. It could keep ripping if they secure big tenants, but position small because shiny IPOs can just as easily fade.

My Verdict: Worth a speculative spot only if you treat it like infrastructure with training wheels.

Space and Defense

Planet Labs Shoots for the Moon, Lands a Berlin Factory

Planet Labs has quietly become the hottest space stock outside of Elon Musk’s orbit. Shares are up nearly 250 percent this year, and the latest catalyst was the news that two Pelican satellites and three dozen SuperDoves are hitching a ride on a SpaceX launch.

Everyone loves satellites in space, but they loved the Berlin announcement even more. A new factory in Germany will double production capacity for the Pelican line and help Planet meet a €240 million contract with the German government and a fresh NATO deal.

The market is reading this as validation that Planet’s Earth-imaging data is becoming mission-critical. From monitoring climate change to tracking troop movements, the use cases are stacking up. The backlog is already up 245% year over year, which means they have demand coming out of their ears.

The risk is execution. Satellites are expensive and delays happen, so the stock could wobble if launches slip or contracts take longer to monetize.

My Take For You: Momentum traders can play the rocket ride, but long-term investors should build carefully on dips.

My Verdict: Accumulate in small bites. Real contracts and sticky demand make it more than just a meme rocket.

Momentum Starts Here (Sponsored)

Some stocks take months or years to move. Others? They can move in weeks.

That’s why we’ve just released a FREE report:

7 Best Stocks for the Next 30 Days.

Less than 5% of all publicly traded companies meet the strict criteria to make this list.

These are hand-selected from thousands of candidates — the very best positioned for potential short-term upside.

If you’re looking for fresh ideas to fuel your next trade, this is the list to start with.

[Download your FREE copy now] before you place your next trade.

Timing is everything in the market. Don’t wait until these moves are yesterday’s news.

*The performance results may not reflect all Zacks selections and could represent partially closed positions. This free resource is provided by Zacks.com. Use is subject to Terms of Service.

*Past performance does not guarantee future results. Investing involves risk. This material is informational only and not investment, legal, tax, or accounting advice. Zacks Investment Research is not a licensed U.S. broker, adviser, or investment bank.

Financials

Equifax Gets a Credit Reality Check

Equifax is suddenly finding out that being a toll collector on financial data does not mean your tollbooth can never be bypassed. Shares dropped more than ten percent after FICO said it would start selling its mortgage scores directly to lenders at half the price.

That means less revenue flowing through the bureaus, which have been the middlemen for decades. Losing that slice of the pie is bad enough, but then Equifax Canada dropped the bomb that credit card fraud is up seventy percent this year. That is not exactly the branding you want if your whole business model is trust and reliability.

Equifax had been trading on the idea that credit data was sticky and regulators would keep the system locked in. Now the moat looks leaky. At nearly fifty times earnings, the stock was already expensive, and investors are not willing to pay up when pricing pressure and fraud risks are both climbing.

My Take For You: Avoid trying to catch this falling knife. Management needs a plan before this becomes a structural margin issue.

My Verdict: Put it on the watchlist, but do not touch it until they prove they can defend their role in the credit ecosystem.

Poll: Would you rather have:

Movers and Shakers

TransUnion [TRU]: Premarket Move: −11%

When the referee of credit checks gets its knees cut out, you don’t expect overtime. Shares sank after a fresh downgrade and a Neutral rating from Seaport Global, adding to a year that already looked bruised. Mix in FICO trying to cut the bureaus out of the mortgage game, and it feels like the scoreboard operator just went rogue.

This is one of those stocks where analysts are still talking up crown jewel businesses overseas, but the home market looks like a clearance rack. High valuation, sector pressure, and consumer weakness are not a cocktail you sip slowly.

My Take: Unless you like playing catch with falling knives, step aside until the dust clears. A bounce could come, but it’s more likely tied to short covering than fundamentals.

Rocket Companies [RKT]: Premarket Move: −3%

Rocket just bought Mr. Cooper for $14.2 billion, creating the mortgage version of Voltron, with one out of every six home loans in the U.S. now running through them. That’s massive scale, but markets yawned in premarket, pulling shares down a touch after a monster year-to-date rally.

Think of it like merging two moving trucks. Bigger capacity, sure, but you still have to dodge potholes in the housing market. If rates stay sticky, volume growth could feel like pushing uphill in neutral.

My Take: If you’ve ridden the 80% YTD climb, trimming here makes sense. Long term, the story is intact, but don’t assume market share alone equals profits when housing demand is still fragile.

Nebius Group [NBIS]: Premarket Move: +7%

Nebius is acting like it skipped the AI boom queue and went straight to dessert. A Microsoft partnership promising $17 billion over five years has traders loading up, pushing the stock to all-time highs. Bulls say it’s the next big AI landlord, bears say it’s a bubble inflated by GPUs and hopium.

At a 90x forward earnings multiple, this thing is priced like it already owns half the cloud. Any hiccup in execution or capital raising, and gravity will introduce itself fast.

My Take: This is a fun stock for momentum junkies, but size small and use stops. Long term, AI demand is real, but so are dilution and capex bills.

Year-End Catalyst (Sponsored)

The clock is ticking.

2025’s final quarter could be the last big rally before the reset of 2026.

Markets are moving fast:

Fed signals hint at cuts

Oil shocks roil supply chains

AI & defense spending explode

We’ve zeroed in on 7 stocks primed to surge before year-end.

This isn’t noise, it’s your shot to finish 2025 ahead of the crowd. But wait too long, and Wall Street takes it first.

[Claim Your Free “Top 7 Stocks for Q4 2025” Guide Now]

Everything Else

OpenAI is lining up a fresh share sale that would tag it with a $500 billion valuation. Half a trillion to answer your emails, wild times.

BYD’s hot streak hit a pothole as monthly sales tumbled for the first time this year. Even EV darlings get flat tires.

Pimco warned that cracks in the debt market are forcing borrowers into ugly trade-offs. Cheap money isn’t on the menu anymore.

Yahoo’s about to offload AOL to Italy’s Bending Spoons for $1.4 billion. From “You’ve got mail” to “Arrivederci.”

Alibaba’s mapping app just logged a record surge in daily users on China’s holiday kickoff. Nothing like a Golden Week traffic jam to boost engagement.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.