A top advertising platform is seeing a breakout rally after securing a spot in a major index. One of the largest banks is setting the tone for earnings season with an outlook boost. And a fast-rising AI infrastructure name just announced a $6 billion expansion that could reshape the data center map. Here's what traders are watching today.

Q2 Picks (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

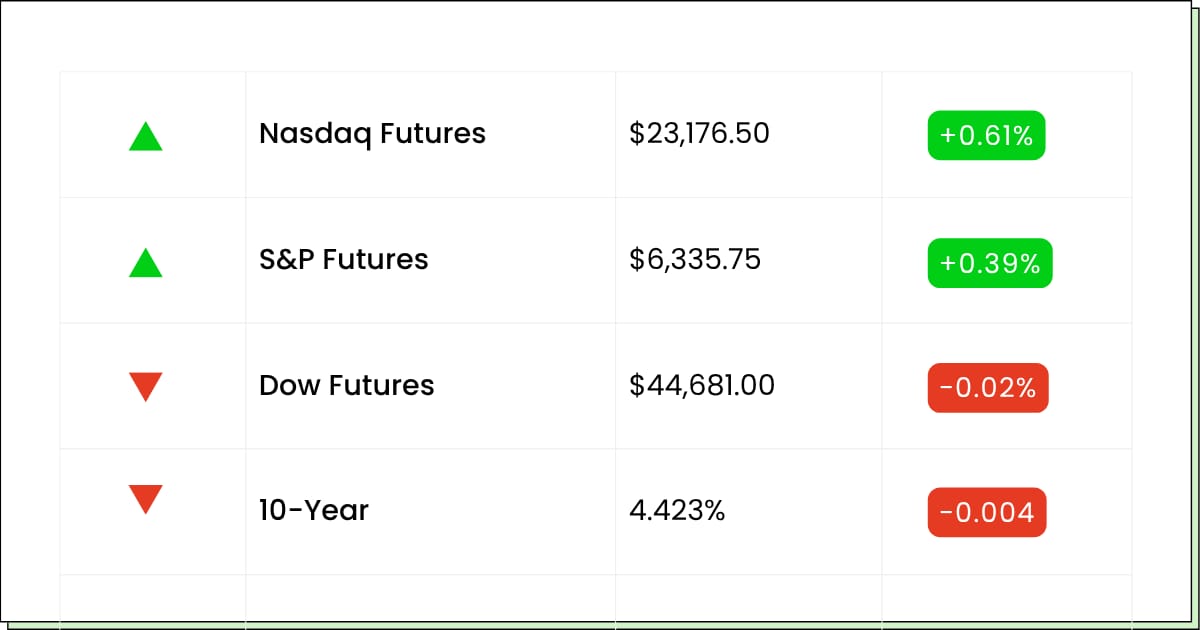

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

JPMorgan Chase & Co. [JPM]: Premarket

Wells Fargo & Company [WFC]: Premarket

BlackRock, Inc. [BLK]: Premarket

Citigroup Inc. [C]: Premarket

The Bank of New York Mellon Corporation [BK]: Premarket

State Street Corporation [STT]: Premarket

Ericsson [ERIC]: Premarket

Albertsons Companies, Inc. [ACI]: Premarket

AngioDynamics, Inc. [ANGO]: Premarket

J.B. Hunt Transport Services, Inc. [JBHT]: Aftermarket

Omnicom Group Inc. [OMC]: Aftermarket

Pinnacle Financial Partners, Inc. [PNFP]: Aftermarket

Hancock Whitney Corporation [HWC]: Aftermarket

Fulton Financial Corporation [FULT]: Aftermarket

Kestra Medical Technologies, Ltd. [KMTS]: Aftermarket

Park Aerospace Corp. [PKE]: Aftermarket

Rocky Mountain Chocolate Factory, Inc. [RMCF]: Aftermarket

Economic Reports:

Consumer Price Index [June]: 8:30 am

CPI Year over Year: 8:30 am

Core CPI [June]: 8:30 am

Core CPI Year over Year: 8:30 am

Empire State Manufacturing Survey [July]: 8:30 am

Fed Governor Michelle Bowman Speech: 9:15 am

Fed Governor Michael Barr Speech: 12:45 pm

Boston Fed President Susan Collins Speech: 2:45 pm

Dallas Fed President Lorie Logan Speech: 6:45 pm

AI Power Plays (Sponsored)

It's lifting Artificial Intelligence to a new level — answering follow-up questions, admitting mistakes, challenging incorrect premises, rejecting inappropriate requests, and more.

This newly released Special Report names and explains 5 tickers to lead the way.

Among them is a “Sleeper Stock” that is still cruising under Wall Street’s radar.

All 5 have exceptional profit potential. There couldn’t be a better time for this investor briefing.

Click here now to claim your copy FREE

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Banking

JPMorgan Boosts Outlook After Topping Q2 Estimates

JPMorgan Chase & Co. [JPM] delivered strong second-quarter results, raising its full-year net interest income (NII) guidance to $95.5 billion, up from $94.5 billion previously. The upward revision comes as robust trading and investment banking activity helped the bank beat analyst expectations.

Shares are down slightly in premarket trading.

For the quarter ended June 30, the bank posted adjusted earnings of $4.96 per share, beating the $4.48 consensus. While headline profit declined from the previous year due to a one-time gain in 2024, core business performance demonstrated strength.

Trading revenue jumped 15% to $8.9 billion, while investment banking fees climbed 7%, lifted by an uptick in IPOs and M&A activity. CEO Jamie Dimon acknowledged the resilient U.S. economy and viewed recent tax and deregulation developments as tailwinds, but flagged ongoing concerns around tariffs, asset bubbles, and geopolitical tension.

Investors are paying close attention to bank earnings this quarter as a proxy for economic momentum in the wake of President Trump’s new tax and spending bill.

JPMorgan’s results and raised forecast suggest the financial sector is better positioned than many expected heading into the second half of the year.

As the first major bank to report, JPM sets the tone for the rest of the earnings season. With continued macro tailwinds and stable loan performance, JPMorgan’s forecast bump may lead other large banks to follow suit.

Technology / AI Infrastructure

CoreWeave Rallies After Unveiling $6B AI Data Center Plan

CoreWeave [CRWV] jumped more than 6.4% in premarket trading after announcing plans to invest $6 billion in a new AI data center in Pennsylvania.

The planned construction marks another aggressive expansion for the hyperscaler, which has tripled in value since its March IPO and is emerging as a foundational player in the global AI infrastructure race.

In another move, the company announced that it will launch a 100-megawatt facility with the capacity to expand to 300 MW, positioning the Mid-Atlantic region as a strategic hub for AI.

This announcement is set to coincide with a CEO roundtable hosted by President Trump at the Pennsylvania Energy and Innovation Summit. CoreWeave expects to create hundreds of construction and technical jobs, adding to its economic and political visibility.

CoreWeave went public just months ago at $40 and touched $183 in June before a modest pullback. Cisco Systems disclosed a 1 million share stake last week, further solidifying institutional interest. The stock’s sharp rebound today suggests investors are betting that physical infrastructure remains critical as AI workloads intensify.

CoreWeave’s bold infrastructure plan arrives at a time when investors are seeking durable AI growth names.

With hyperscaler demand rising and AI compute capacity becoming a national priority, CRWV could see further institutional accumulation if momentum holds.

High-Rated Buys (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return—posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list—free.

Access the “7 Best Stocks for the Next 30 Days” now.

Advertising

The Trade Desk Soars on S&P 500 Inclusion and Earnings Optimism

The Trade Desk [TTD] surged about 14% in premarket trading after news broke that the digital ad firm will join the S&P 500 index this Friday. This follows Synopsys’ acquisition of Ansys and represents a significant milestone that could drive new passive inflows and broaden institutional ownership.

Amid a wave of bullish sentiment, Citi recently raised its price target to $90 and added the stock to its “90-day catalyst watch,” highlighting feedback from media buyers and marketers who see the company’s Kokai platform as a best-in-class demand-side solution.

The firm is also widely viewed as a leader in data-driven campaign execution, with strong adoption trends even as rivals like Amazon scale their DSP offerings.

Despite a disappointing start to the year and a 35% YTD decline, TTD appears to be turning a corner. Analysts are hopeful for a Q2 earnings beat after a stumble in February, and the S&P inclusion could reset investor sentiment at a critical time.

S&P inclusion is more than symbolic as it often precedes sustained institutional demand. With Q2 results just around the corner and momentum shifting, The Trade Desk may be primed for a broader rerating.

Movers and Shakers

Coherent Corp. [COHR] – Last Close: $94.52

Coherent is a global leader in laser and photonics technologies used across semiconductors, aerospace, industrial, and medical sectors. While the stock is down about 6% for the year, recent analyst optimism and institutional accumulation are starting to shift sentiment.

Shares are up 4.7% in premarket trading after the company was rated “Outperform” by analysts earlier this month. The combination of technical momentum and strategic backing may be creating a short-term setup worth watching. The stock is also trading below its 52-week high, leaving room for recovery if investor confidence continues to build ahead of its next earnings report.

My Take: COHR is a stealth rebound play with real institutional support. If market conditions hold, it could be one of the stronger optical tech names to lead in the second half of 2025.

Oceaneering International, Inc. [OII] – Last Close: $21.10

Oceaneering provides robotics and engineering solutions to the offshore energy, defense, and aerospace industries. The company’s subsea robotics unit just landed a major win from ExxonMobil’s Esso division in Angola.

OII stock is up 6.7% premarket after announcing a three-year, $80–$90 million contract renewal to provide ROV and subsea services. The competitive re-award signals strong customer trust and reinforces Oceaneering’s position in a key offshore growth market. As oil and gas development ramps up globally, this name may quietly outperform.

My Take: After a rough year, OII could be bottoming. Contract wins like this one offer early signs of a rebound in offshore services and is worth keeping on your watch list.

Metsera Inc. [MTSR] – Last Close: $42.47

Metsera is a biotech company focused on metabolic and endocrine disorders, and it’s gaining traction with investors as a momentum name. The stock has surged over 100% in the past three months and now trades near the top of its 52-week range.

MTSR is up 4.7% in premarket trading, despite no new headlines. However, recent commentary suggests a “trend fit” based on recent strength, positive earnings estimate revisions, and high relative volume. With institutional buying likely accelerating and technicals aligning for a breakout, Metsera could be gearing up for its next leg higher.

My Take: This name has breakout potential written all over it. If the biotech rally continues, MTSR is one of the cleaner setups on the screen. It might be worth taking a small position around these levels if your risk tolerance is up to it.

Gold Trust Shift (Sponsored)

A quiet shift is happening in the financial system — and big banks are already making their move.

They’re now able to treat gold as a cash-equivalent asset, and they’re acting fast behind the scenes.

Meanwhile, millions remain heavily exposed to volatile paper assets. One economist recently warned that gold is now “the only money banks trust.”

There’s still time to take steps using a legal, IRS-approved strategy — one that avoids taxes or penalties while rebalancing toward more stable assets.

A free Wealth Protection Guide explains how to do exactly that.

[Click here to get your free copy]

P.S. Every day of delay gives institutions more time to get ahead. Take action while the window is still open.

Everything Else

Google commits $25 billion to new U.S. data centers as it expands its AI infrastructure footprint.

Tesla’s $70,000 Model Y debuts in India, testing appetite for premium EVs in Delhi and Mumbai.

Bitcoin crosses the $120,000 mark to hit a new record high, fueled by institutional inflows and ETF demand.

Nvidia plans to restart H20 GPU sales in China after months of regulatory delays.

Robinhood gets passed over for S&P 500 inclusion again, as The Trade Desk secures the spot in the upcoming reshuffle.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.