A battered biotech name is staging a surprise comeback after a wave of restructuring and regulatory clarity. A global chip leader just posted blowout profits thanks to booming AI demand. And a high-end casino operator is stacking chips after hitting record margins. Here's what traders are watching this morning.

Next AI Boom (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

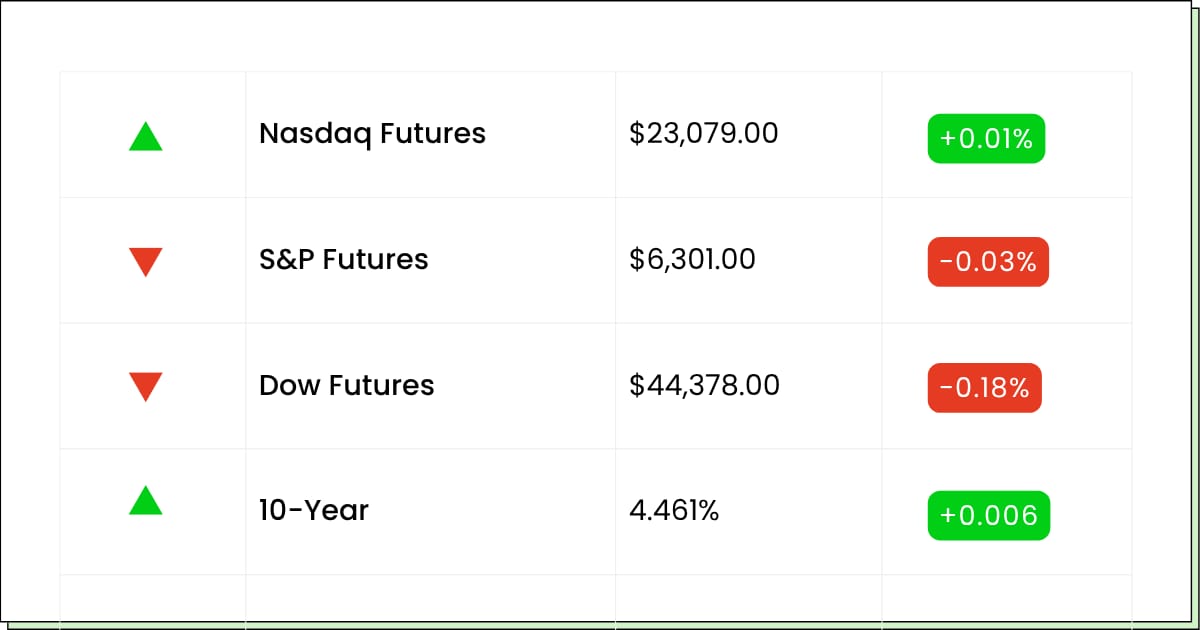

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Taiwan Semiconductor Manufacturing Co. [TSM]: Premarket

Novartis AG [NVS]: Premarket

Abbott Laboratories [ABT]: Premarket

Marsh & McLennan Companies, Inc. [MMC]: Premarket

Cintas Corporation [CTAS]: Premarket

Elevance Health, Inc. [ELV]: Premarket

U.S. Bancorp [USB]: Premarket

Citizens Financial Group, Inc. [CFG]: Premarket

Snap-On Incorporated [SNA]: Premarket

Texas Capital Bancshares, Inc. [TCBI]: Premarket

ManpowerGroup [MAN]: Premarket

Wipro Limited [WIT]: Premarket

Netflix, Inc. [NFLX]: Aftermarket

Western Alliance Bancorporation [WAL]: Aftermarket

Bank OZK [OZK]: Aftermarket

F.N.B. Corporation [FNB]: Aftermarket

Cohen & Steers Inc. [CNS]: Aftermarket

Independent Bank Corp. [INDB]: Aftermarket

Simmons First National Corporation [SFNC]: Aftermarket

Metropolitan Bank Holding Corp. [MCB]: Aftermarket

Economic Reports:

Initial Jobless Claims [July 5]: 8:30 am

U.S. Retail Sales [June]: 8:30 am

Retail Sales minus Autos [June]: 8:30 am

Import Price Index [June]: 8:30 am

Import Price Index minus Fuel [June]: 8:30 am

Philadelphia Fed Manufacturing Survey [July]: 8:30 am

Business Inventories [May]: 10:00 am

Home Builder Confidence Index [July]: 10:00 am

Fed Governor Adriana Kugler Speech: 10:00 am

San Francisco Fed President Daly Speech: 12:45 pm

Fed Governor Lisa Cook Speech: 1:30 pm

Fed Governor Christopher Waller Speech: 6:30 pm

Exit the Chaos (Sponsored)

Markets don’t wait for calm—especially when political chaos takes center stage.

With Trump and Musk locked in a growing public feud, the fear of market volatility is very real.

While the headlines escalate, institutions are quietly stockpiling gold to shield against the blowback.

This free Gold IRA Survival Guide outlines a fully legal way to reposition your savings now—without taxes or penalties.

Get ahead of the next wave before the damage becomes irreversible.

[Get the Gold Protection Guide Free]

Semiconductors

TSMC Earnings Soar as AI Demand Fuels Record Quarter

Taiwan Semiconductor Manufacturing Company [TSM] delivered a blowout second quarter, with profit jumping 61% year-over-year to NT$398.27 billion ($12.6 billion), driven by booming demand for AI chips.

Revenue climbed nearly 39% to NT$933.8 billion ($31.7 billion), beating estimates and marking a record for the world's largest contract chipmaker. TSMC’s high-performance computing segment, home to its AI and 5G processors, accounted for 60% of total sales, up from 52% last year, as the company continues to benefit from strong orders from clients like Nvidia and Apple.

Management guided third-quarter revenue to be between $31.8 billion and $33 billion, representing an 8% sequential increase at the midpoint, and expects full-year U.S. dollar revenue to grow by 30%. Advanced chip nodes (7nm and below) now make up 74% of wafer revenue, underscoring TSMC’s positioning at the leading edge of semiconductor technology.

The stock traded up over 4%, despite concerns over potential U.S. tariffs on Taiwanese semiconductors. CEO C.C. Wei noted that customer behavior remains unchanged for now, though he acknowledged risks tied to trade policy and currency headwinds.

With AI still in its early innings and hyperscalers ramping custom silicon production, TSMC’s scale and technology leadership give it a critical edge.

While macro risks persist, especially in China and the consumer devices sector, investors appear increasingly focused on the company’s accelerating momentum in AI infrastructure.

Biotech

Sarepta Shares Surge 32% as Restructuring and FDA Clarity Revive Bull Case

Sarepta Therapeutics [SRPT] jumped more than 32% in premarket trading Thursday, as investors cheered management’s restructuring plan and a surprisingly constructive update from the FDA.

The company, whose shares have declined by over 85% year-to-date, announced layoffs affecting one-third of its workforce, which is expected to save $100 million annually. Sarepta also confirmed that its gene therapy Elevidys will remain on the market for ambulatory patients, albeit with a black box warning.

While the drug remains paused for non-ambulatory use, the FDA has left the door open for potential expansion pending the development of new protocols.

Contrarian investors see this as a critical turning point. With a market capitalization under $2 billion and annual sales exceeding $2 billion, the company is now trading at less than 2 times sales. Sarepta also has multiple pipeline programs nearing key readouts, including SRP-9003 for limb-girdle muscular dystrophy and a suite of RNA-based therapies in early trials.

Short interest stands at nearly 15%, indicating potential for further upside from covering activity. Technically, SRPT entered oversold territory earlier this month, and Wednesday’s rally may mark the beginning of a longer-term rebound.

The company’s leaner cost base, renewed regulatory clarity, and upcoming catalysts position Sarepta as one of the most asymmetric risk-reward plays in biotech today, though it remains highly volatile and best suited for high-risk investors.

Hidden Asset (Sponsored)

While banks quietly shift toward gold-backed assets, most Americans remain exposed to high-risk paper investments.

One leading economist says gold is now “the only money banks trust.”

There’s still time to position yourself—using an IRS-approved strategy that protects your savings without triggering taxes or penalties.

This FREE Wealth Protection Guide reveals how to make the move before it’s too late.

P.S. Every day you wait, the insiders keep gaining ground. Get informed before the next big move.

Gaming & Leisure

Monarch Casino Reports Record Q2 Results, Boosted by Strong Casino Margins

Monarch Casino & Resort [MCRI] posted record Q2 2025 results, with profits climbing 19.1% to $27 million and Adjusted EBITDA jumping 16.8% to $51.3 million. The strong showing was driven by robust performance at its casino operations, which saw 12.1% year-over-year revenue growth.

Overall net revenue rose 6.8% to $136.9 million, while diluted EPS increased 21% to $1.44. Operating efficiencies played a key role, with casino and food & beverage margins improving meaningfully year-over-year.

The company expanded its EBITDA margins by over 300 basis points to 37.5%, demonstrating disciplined expense control despite some segments underperforming.

Hotel revenues declined 3.1% due to softer convention activity, but this was more than offset by gains in other areas. Monarch completed a $100 million hotel room redesign at its flagship Atlantis property in Reno, which is now ranked the top hotel in the city by U.S. News & World Report.

The balance sheet remains solid, with $71.6 million in cash and no borrowings, enabling continued capital returns. In Q2, Monarch repurchased $19.8 million in stock and maintained its $0.30 dividend.

While legal uncertainty looms over a $74 million contractor judgment, investors appear to be focused on the strong operating trends and potential for margin-driven earnings growth. The stock rose 17% in premarket trading, with upside potential if the company’s reinvestment strategy continues to translate into market share gains.

Movers and Shakers

Bitmine Immersion Technologies Inc. [BMNR] – Last Close: $44.80

Bitmine Immersion Technologies is a crypto infrastructure firm transitioning from traditional bitcoin mining to an Ethereum-focused treasury model. The company recently made headlines by appointing Fundstrat’s Tom Lee as chairman and adopting a bold ETH accumulation strategy, positioning itself as the “MicroStrategy of Ether.”

Shares jumped another 6.1% in premarket trading after Peter Thiel’s Founders Fund disclosed a 9% stake. That move follows broader excitement around Ethereum, driven by Circle’s IPO and Robinhood’s push into tokenized U.S. equities.

My Take: With strong backers and smart positioning around ETH, Bitmine is tapping into both the crypto narrative and investor FOMO. But with the stock up over 500% YTD, entry timing matters, so wait for dips if you’re not already in.

CSX Corp. [CSX] – Last Close: $33.26

CSX Corp. is a major U.S. rail operator serving key industrial and consumer freight corridors across the East Coast. While known for its steady dividend and dependable cash flows, the stock caught fire this week on speculation of a takeover by Union Pacific.

Premarket shares are up 5.4% following a Semafor report that Union Pacific is exploring acquisitions of East Coast railroads. Combined with CSX's recent dividend approval and upgraded analyst outlooks, the M&A chatter is reigniting investor interest.

My Take: This is a fundamentally sound operator now trading with a potential acquisition premium. Short-term upside could come from deal headlines, but long-term holders may appreciate the solid core business either way.

Toast Inc. [TOST] – Last Close: $45.14

Toast builds end-to-end restaurant management software and POS systems for more than 140,000 locations globally. It’s rapidly growing across enterprise and international markets while investing heavily in AI-driven features to enhance user productivity.

Shares are up 2.8% in premarket trading after the company highlighted strong early traction for its new AI tools, including the Sous Chef assistant and ToastIQ platform. Raised guidance on gross profit and margins is adding to the bullish narrative.

My Take: Toast is building real competitive advantage through specialization and tech innovation. The stock isn’t cheap, but its consistent growth makes it one of the more exciting software plays in hospitality.

Q2 Picks (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Everything Else

Regulators and activists are pushing back on plans to build a data center tied to Elon Musk’s xAI in Tennessee, citing environmental and civil rights concerns.

Meta and Google are expanding their global internet reach with a new wave of high-capacity subsea cables connecting Asia, Africa, and the Americas.

Couche-Tard has pulled its $4.7 billion bid to acquire Japan’s Seven & i, ending months of takeover speculation.

Volvo’s quarterly profits slid as tariff pressures weighed on margins in key export markets.

BlackRock shares are rebounding after the firm brushed off a $25 billion client redemption, with Wall Street focusing instead on strong inflows elsewhere in the business.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.