A plumbing and HVAC giant is sliding after missing Q2 earnings estimates, a major sporting goods chain is forecasting slower profit growth due to economic uncertainty, and a tiny biotech firm is soaring after being acquired for $286M. Read on to find out more.

AI & Crypto (Sponsored)

The crypto market has been brutal in 2025—Bitcoin has stalled, altcoins have tumbled, and uncertainty is at an all-time high. But while most traders panic, a small group of investors is using AI to find hidden opportunities.

A proprietary AI trading system—built specifically for crypto—has already delivered a 79% win rate on short-term trades, even in bear markets. Now, it’s flashing signals on which cryptos may be bottoming out—before the next surge.

A major event is happening this Wednesday, March 12, at 8 p.m. ET, revealing:

✔️ Why its biggest moves tend to happen in short, 60-day windows

✔️ Which cryptos are now flashing “BUY” signals

All attendees will also receive a free report: "AI + Crypto Blacklist: Red Flags That Could Wipe Out Your Portfolio"—detailing the biggest crypto trading traps to avoid.

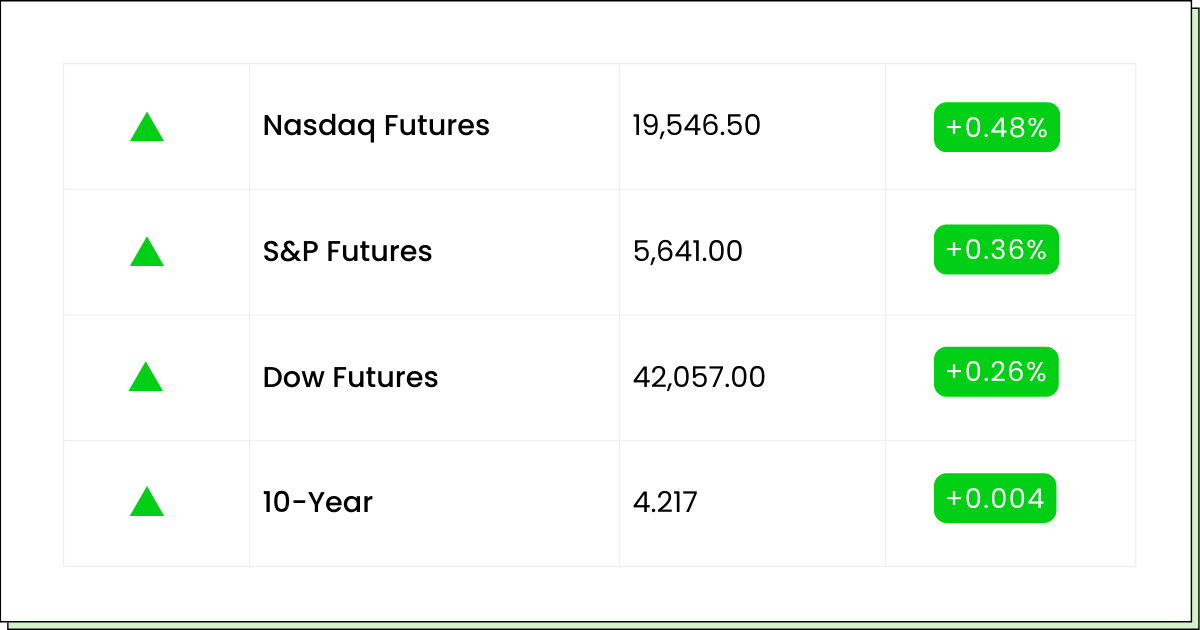

Futures 📈

What to Watch

Earnings:

Caseys General Stores, Inc. (CASY): Aftermarket

Cadre Holdings, Inc. (CDRE): Aftermarket

Economic Reports:

NFIB optimism index (Feb): 6:00 a.m.

Job openings (Jan): 10:00 a.m.

Plumbing, Heating and Ventilation

Ferguson Shares Slide as Q2 Earnings Fall Below Estimates

Ferguson PLC (NYSE: FERG) reported weaker-than-expected second-quarter earnings and revenue, sending its stock down 6.3% in premarket trading.

The plumbing and heating products distributor posted adjusted earnings per share of $1.52 for the quarter ending January 31, falling short of the $1.99 consensus estimate.

Revenue is at $6.9 billion, also missing analyst projections of $7.09 billion.

Sales volume increased by 5% in the quarter, but this was offset by a 2% decline due to commodity price deflation.

CEO Kevin Murphy acknowledged that the company is navigating challenging market conditions, with continued pricing pressures affecting operating margins.

As a result, Ferguson has lowered its full-year adjusted operating margin forecast to a range of 8.3% to 8.8%, down from the prior estimate of 9.0% to 9.5%.

However, the company maintained its revenue growth outlook at low single digits.

Ferguson also reduced its capital expenditure expectations for fiscal 2025, revising its forecast to $325 million–$375 million from the previous $400 million–$450 million range.

Despite the softer earnings, Ferguson increased its quarterly dividend by 5% to $0.83 per share and expanded its share buyback program by an additional $1 billion.

Cruise Ships

Viking Reports Strong Q4 Revenue But Misses Earnings Estimate

Viking Holdings Ltd (NYSE: VIK) reported strong revenue figures for the fourth quarter and full year of 2024, driven by increased passenger demand and strategic expansion.

Total revenue for the year is up 13.2% to $5.33 billion, while adjusted EBITDA rose 23.7% to $1.35 billion.

For the fourth quarter, revenue increased by 20.5% year-over-year to $1.35 billion, supported by a 10.9% rise in passenger cruise days.

The firm returned to profitability in the fourth quarter, posting net income of $0.24 per diluted share, a sharp turnaround from the $1.39 loss per share recorded a year earlier.

However, despite the improved performance, the earnings figure fell short of analyst expectations of $0.34 per share, causing its shares to dip marginally in early trade.

Looking ahead, Viking will expand its fleet, taking delivery of the Viking Vela ocean ship and securing contracts for eight new river vessels, with deliveries scheduled between 2027 and 2030.

The company expects to introduce one ocean ship and ten river ships in 2025.

As of February 23, Viking has already sold 88% of its available passenger cruise days for the 2025 season, with advance bookings totaling $5.31 billion—26% higher than the same period last year.

CEO Torstein Hagen expressed confidence in continued growth, emphasizing the company’s strong customer demand and commitment to delivering exceptional cruise experiences.

Smart Glass Market (Sponsored)

This Nasdaq-listed company is redefining AI in the $124 billion smart glass market. From cockpit shading systems to energy-efficient building glass, their technology powers global leaders like Boeing, Mercedes-Benz, and National Geographic.

Their projected $240M revenue from aerospace positions them as an AI-driven market disruptor you can’t ignore.

Sporting Goods

Dick’s Sporting Goods Forecasts Slower Growth as Economic Uncertainty Looms

Dick’s Sporting Goods (NYSE: DKS) issued a weaker-than-expected profit forecast for 2025, citing economic uncertainty, inflation, and potential tariffs as key challenges.

The company’s projected earnings per share of $13.80 to $14.40 fall below Wall Street’s estimate of $14.86.

Net sales are expected to range between $13.6 billion and $13.9 billion, aligning with analyst expectations at the high end.

Comparable sales growth is projected between 1% and 3%.

Despite the cautious outlook, Dick’s reported a record-breaking holiday quarter.

Comparable sales are up 6.4%, more than double the 2.9% analysts had expected. Earnings per share for the quarter are at $3.62, surpassing the $3.53 estimate, while revenue hit $3.89 billion, exceeding the $3.78 billion forecast.

CEO Lauren Hobart acknowledged that while the company remains confident in its strategies, the uncertainty around tariffs and consumer confidence are key risks.

Looking ahead, Dick’s will invest heavily in its "House of Sport" concept and e-commerce, planning to spend $1 billion in 2025 to build 16 House of Sport locations and 18 Field House stores.

The retailer sees long-term potential in the sports industry, particularly with the upcoming 2026 World Cup and growing interest in health and wellness.

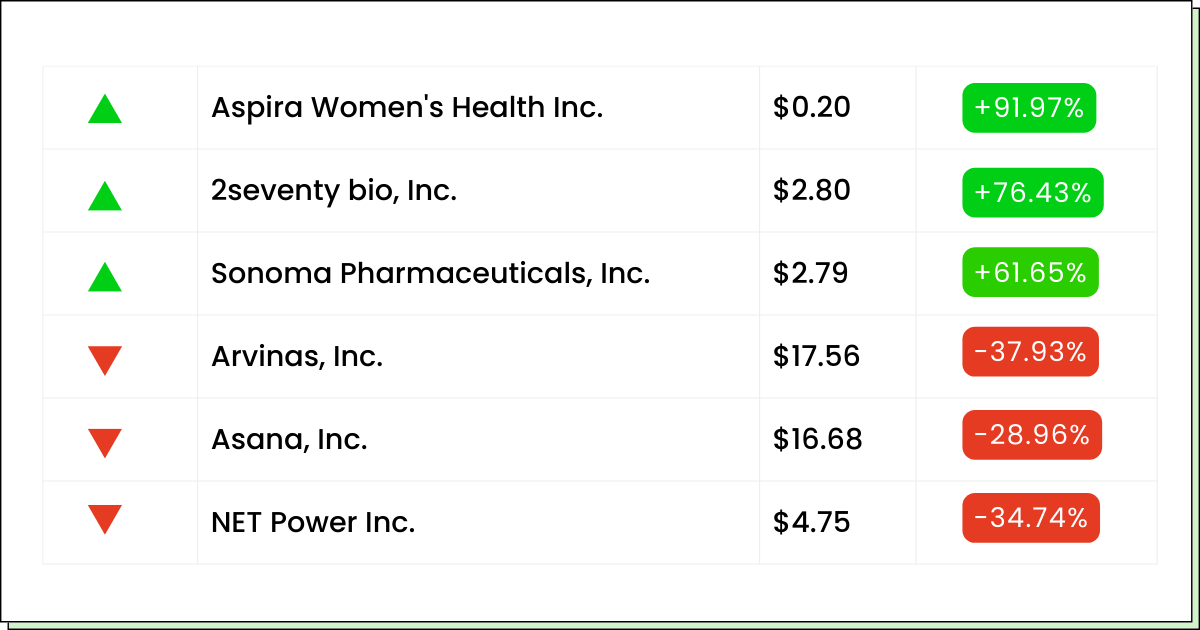

Movers and Shakers

2seventy bio, Inc. [TSVT] - Last Close: $2.80

2seventy bio, Inc., is a biotechnology company specializing in cancer cell therapies, particularly CAR T-cell treatments for multiple myeloma. The company has been focusing on its flagship therapy, Abecma, in partnership with Bristol Myers Squibb (BMY).

Its shares are soaring 76% in premarket trading after Bristol Myers Squibb announced plans to acquire the firm for $286 million in cash at an 88% premium to its last closing price.

My Take: The acquisition eliminates future profit-sharing costs for Bristol Myers. 2seventy is also able to exit after struggling to scale Abecma. This deal is positive for both BMY and TSVT. Investors can look forward to the positive impact in BMY stock.

LifeMD, Inc. [LFMD] - Last Close: $4.27

LifeMD is a telehealth company offering virtual healthcare services.

Its shares are surging 23% in early trading after LifeMD announced a strong 2025 revenue forecast of $265M–$275M, surpassing analyst expectations.

The company also reported a 27% increase in active telehealth subscribers and better-than-expected Q4 earnings, signaling continued business momentum.

LifeMD’s strong revenue projections and growing subscriber base suggest long-term potential, but execution and competition in the telehealth space remain key factors to watch.

My Take: LifeMD’s strong revenue projections and growing subscriber base suggest long-term potential. While profitability has been a challenge in recent quarters, this stock certainly deserves to be on your watchlist.

Tenon Medical, Inc. [TNON] - Last Close: $1.25

Tenon Medical is a medical device company specializing in minimally invasive solutions for sacroiliac joint dysfunction, a common cause of lower back pain.

Its shares are jumping 45% in premarket trading after Tenon Medical announced that the European patent office had granted two new patents for its Catamaran Sacroiliac Joint Fixation Device.

My Take: The patent approvals are a key step toward international market expansion. While the stock has struggled over the past year, this could give it a boost. Keep this on your radar.

Technology

Forget rockets or brain implants…

Elon’s new AI product could be his biggest invention yet.

Jeff Brown tried it himself recently and caught his experience on camera.

Click here to see this footage because according to Tesla Magazine, this new product “could well shape the technological and economic future of our society.”

Everything Else

Tesla’s stock tumbles to its lowest level since last year amid ongoing declines.

Airline stocks tumble after Delta warns of weaker corporate and consumer spending.

Oracle’s stock struggles after a disappointing revenue forecast.

StandardAero forecasts solid 2025 revenue despite missing profit estimates.

Vail Resorts’ stock jumps after a strong second-quarter performance.

Weak revenue outlook and a leadership change send Asana’s stock down 25%.

Paymentus posts impressive transaction growth and raises its 2025 outlook.

Strong ADAS demand drives Hesai Group’s revenue growth and expansion plans.

Strong cost reductions help HighPeak Energy exceed fourth-quarter profit estimates.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.

*Standard message/carrier rates may apply.

Legal Stuff: Stocks featured in this newsletter are for entertainment purposes only. You should not base any investment decisions on information contained in my newsletter. Stocks featured in this newsletter may be owned by owners/operators of this website, which could impact our ability to remain unbiased. Please consult a financial advisor before making any trading decisions. I may earn a small commission from links placed inside these emails.