The platform that made zero-commission trading famous is about to collect a different kind of commission: S&P 500 membership. Index demand + retail FOMO = a recipe for fireworks. Here’s what that means for you.

Growth Path (Sponsored)

The clock is ticking — and so is this rare opportunity.

At midnight, access to the newest report “5 Stocks Set to Double” will close.

Inside, you’ll discover companies with the strongest combination of growth potential, market momentum, and technical setups we’ve seen this year.

While future performance can never be guaranteed, earlier editions of this same report uncovered gains as high as +673%.

This is your last chance to see the picks before they’re gone.

[Download your free copy now before the deadline]

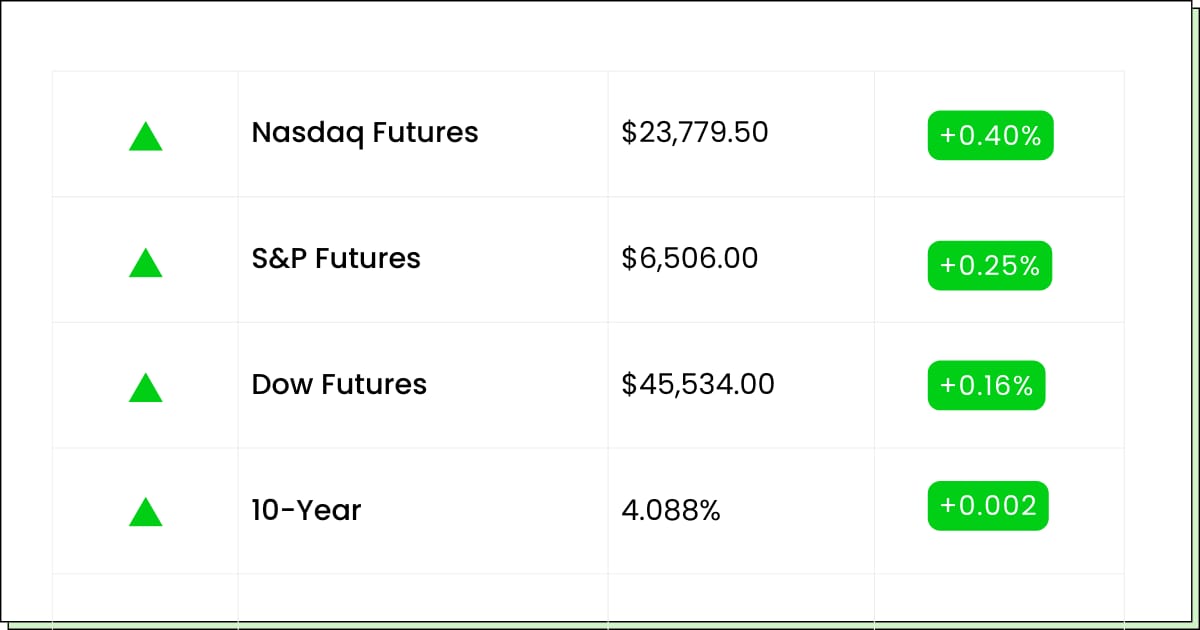

Futures at a Glance📈

Stocks are opening the week with cautious green, but all eyes are on inflation data to see if this optimism has legs.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Planet Labs PBC [PL]

TOYO Co. Ltd [TOYO]

Dynagas LNG Partners LP [DLNG]

Aftermarket Earnings:

Casey’s General Stores Inc. [CASY]

Mission Produce Inc. [AVO]

Mama’s Creations Inc. [MAMA]

Economic Reports:

Consumer credit [July]: 3:00 pm

Nuclear

Nuclear Is Hot, and Constellation Energy Has a Chill

Constellation Energy (NASDAQ: CEG) sits at the crossroads of the “AI needs power” megatrend and the nuclear renaissance narrative, as data centers turn into bottomless electricity pits. Macro jitters and a recent earnings wobble knocked the stock, but the secular setup, baseload power, decarbonization push, friendlier policy tone, still reads strong.

Why it matters: Governments are dangling incentives, Big Tech is desperate for firm clean power, and utilities with nuclear exposure aren’t just sleepy bond proxies anymore. They’re strategic suppliers with pricing leverage in an environment where everyone’s trying to keep the lights on for GPUs. Rate cuts (if/when) also drop discount rates, which helps utility valuations do their glow-up.

What to know:

Last week’s pullback came on profit noise and macro fear, not a broken thesis.

Policy tailwinds and data-center demand remain the bigger storyline, volatility is just the toll.

U.S. is leaning into nuclear more aggressively than in decades, which resets the growth runway.

Investor Takeaway: The selloff looks more like a sentiment reset than a structural crack. With decarbonization demand, regulated operations, and potential Fed tailwinds, CEG remains a long-term nuclear story. Short-term, expect chop until earnings stabilize. Dip-buyers may find value under $300, but patience is key.

Semiconductors

Broadcom’s AI Assembly Line Keeps Humming

Broadcom (NASDAQ: AVGO) delivered the classic beat-and-raise last week, with custom AI accelerators doing the heavy lifting and guidance pointing higher into Q4. Free cash flow is gushing, the pipeline looks stacked, and Hock Tan re-upping for five more years is the corporate version of locking in your franchise player.

Why it matters: The hyperscaler pivot from one-size-fits-all GPUs to bespoke silicon is exactly where Broadcom shines. Every new AI workload that wants speed, power efficiency, and more control is a fresh audition for its ASIC shop. That’s the kind of business that compounds for years if execution holds.

Quick hits:

Q3 topped on both lines: AI revenue up 60%+ y/y, free cash flow ~$7B.

Q4 guide beat consensus, while Tan’s contract extension adds rare CEO stability.

Broadcom’s hybrid model of semis + VMware’s software platform helps smooth cycles.

Investor Takeaway: Momentum + fundamentals = let it run. The stock is printing higher highs, and funds are chasing the AI picks-and-shovels trade. You can ride strength, add on clean pullbacks, and monitor supply-chain execution. In AI land, delivery schedules are the only gods the market fears, as you miss one and sentiment turns quick.

Hidden Edge (Sponsored)

Let’s cut to the chase: You don’t need deep pockets to invest in tomorrow’s winners.

A new report uncovered 3 AI companies trading for less than $20 that are quietly dominating 3 trillion-dollar trends:

Voice-controlled AI

U.S. defense tech

Enterprise software

Why these stocks?

✅ Stock A: Supplies sound-recognition tech to Apple, Mercedes, and Disney+. Patents make it untouchable.

✅ Stock B: Backed by $200M+ in military contracts (hint: Trump’s new budget proposal could send this soaring).

✅ Stock C: Helps small businesses automate workflows—revenue up 142% last quarter alone.

This isn’t a gamble. It’s a calculated play.

Get all 3 AI stock names, tickers, and buy targets in this FREE report—no strings attached.

Fintech

Robinhood Finally Gets the Cool Kids’ Table Invite

Robinhood (NASDAQ: HOOD) scored S&P 500 inclusion alongside AppLovin, which is basically the market saying, “you can sit with us now.” Index funds will have to buy shares before Sept. 22, and the premarket pop is your classic “forced-buyer” squeeze colliding with a name retail already treats like a cult hoodie.

Why it matters: S&P entry isn’t just vibes. It reshapes the shareholder base, adds passive demand, and often brings steadier multiples. Combine that with options liquidity and a meme-adjacent user crowd, and you’ve got rocket fuel for near-term flows. For a stock that’s already doubled this year, the index move keeps momentum alive.

If you blinked, you missed it:

Inclusion goes live Sept. 22, so passive funds must rebalance.

Shares jumped after hours and are cruising premarket as tracking money lines up.

HOOD’s market cap now sits just shy of $90B, with room to grow as assets scale.

Investor Takeaway: Trade the flow, respect the air pockets. You can lean long into the rebalance window and trail stops, then reassess after the dust settles. Fundamentals of net new assets, interest rate sensitivity, and product expansion will retake the mic post-add. Until then, the flow is the show.

Poll: If a famous movie quote applied to your finances, which one fits?

Movers and Shakers

AppLovin [APP] – Premarket Move: +8%

AppLovin just scored an S&P 500 slot, which means passive funds are about to be forced buyers. The ad-tech name already had cult stock energy, and now index inclusion adds rocket fuel. Hedge funds love front-running this kind of flow, so expect extra froth into the effective date.

My Take: Index adds usually mean front-running flows, not fundamentals. I’d trade the momentum, but don’t mistake it for a new business model.

Alkermes [ALKS] – Premarket Move: +7%

Wells Fargo slapped an “Overweight” on Alkermes with a $44 target, joining a chorus of bullish analysts. Biotech rerates fast when the Street leans in, and traders are chasing the sentiment swing. With multiple firms stacking buy ratings, the stock suddenly looks like the teacher’s pet in pharma.

My Take: Analysts piling in can extend this move, but remember, ratings don’t change drug pipelines. Ride the pop, then watch if it can stick above $32.

Summit Therapeutics [SMMT] – Premarket Move: −23%

Summit ripped triple-digit gains this year on big cancer trial wins, but after its latest update, profit-takers finally showed up. The pullback doesn’t erase the pipeline story, just cools the tape. Biotech money moves fast, and yesterday’s darling can be tomorrow’s dip-buy, if conviction holds.

My Take: Biotech is always feast or famine. If you believe in ivonescimab’s global runway, weakness like this is the place to scale, not chase. I’d take a stab here but maybe average in over the next few trading sessions.

Options For Stability (Sponsored)

The market’s wild swings—like a 427‑point drop one day and a 619‑point rally the next—are enough to make anyone’s head spin.

With Washington trade talks and Fed policy chatter fueling volatility, you need a proven playbook.

Grab our FREE e‑book, Mastering Options Trading: A Beginner’s Guide, and discover:

Market‑proof strategies for up, down, or sideways moves

Easy income tactics that work in any climate

Smart discount buys to snag top stocks at lower prices

Advanced setups favored by pros for rapid growth

Dividend‑option combos that lock in extra premium

Don’t let this chaos pass you by.

Everything Else

Klarna’s planned IPO faces investor side-eye as its digital bank pivot still feels more like a sketch than a finished product.

Tesla’s U.S. market share slips to its lowest since 2017, proving even Elon’s shine can get a little rusty.

Kenvue stock sinks after RFK Jr. claims Tylenol causes autism.

Oil prices climb after OPEC’s “big output hike” turns out to be a drizzle instead of a flood.

Paying an AI engineer more than Steph Curry screams bubble, at least Curry can hit 3s when the clock’s ticking.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.