Good morning. It's October 23rd, and today we’ll look at Coke’s disappointing quarterly results, McDonald’s E. Coli nightmare, Hilton’s demand woes, and AT&T’s strong subscriber growth as quarterly results move into full swing this week.

🔥 We got a killer stock pick coming up this week. Want in? Check out Elite Trade Club Insider.

Previous Close 📈

The S&P 500 posted its first back-to-back losses since early September on Tuesday, while the Dow Jones saw marginal declines. The Nasdaq Composite bucked the trend, rising 0.2%. Rising 10-year Treasury yields, which briefly topped 4.2%, continue to pressure stocks, driven by robust economic data and concerns over the federal deficit.

Futures

U.S. stock futures are sliding Wednesday morning. Dow futures are down 129 points (0.3%), S&P 500 futures are off 0.06%, and Nasdaq 100 futures have dropped 0.14%. Investors are focusing on earnings reports from major companies like Coca-Cola and Tesla, which are set to report throughout the day.

Technology

Remember when Tesla shocked the world with its game-changing electric cars? Well, the smartphone industry is experiencing a similar disruption with a new player redefining what smartphones can do.

This company isn’t just producing another gadget—it’s breaking the mold by offering high-tech smartphones at an affordable price. From 2019 to 2022, its revenue skyrocketed by 32,481%, making waves in the $1T+ smartphone market.

But it’s not just about the device. Like Tesla built an energy ecosystem, this company’s smartphone allows users to earn money through simple, everyday activities—like playing games, listening to music, or even charging their phones.

Investors who recognized Tesla’s potential early saw massive returns, and this could be the next big opportunity in tech. With shares priced at just $0.25, early investors stand to gain big.

* This is a paid advertisement for Mode Mobile Regulation A offering. Please read the offering circular and related risks at invest.modemobile.com.

What to Watch

Keep a close eye on several major companies that will report their quarterly earnings before the opening bell today, including Coca-Cola Company (NYSE: KO), Thermo Fisher Scientific (NYSE: TMO), NextEra Energy (NYSE: NEE), AT&T (NYSE: T), and Boeing Company (NYSE: BA).

The earnings action will continue after the market closes as Tesla (NASDAQ: TSLA), T-Mobile US (NASDAQ: TMUS), International Business Machines (NYSE: IBM), ServiceNow (NYSE: NOW), and Lam Research Corporation (NASDAQ: LRCX) will also share their numbers.

On the economic calendar, Existing Home Sales data for September will be released at 10:00 a.m. ET, providing insights into the housing market.

Food & Beverage

Coca-Cola’s Q3 Revenue Tops Forecasts, But Sales Volumes and Income Drop

Coca-Cola reported higher-than-expected third-quarter revenue today, as price increases helped offset declining sales volumes.

The beverage giant posted $11.9 billion in revenue, a slight 1% decline from last year but still surpassing Wall Street’s $11.6 billion forecast.

Coca-Cola raised prices by 10% during the July-September period, continuing a trend of price hikes since the end of 2020. However, the company saw a 1% drop in unit case volumes, reflecting weaker sales.

Coke's net income fell 8% to $2.8 billion, but its adjusted earnings of 77 cents per share beat analysts' estimates of 75 cents per share.

Despite these positive earnings results, Coca-Cola shares are falling by 2% in premarket trading.

While Coke’s pricing strategy has helped maintain revenue growth, the company faces challenges with declining sales volumes and an uncertain economic environment.

Telecom

AT&T Shares Climb After Mixed Q3 Results, Earnings Guidance Maintained

AT&T’s third-quarter earnings report beat analysts' expectations but fell slightly short on revenue. The telecommunications giant posted adjusted earnings of 60 cents per share, exceeding the predicted 57 cents per share.

However, its revenue of $30.2 billion missed the anticipated $30.4 billion, and is also down from the $30.4 billion reported during the same period last year.

Despite the revenue miss, AT&T’s stock is rebounding after an initial dip, climbing 2.8% in premarket trading.

The company's service revenue growth was offset by lower equipment sales, reflecting a trend also noted by rival Verizon, which recently reported lower wireless equipment sales due to fewer phone upgrades.

AT&T added 403,000 postpaid phone subscribers in the quarter, falling short of both second-quarter results and analysts' estimates. Still, CEO John Stankey expressed confidence in the company’s financial outlook, reaffirming its full-year earnings guidance of $2.15 to $2.25 per share.

This quarter’s results come after AT&T’s decision to sell its 70% stake in DirecTV as part of its ongoing shift away from traditional television services. So far this year, AT&T’s stock has risen 28%, outperforming the S&P 500’s 23% gain.

Fast Food

McDonald’s Faces E. Coli Crisis: 49 Infected, 1 Dead, Shares Plummeting 7%

McDonald’s stock is falling by 7% in premarket trading following a CDC report on Tuesday linking an E. coli outbreak to its Quarter Pounder burgers.

The outbreak, which has led to 10 hospitalizations and one death, has impacted 49 individuals across 10 states, with the most cases reported in Colorado and Nebraska. The CDC warns the actual number of cases could be higher due to unreported illnesses.

McDonald’s responded by removing slivered onions, identified as a potential source of contamination, from its Quarter Pounder burgers in affected regions.

The company has temporarily halted Quarter Pounder sales in several Western states, including Colorado, Kansas, Utah, and Wyoming. Other beef products like the Big Mac and cheeseburger remain unaffected, as they use a different type of onion.

McDonald’s USA President Joe Erlinger emphasized the company's commitment to food safety and assured customers that efforts are underway to restore full menu options. The CDC continues its investigation, cautioning that symptoms of E. coli can range from mild stomach upset to severe complications like kidney failure.

This incident follows previous E. coli cases at McDonald’s, including a 2022 outbreak in Alabama involving children who consumed Chicken McNuggets.

Hotels

Hilton Lowers 2024 Revenue Growth Forecast Amid Consumer Spending Slowdown, Stock Slides 5%

Hilton Worldwide reduced the upper end of its 2024 room revenue growth forecast, citing a decline in domestic travel spending in the U.S.

The hotel giant now expects system-wide revenue growth of 2% to 2.5%, down from its previous estimate of up to 3%. This adjustment reflects the impact of consumers cutting back on travel amid rising credit card debt and shrinking savings.

Shares in the firm are dropping 4.7% in premarket trading.

Since the start of the year, U.S. travel demand has faced challenges as more Americans opt for budget-friendly accommodations over full-service hotels. Many consumers are choosing lower-cost alternatives as disposable income continues to drop.

Despite these headwinds, Hilton reported a strong third-quarter performance, posting a profit of $1.92 per share, up from $1.67 a year earlier. Total revenue for the quarter reached $2.87 billion, compared to $2.67 billion in the same period last year.

As consumer spending slows, Hilton and other hotel chains are adjusting expectations for the upcoming year, navigating an increasingly cautious market.

Technology

AI has been making waves, transforming industries and dominating the headlines. But there’s something even bigger on the horizon—Artificial General Intelligence (AGI). This next-level technology could surpass human intelligence, revolutionizing how we live, work, and interact with the world.

Eric Fry, a renowned investment analyst, has just released a free report highlighting 7 investments that are poised to surge as AGI becomes a reality. According to Fry, AGI could start to outpace AI by as soon as 2025, and investors who position themselves now could see tremendous gains.

This is your opportunity to get in before the next major tech boom. AGI could change everything, and those who recognize its potential early could be set to profit in a big way.

Get access to this FREE report and discover how you can position yourself for the next big leap in technology.

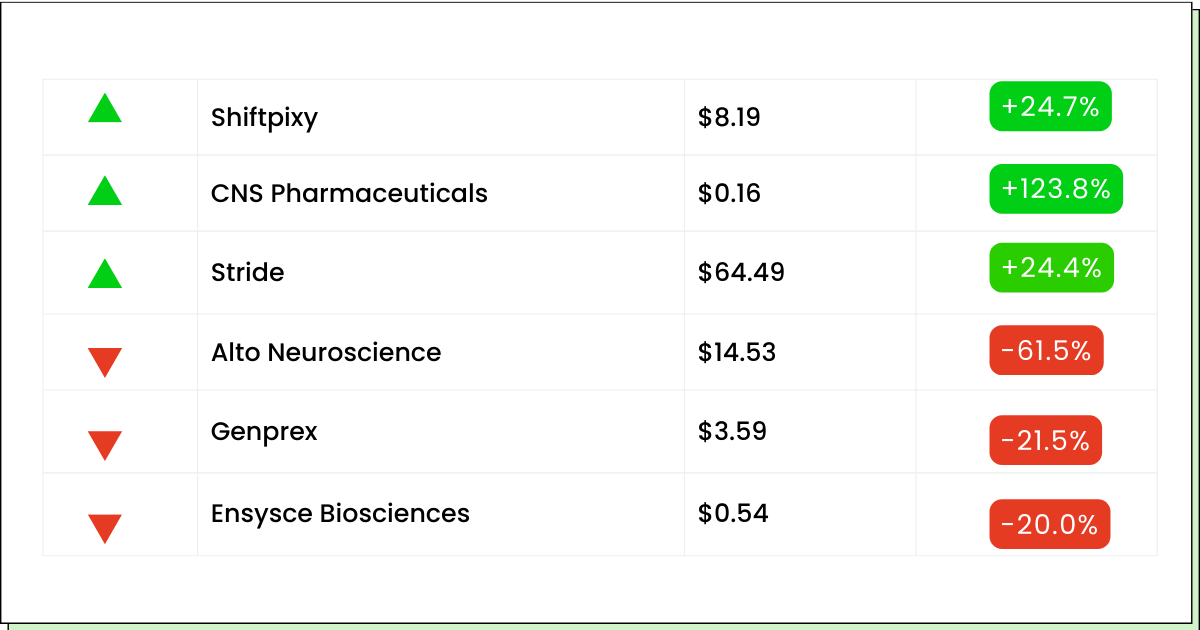

Movers and Shakers

ShiftPixy Inc. [PIXY] - Last Close: $8.19

ShiftPixy is up nearly 25% in premarket today.

The firm announced a signed Letter of Intent (LOI) to acquire TurboScale, an AI technology company specializing in scalable GPU cloud infrastructure.

This $150 million deal, split between stock and debt, signals ShiftPixy’s commitment to integrating advanced AI solutions into its platform.

TurboScale’s technology could enhance ShiftPixy’s ability to optimize staffing efficiency, improve labor forecasting, and offer AI-driven workforce solutions.

The acquisition could become a significant move to boost ShiftPixy’s capabilities in the growing gig economy.

My Take: The acquisition is being viewed positively by the market, and with AI being a hot area right now, it’s a good time to put this stock on your watchlist for growth.

Stride, Inc. [LRN] - Last Close: $64.49

Stride's stock is rising 24% in premarket trading.

The company reported strong first-quarter fiscal 2025 results, driven by record enrollment.

Its revenue rose by 14.8% to $551.1 million, compared to $480.2 million in the previous year. Net income surged significantly to $40.9 million, up from $4.9 million, reflecting a strong demand for its education services.

Notably, enrollments increased by 18.5%, with Career Learning enrollments up by 30.4%, showcasing the company’s growth in both general and career-focused education.

My Take: Even though Stride has fallen off its September peak, the stock is still up by about 7% YTD and has strong fundamentals. It’s a good stock to keep on your radar.

DBV Technologies S.A. [DBVT] - Last Close: $0.70

DBV Technologies shares are rallying by 74.3% in premarket trading.

The firm released positive regulatory updates for its Viaskin Peanut patch.

It announced that it will pursue an Accelerated Approval pathway from the FDA for toddlers aged 1–3 with peanut allergies, with plans to initiate a safety study in 2025.

Additionally, the European Medicines Agency (EMA) provided guidance for a Marketing Authorization Application covering children aged 1–7.

These regulatory advancements bring the company closer to potentially offering a novel treatment for peanut allergies in young children.

My Take: Overall this stock has taken a beating this year and is currently trading at 66% below YTD. It would be best to put this on the wait-and-watch list for now.

Mobile Industry

Just as Tesla revolutionized the car industry, a new company is set to change the smartphone market forever.

This innovative firm isn’t just launching another phone—they’re creating a whole new way to engage with technology, and they've seen an astounding 32,481% revenue growth in just three years.

Their smartphone, designed to be more than just a device, allows users to earn money by doing things they already love—playing games, listening to music, and even charging their phone.

With major partnerships already secured, this company is building an ecosystem that could shake up the entire industry.

At just $0.25 per share, this opportunity is flying under the radar. With the potential for up to 100% bonus shares, now is the time to act before the market catches on.

* This is a paid advertisement for Mode Mobile Regulation A offering. Please read the offering circular and related risks at invest.modemobile.com.

Everything Else

Tokyo Metro sees strong investor demand as shares surge 45% in IPO debut.

Deutsche Bank faces a setback as a court sides with plaintiffs in the Postbank lawsuit.

The ARM-Qualcomm feud has intensified, threatening smartphone and PC markets; both shares are plunging by more than 3% in premarket trade.

Starbucks CEO Brian Niccol outlined a turnaround plan as the company struggles with slumping demand; its stock is plummeting in premarket trade.

American Airlines faces a record fine for failing to assist disabled passengers properly.

NVIDIA’s Huang addresses the Blackwell production delay, saying the design flaw in Blackwell chips is resolved now.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.