Good morning. It's October 15th, and today we’ll look at better-than-expected earnings reports from BofA and Johnson & Johnson, plus a semiconductor stock that is surging by more than 20% in premarket trade.

Previous Close 📈

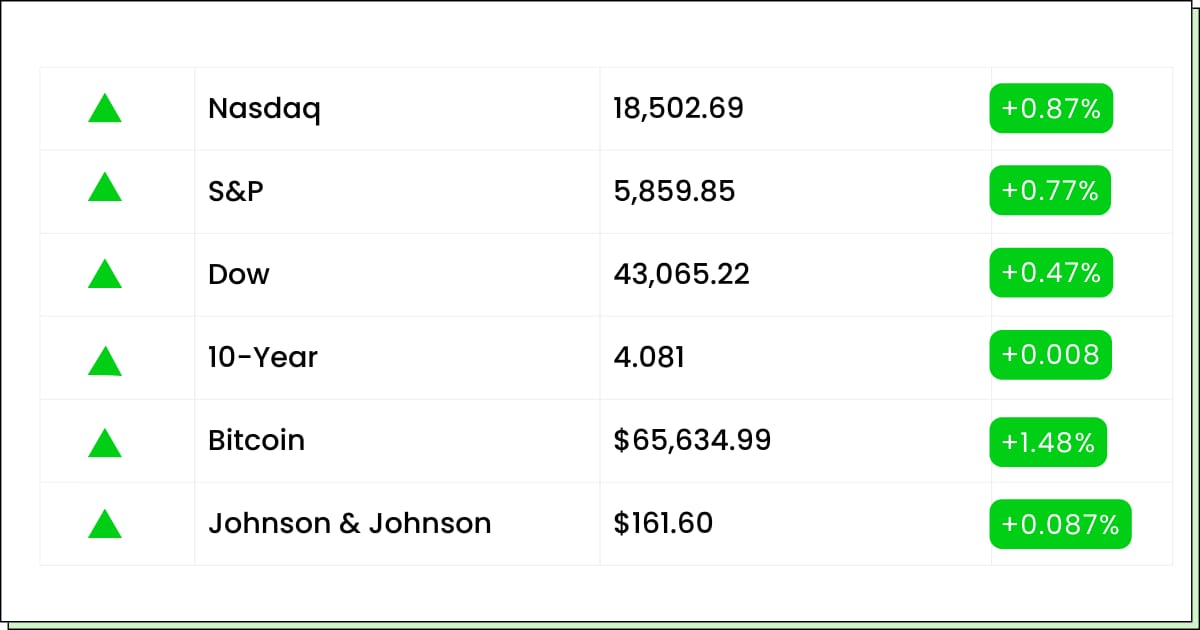

The Dow Jones closed above 43,000 for the first time on Monday, gaining over 200 points. The S&P 500 also hit new intraday and record closes, driven by a 1.4% gain in information technology stocks.

Futures

Dow futures are up slightly, gaining 55 points (0.1%), while S&P 500 and Nasdaq 100 futures are trading near flat.

Investors are looking ahead to the corporate earnings reports of major banks like Goldman Sachs, Citigroup, and Bank of America. Economic data on manufacturing and consumer expectations will also be in focus.

Private Markets

What if you had the chance to get in on companies like Groq, Anthropic, Neuralink, and SpaceX before they went public?

This platform has opened the door to exactly those kinds of pre-IPO opportunities, alongside hedge funds that have delivered impressive annualized returns—32.8% since 2012 and 37.3% since 2009.

With no membership fees and a streamlined online experience, investors can tap into curated opportunities that include private equity, pre-IPO deals, and more. Plus, every offering undergoes thorough due diligence, ensuring high-quality investment options.

To date, it has already helped investors deploy over $150 million into private markets.

What to Watch

Several major stocks, including Goldman Sachs Group (NYSE: GS), Citigroup (NYSE: C), Charles Schwab (NYSE: SCHW), PNC Financial Services Group (NYSE: PNC), and State Street (NYSE: STT) will report their quarterly earnings today morning before the market opens.

On the economic calendar, the Empire State Manufacturing Survey for October will be released at 8:30 a.m. ET. Additionally, Fed Governor Adriana Kugler will speak at 1:00 p.m. ET, providing insights into monetary policy.

After the closing bell, Interactive Brokers (NASDAQ: IBKR) and United Airlines Holdings (NASDAQ: UAL) will announce their results.

Banking

BofA Reports Strong Q3 Earnings Despite 3% Drop in Interest Income

Bank of America (NYSE: BAC) posted better-than-expected third-quarter earnings, reporting earnings per share (EPS) of $0.81 and beating analysts' estimates of $0.76 by $0.05.

Revenue for the quarter reached $25.35 billion, slightly ahead of the $25.25 billion consensus estimate. Its stock is up 1.5% during premarket trading.

Despite the earnings beat, BofA’s net interest income (NII) fell 3% to $14 billion, as higher interest rates made deposit competition tougher. Provision for credit losses also increased to $1.5 billion from $1.2 billion a year ago, reflecting growing risks from pressured borrowers.

On the bright side, the bank's investment banking fees jumped 18% to $1.4 billion, benefiting from a resurgence in mergers, acquisitions, and debt issuance. Wall Street's overall rebound has bolstered financial activity, and last month’s Federal Reserve rate cut is expected to support further dealmaking.

The bank’s net income dropped to $6.9 billion, or $0.81 per share, compared to $7.8 billion, or $0.90 per share, a year earlier.

However, the positive earnings performance contrasts with its rivals, JPMorgan Chase and Wells Fargo, both of which outperformed in Q3.

Healthcare

UnitedHealth's Q3 Profit Beats Expectations, But Rising Medical Costs Weigh on Shares

UnitedHealth Group reported a sharp rise in medical costs for the third quarter, which is leading to a 3.55% drop in its shares during premarket trading this morning.

The company’s medical loss ratio—representing the percentage of premiums spent on medical care—rose to 85.2%, significantly higher than last year’s 82.3% and above analyst expectations of 84.2%.

This increase was driven by heightened demand for healthcare services, particularly among Medicare recipients who had delayed procedures during the pandemic.

UnitedHealth is also facing challenges in its Medicaid business, where a turnover in enrollees left insurers with a sicker population, raising costs further.

Medicaid reassessments have been ongoing since the pandemic-era requirement for consistent coverage lapsed in April of last year.

Despite these challenges, UnitedHealth posted adjusted earnings of $7.15 per share, surpassing Wall Street estimates by 15 cents.

The company also beat revenue forecasts, reporting $100.8 billion compared to an expected $99.28 billion. Increased membership across its various segments helped offset some of the pressure from rising medical costs.

Pharmaceuticals

Johnson & Johnson Beats Q3 Expectations, But Talc Lawsuit Worries Still Loom

Johnson & Johnson reported strong third-quarter earnings, surpassing Wall Street’s expectations with adjusted earnings of $2.42 per share, higher than the $2.21 consensus estimate.

Sales reached $22.5 billion, up 5.2% from the same period last year. However, the company slightly reduced its full-year adjusted earnings forecast to $9.91 per share, reflecting a recent acquisition-related charge.

The company’s stock is trading at nearly 2% above its previous closing during premarket trade. Overall, its shares are up 3% this year but continue to underperform the broader market.

J&J’s MedTech division faced challenges due to economic slowdowns in Asia and a physician strike in Korea, but the pharmaceutical segment secured five new drug approvals, helping J&J maintain solid performance overall.

Despite the positive financials, lingering concerns over the company’s ongoing talc litigation continue to overshadow its results.

Johnson & Johnson is pursuing a third attempt to settle claims through bankruptcy, supported by 83% of claimants. If successful, it may ease investor worries, but the timeline remains uncertain.

Gold

Gold has hit new all-time highs, surging beyond $2,600 per ounce, and this small-cap gold stock is primed for explosive growth.

What if you had known this surge was coming? You now have the chance to capitalize on the trend. With over 4 million ounces of gold already confirmed at its flagship project, this company is trading at just $0.25 per share, offering an incredible early entry point.

The company is set to ramp up its drilling efforts to uncover even more high-grade gold, putting it in a prime position as gold prices continue to rise.

With a strong leadership team and plans for expansion, this is a gold stock that could deliver significant gains for those who act quickly.

Movers and Shakers

Wolfspeed [WOLF] - Last Close: $11.38

Semiconductor manufacturer Wolfspeed's stock is up nearly 25% in premarket trading.

The firm is receiving $750 million in proposed funding from the U.S. CHIPS Act, along with an additional $750 million in financing from a consortium of investment groups led by Apollo.

These funds, combined with $1 billion in expected tax refunds, will provide Wolfspeed with a total of $2.5 billion in capital.

This significant financial backing will enable Wolfspeed to expand its production of silicon carbide technology, which is crucial for industries like electric vehicles, renewable energy, and AI data centers.

My Take: The large infusion of funding and strong vote of confidence for the company makes it an exciting stock to keep your eye on in the future.

Hoth Therapeutics [HOTH] - Last Close: $0.82

Hoth Therapeutics' stock is up 19% before the opening bell today.

The company announced that it has been awarded a key U.S. patent for its Alzheimer's treatment, HT-ALZ.

This patent secures the intellectual property for their innovative approach to treating Alzheimer's, which targets the Substance P/Neurokinin-1 Receptor pathway, known to play a crucial role in neuroinflammation.

Preclinical studies have shown promising results, including reduced neuroinflammation and improved cognitive functions.

Hoth is now preparing for clinical trials of HT-ALZ, a significant step toward developing a new, potentially groundbreaking treatment for Alzheimer's disease.

My Take: The patent is excellent news for Hoth, making it a good prospect to keep on your radar for future growth.

Lipella Pharmaceuticals [LIPO] - Last Close: $0.41

Lipella Pharmaceuticals' stock is surging by 48% in premarket trading.

The firm has received a patent for its innovative liposomal drug delivery platform.

This proprietary technology enables the precise delivery of therapeutic agents, improving the safety and effectiveness of treatments in areas like oncology, cancer survivorship, and immunotherapy.

The patent also extends market exclusivity for Lipella’s two lead clinical assets, LP-10 and LP-310, both of which are in Phase 2 trials for treating hemorrhagic cystitis and oral lichen planus, respectively.

This milestone strengthens Lipella's competitive position and sets the stage for further growth.

My Take: The patent is a strong positive news for the stock. However, this is a tiny low float stock so be cautious while investing in it.

Smart Trading

In today’s unpredictable market, staying ahead of the curve is crucial. With A.I. technology leading the way, traders now have access to powerful tools that can predict market movements with precision.

This next trade could be the key to unlocking significant returns. Learn how A.I. called the recent market crash and what it's signaling for the next big opportunity.

The market is presenting major opportunities—don’t miss out on the chance to capitalize on them.

Everything Else

Boeing secured a $10 billion credit agreement with banks as it faces a crippling strike and impending debt maturities.

The Biden administration explores country-specific limits on advanced AI chip sales to bolster diplomatic leverage.

Investors seek clarity in Chinese policy as stocks underperform despite government stimulus efforts.

New business software firm Tebi targets growth with $22M in funding, aiming to simplify order and payment processing for small businesses.

Governments race against time to salvage global tax agreement by June deadline amid rising stakes.

Trump Media's stock recovery continues with strong trading volume and the rollout of the Truth+ streaming service.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.