An industrial powerhouse is hitting new highs after a strong quarter, a regional lender is back in analysts' good books with momentum to match, and a strategic metals supplier just secured its place in a trillion-dollar future. Here's what traders are watching today.

Expert Stock List (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

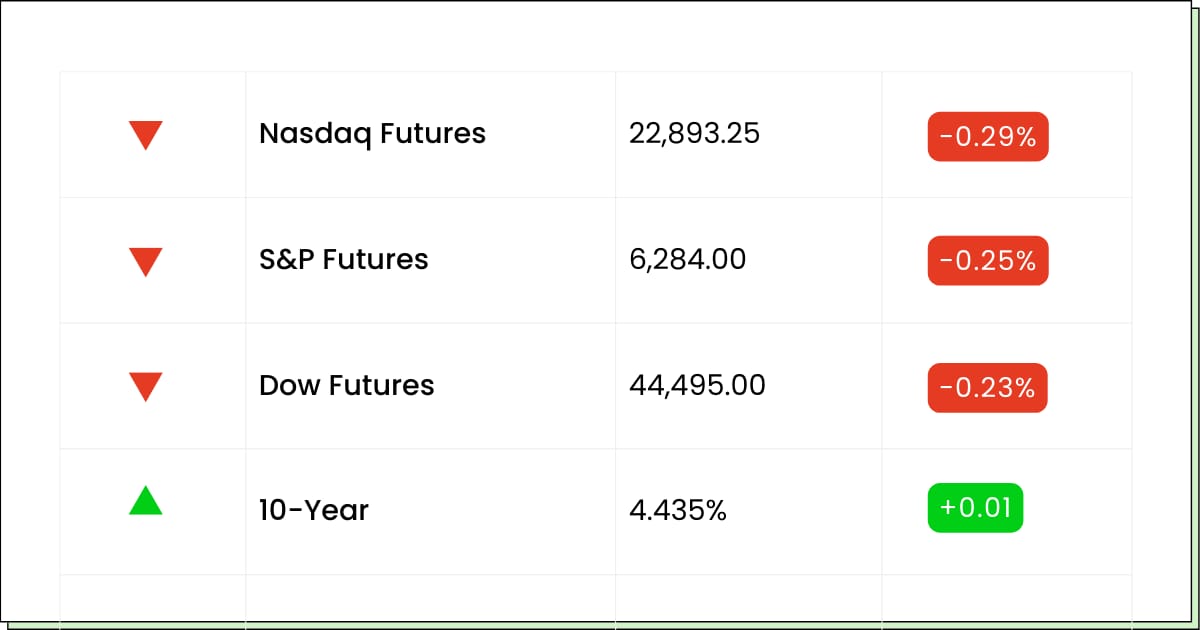

Futures 📈

Want to make sure you never miss a premarket alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Fastenal Company [FAST]: Pre-Market

FB Financial Corporation [FBK]: After Hours

Equity Bancshares, Inc. [EQBK]: After Hours

Simulations Plus, Inc. [SLP]: After Hours

Barnes & Noble Education, Inc. [BNED]: Time Not Supplied

Economic Reports:

None scheduled

Future of AI (Sponsored)

It's lifting Artificial Intelligence to a new level — answering follow-up questions, admitting mistakes, challenging incorrect premises, rejecting inappropriate requests, and more.

That’s why this Special Report names and explains 5 tickers to lead the way.

Among them is a “Sleeper Stock” that is still cruising under Wall Street’s radar.

All 5 have exceptional profit potential. There couldn’t be a better time for this investor briefing.

Click here now to claim your copy FREE

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Industrials

Fastenal Beats Expectations With Q2 Results, But a Bigger Story Is Coming

Fastenal [FAST] delivered a solid second quarter report, with earnings per share of $0.29 beating analyst estimates by a penny and revenue reaching $2.08 billion, slightly ahead of the $2.07 billion consensus.

The better-than-expected performance sent shares higher in premarket trading, up over 3%.

The Minnesota-based industrial distributor has now climbed more than 21% year to date and is trading near a 52-week high. Behind the numbers is a company benefiting from steady demand in manufacturing and construction, sectors that continue to stabilize after a rocky macro backdrop in 2024.

Fastenal has also seen seven positive EPS revisions over the past 90 days, hinting at growing analyst confidence.

While today’s bump is earnings-driven, there’s a longer-term setup worth paying attention to. Fastenal’s scale, diverse product portfolio, and customer stickiness make it a strong candidate to benefit from the broader reshoring and infrastructure build-out across North America.

The company also boasts a strong balance sheet and consistent dividend growth, giving it appeal as both a cyclical and defensive holding. With infrastructure spending projected to rise and industrial supply chains normalizing, Fastenal may be entering a sweet spot.

The post-earnings pop reflects near-term optimism, but the company’s position in the supply chain suggests there’s more to come if macro tailwinds continue. For investors seeking quality exposure to U.S. manufacturing momentum, FAST is one to keep firmly on the radar.

Financials

KeyCorp Gains Analyst Momentum as Regional Bank Rebound Builds

KeyCorp [KEY] is beginning to stand out from the pack as Wall Street warms to the idea of a regional bank rebound. The stock has climbed nearly 8% this year, and a fresh wave of analyst upgrades is pointing to more upside ahead.

UBS upgraded Key to “Buy” last week, citing its “superior capital arsenal” and faster-than-expected loan growth, while Wells Fargo and RBC also lifted their price targets in recent sessions.

Analyst Erika Najarian at UBS believes Key is primed for multiple expansion now that balance sheet repair is largely complete.

She highlighted the firm’s C&I loan growth, progress toward a $3 billion annual target by midyear, and an aggressive hiring plan to deepen middle market coverage. UBS raised its price target from $18 to $22, with upward revisions to EPS through 2027.

This comes on the heels of a $2 billion minority investment from Scotiabank last year, which fortified Key’s capital position and gave it more room to compete for deposits and expand into capital markets.

Combined with a robust dividend yield of 4.47%, analysts say KeyCorp offers a rare combination of income and growth in an otherwise cautious regional banking landscape.

For investors seeking value in the financial sector, KeyCorp may be turning a corner.

Recent institutional interest, rising loan production, and stronger forward guidance suggest this is no longer just a turnaround story, as it’s a bank starting to play offense again. The market may be underestimating how much room there still is to re-rate.

Gold Trust Shift (Sponsored)

A quiet shift is happening in the financial system — and big banks are already making their move.

They’re now able to treat gold as a cash-equivalent asset, and they’re acting fast behind the scenes.

Meanwhile, millions remain heavily exposed to volatile paper assets. One economist recently warned that gold is now “the only money banks trust.”

There’s still time to take steps using a legal, IRS-approved strategy — one that avoids taxes or penalties while rebalancing toward more stable assets.

A free Wealth Protection Guide explains how to do exactly that.

[Click here to get your free copy]

P.S. Every day of delay gives institutions more time to get ahead. Take action while the window is still open.

Industrials

MP Materials Surges on Pentagon Deal, But the Real Upside May Still Be Ahead

MP Materials [MP] is fast becoming a cornerstone in America’s push for rare earth independence, and its latest breakthrough may only be the beginning. Shares jumped more than 50% in a single session last week after the U.S. Department of Defense revealed a $400 million investment in the company.

That rally, paired with a staggering 175% gain year to date, reflects more than just a headline bump. It’s a sign that investors see MP as a long-term strategic asset, not just a mining play.

The Pentagon’s funding will help MP complete its “10X” magnet facility in Texas and expand production at its Mountain Pass site in California, one of the only rare earth mines outside of China.

These materials, used in everything from missiles to electric vehicles, are becoming increasingly essential to both defense and next-generation technologies like AI, robotics, and clean energy.

Just as important, MP now has a 10-year price floor and supply contract in place, effectively de-risking revenue in a notoriously boom-and-bust sector.

With Washington doubling down on reshoring critical supply chains and global demand for rare earths accelerating, MP is uniquely positioned to ride the wave. While China still dominates the space, MP’s domestic footprint gives it a geopolitical edge that few competitors can match.

Yes, the stock has already surged. But the Pentagon’s endorsement may signal something bigger: the transformation of MP from niche miner to linchpin of the 21st-century industrial economy. For investors, this could be the beginning, not the end, of the story.

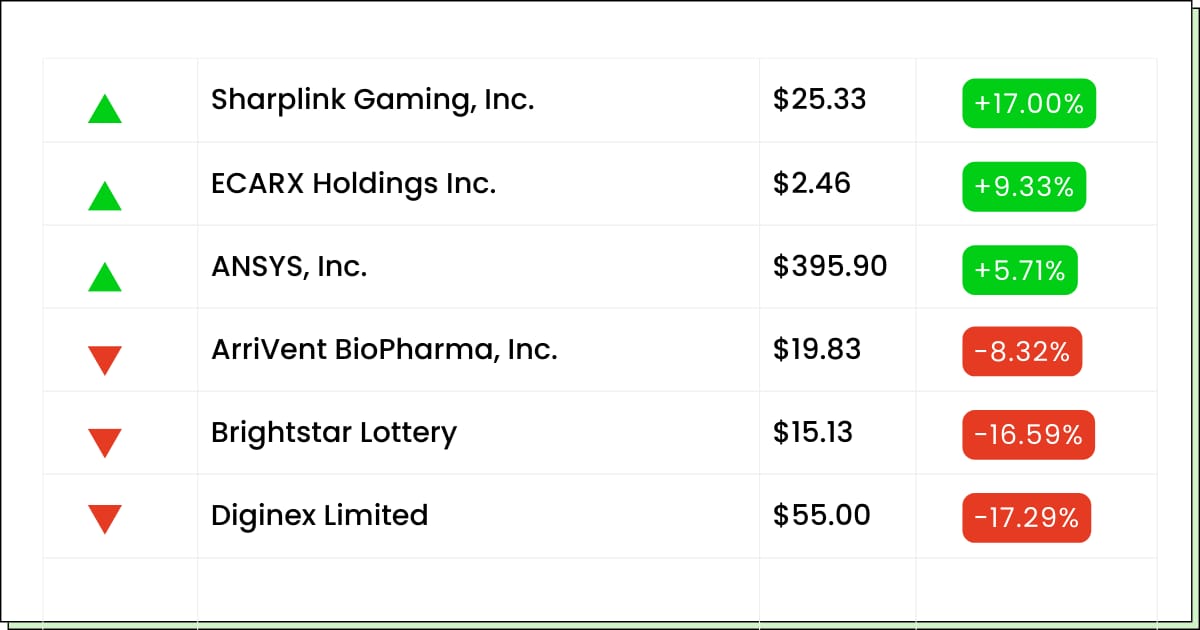

Movers and Shakers

SharpLink Gaming [SBET] – Last Close: $21.65

SharpLink Gaming is pivoting from traditional sports betting into the crypto ecosystem in a big way. The company has aggressively expanded its Ethereum holdings, including a recent 10,000 ETH acquisition directly from the Ethereum Foundation. That move, paired with 21,487 ETH picked up from Galaxy Digital and Coinbase, brings its total stash to a staggering 253,000 ETH. This crypto-focused strategy positions SBET as a significant institutional player in the Ethereum ecosystem.

Shares are up nearly 17% in premarket trading today, riding a surge in ETH demand and strategic endorsements from Ethereum heavyweights like Joseph Lubin of Consensys. With Ethereum ETFs gaining traction and institutional inflows rising, SBET is catching investor attention as a backdoor play on the ETH ecosystem.

My Take: SharpLink is aligning itself with Ethereum’s institutional breakout, which could fuel a longer-term narrative. For investors bullish on crypto infrastructure, this one is worth monitoring, but expect volatility as it charts new territory.

Nebius Group [NBIS] – Last Close: $44.30

Nebius Group is a cloud-based AI infrastructure provider giving companies access to powerful GPU compute through its Neocloud platform. In a world hungry for generative AI, Nebius offers full-stack, cost-efficient, and scalable access to high-performance compute, making it an attractive partner for enterprise and dev clients alike.

Goldman Sachs just initiated coverage with a “Buy” rating and called for over 50% upside. The stock is up more than 4% in premarket trading today after the note highlighted Nebius as undervalued versus peers like CoreWeave. With the AI spending wave still building and the stock trading at only 3x EV/Sales, there's room for upside if execution stays sharp.

My Take: NBIS could be a stealth winner in the GPU cloud space. Goldman’s coverage brings new eyes, but it's the company’s full-stack model and scalability that offer long-term intrigue. A good one to keep on a breakout watchlist.

Pitney Bowes [PBI] – Last Close: $11.01

Pitney Bowes is best known for its mail processing systems, but it's also a quiet value play with a growing digital and e-commerce logistics arm. The company holds a Zacks Value Score of “A” and trades at just 8.4x forward earnings, with improving fundamentals and rising EPS estimates pushing shares higher.

PBI is up more than 5% in premarket action today, helped along by analyst upgrades and renewed interest from value-oriented investors. A forward PEG of just 0.6 and earnings revisions suggest the story may be turning around for this legacy name.

My Take: This isn’t a moonshot, but it could be a sturdy base hit. Pitney Bowes is trading well below intrinsic value, and today’s momentum might finally give this one a lift beyond its 52-week highs.

AI (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Everything Else

EU and South Korea scramble to cut side deals with Washington as tariffs disrupt global trade flows.

France vows to boost defense spending after Macron’s fiery warning that freedom demands fear. Full story here.

Elon Musk dismisses rumors of a Tesla-xAI merger, saying the two companies will stay separate.

Bitcoin pushes past $120,000 to hit a fresh all-time high, fueled by global macro angst and flight-to-safety buying.

This week’s earnings season could reveal whether investors are truly done worrying about tariffs.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.