Good Afternoon!

Hey, everyone. It's Adam from Elite Trade Club. Here’s what moved the market today.

Q2 Stock Picks (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Markets

Wall Street closed higher on Thursday as surging chip stocks, driven by strong AI-related demand and TSMC’s bullish sales report, outweighed ongoing concerns over new Trump tariffs and trade tensions.

DJIA [+0.43%]

S&P 500 [+0.27%]

Nasdaq [+0.09%]

Russell 2k [+0.64%]

Market-Moving News

Food & Beverage

Ferrero Ends WK Kellogg's Public Run With $3.1B Breakfast Power Play

WK Kellogg (NYSE: KLG) is being acquired by Ferrero for $3.1 billion in cash, less than a year after its spinoff from Kellogg Company.

The all-equity deal values KLG at $23 per share and will take the breakfast cereal maker private, marking the end of a brief and tumultuous chapter as a standalone public company.

Ferrero will gain full control of WK Kellogg's North American cereal operations across the U.S., Canada, and the Caribbean, subject to regulatory and shareholder approvals.

Key stakeholders, including the W.K. Kellogg Foundation Trust, have already pledged support, helping to clear the path for a close in the second half of 2025.

For long-term shareholders, the offer represents a clean exit with a sharp upside.

Strategically, this is Ferrero's latest move in a clear pattern of U.S. expansion, joining its acquisitions of Nestlé's candy unit, Fannie May, and other legacy brands.

The cereal market may be slow-growing, but it offers high household penetration, built-in distribution, and brand loyalty.

Those evaluating the packaged food space may note this trend: family-owned European giants are moving in where U.S. conglomerates are pulling back.

Ferrero's ability to leverage operational scale, invest for the long haul, and avoid quarterly reporting pressure gives it a distinct advantage in reworking mature categories.

The deal will delist WK Kellogg from the NYSE, removing one of the few pure-play cereal stocks from the public market.

ChatGPT Power Plays (Sponsored)

It's lifting Artificial Intelligence to a new level — answering follow-up questions, admitting mistakes, challenging incorrect premises, rejecting inappropriate requests, and more.

That’s why Zacks just released a Special Report that names and explains 5 tickers to lead the way.

Among them is a “Sleeper Stock” that is still cruising under Wall Street’s radar.

All 5 have exceptional profit potential. There couldn’t be a better time for this investor briefing.

Click here now to claim your copy FREE

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Automotive

Ford’s 850,000-Vehicle Recall Signals Deeper Trouble Than a Faulty Fuel Pump

Ford (NYSE: F) is facing intense scrutiny after recalling over 850,000 vehicles due to a fuel pump defect that can cause sudden engine failure while driving.

The National Highway Traffic Safety Administration confirmed the defect is more likely to trigger crashes in hot weather or when fuel levels are low, and Ford has yet to finalize a fix.

The affected vehicles, built from mid-2021 through late 2022, were equipped with a redesigned fuel pump manufactured in Chihuahua, Mexico.

An internal investigation identified design flaws that led to internal contamination and excessive pressure buildup in the pump chamber.

For investors, this is more than a routine safety event. It hits Ford at a vulnerable moment as it tries to stabilize earnings, reduce EV losses, and reposition around hybrid demand.

Large-scale recalls don’t just impact warranty costs. They affect dealer relationships, future product perception, and regulatory trust.

Those evaluating Ford’s margin outlook must now weigh the ripple effects.

Delayed repairs could span multiple quarters, while costs associated with litigation, fixes, or customer accommodations may not fully materialize until later filings.

Ford is already under pressure to prove that it can scale profitably. This recall highlights just how tight the execution window is.

Until the repair campaign is launched, investor focus will stay locked on cost disclosures, NHTSA updates, and whether management can contain the fallout.

Hidden Asset (Sponsored)

A quiet shift is happening in the financial system — and big banks are already making their move.

They’re now able to treat gold as a cash-equivalent asset, and they’re acting fast behind the scenes.

Meanwhile, millions remain heavily exposed to volatile paper assets. One economist recently warned that gold is now “the only money banks trust.”

There’s still time to take steps using a legal, IRS-approved strategy — one that avoids taxes or penalties while rebalancing toward more stable assets.

A free Wealth Protection Guide explains how to do exactly that.

[Click here to get your free copy]

P.S. Every day of delay gives institutions more time to get ahead. Take action while the window is still open.

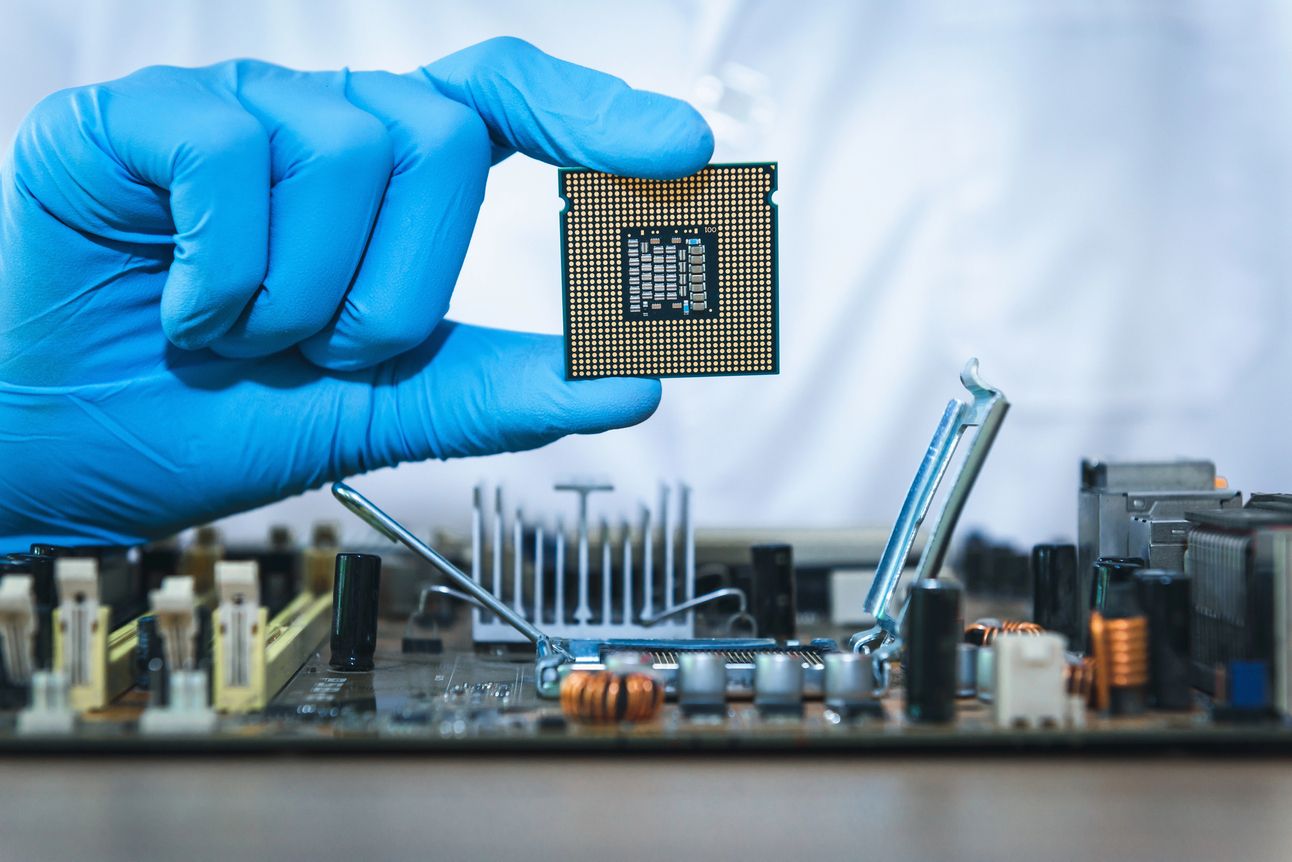

AI Infrastructure

Big Money Is Quietly Backing These 3 Names in the AI Supply Chain

As demand for AI chips grows, the companies that build the tools behind the scenes are drawing more attention and capital.

While most headlines focus on NVIDIA and AMD, the real operational leverage lies one step upstream.

Semiconductor equipment makers have become essential to keeping up with production cycles that serve both data center expansion and next-gen memory needs.

Their role isn’t optional, and that’s starting to show up in stock performance and analyst targets.

ASML (NASDAQ: ASML)

ASML holds a unique position as the sole provider of EUV lithography systems.

These machines are critical for producing the smallest transistors found in AI accelerators and advanced processors.

The company recently reported 52 percent revenue growth. Even after a steep decline from its 2024 highs, analysts still expect over 16 percent upside from current levels.

With a high price tag and a monopoly on EUV tools, ASML doesn’t need hype to justify demand. It just needs orders to keep flowing, and so far, they are.

Applied Materials (NASDAQ: AMAT)

Applied’s tools are used throughout the manufacturing process in logic, DRAM, and NAND. That breadth gives it exposure beyond AI-specific demand.

Analysts expect mid-single-digit revenue growth this year, but the longer-term outlook is driven by increased foundry investment.

With the stock still below its 2024 highs, there’s room for appreciation if capital spending ramps in the second half of the year.

KLA Corporation (NASDAQ: KLAC)

KLA manufactures inspection tools that help chipmakers identify defects early. That directly protects yield and profit margins.

The stock has already hit all-time highs, but price target revisions continue to trend upward. Analysts expect another strong quarterly report.

In a cost-sensitive industry, tools that reduce waste have pricing power.

Why Equipment Still Commands a Premium

Investors seeking the next wave of growth in semiconductors will face a more challenging task in identifying undervalued chip designers.

But the companies supplying the tools to produce them are still showing pricing discipline, recurring demand, and a margin profile worth paying attention to.

Equipment names may not move on headlines, but their role in the revenue chain is getting stronger, not weaker, and the market is pricing that in quarter by quarter.

Want to make sure you never miss our post-market roundup?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone right after the closing bell rings.

Email’s great. Texts are faster.

Top Winners and Losers

DallasNews Corp [DALN] $13.56 (+217.56%)

DallasNews shares soared to record highs after Hearst agreed to acquire the company for $14/share, a 219% premium over yesterday’s closing price.

BIT Mining Ltd [BTCM] $6.29 (+136.17%)

BIT Mining rose after announcing plans to raise up to $300 million to build a Solana-focused crypto treasury, pivoting away from Bitcoin.

MP Materials Corp [MP] $45.27 (+50.75%)

MP stock jumped after the U.S. Defense Department announced a $400 million investment and a 10-year supply agreement to secure domestic rare earths.

Bitmine Immersion Technologies Inc [BMNR] $46.04 (-30.99%)

BMNR is leading our losers list for the second consecutive day, as investors reacted negatively to a new $2 billion at-the-market stock offering, just one day after a major funding round for ETH purchases.

Ultragenyx Pharmaceutical Inc [RARE] $31.04 (-25.10%)

Ultragenyx sank after a late-stage trial for its brittle bone disease drug failed to meet early efficacy goals, reducing hopes for accelerated approval.

Methode Electronics [MEI] $7.74 (-24.81%)

Methode Electronics slid after reporting a steep quarterly loss and slashing full-year guidance due to weak EV demand from key customers.

AI (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Everything Else

Delta Air is forecasting stronger profits as it leverages expanded capacity and tighter cost controls to boost margins.

Space startup Varda has raised $187 million to accelerate its mission of manufacturing pharmaceuticals in orbit.

Walmart is recalling its Ozark Trail water bottles following three reported injuries tied to a faulty spout.

FedEx is cutting nearly 500 jobs and shutting down two facilities as part of its ongoing efficiency drive.

Temasek is eyeing deeper plays in Europe after pouring $7.8 billion into the region over the past year.

Tesla plans to integrate Grok AI into its vehicles, incorporating conversational technology to enhance in-car experiences.

YouTube is phasing out its Trending page and 'Trending Now' list as it shifts focus to personalized discovery.

That's it for today! Please, write us back, and let us know what you think of the Closing Bell Roundup. We're always eager to hear feedback!

Thanks for reading. I'll see you at the next open!

Best Regards,

— Adam G.

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.