Good morning. It's December 2nd, and today we’ll discuss the trouble at Stellantis with the sudden departure of its CEO Carlos Tavares, why Bezos is backing a tiny NVIDIA killer, and an office solutions stock that is rallying by 65% in premarket trade.

📲 Want our updates via text message? Get Elite Trade Club's pre-market insights and hottest stocks straight to your cell for 100% free. Click here to sign up.

Previous Close 📈

Stocks rose again on Friday, with the Dow Jones Industrial Average going up 0.42% to close at a record 44,910.65 points, the S&P 500 increasing by 0.6%, and the Nasdaq Composite advancing 0.8% to 19,218.17.

Futures

Futures appear to be continuing the upward trend today. Dow Jones Industrial Average futures are up 0.5%, S&P 500 futures have gained 0.6%, and Nasdaq-100 futures have increased by 0.89%.

Investors will focus on upcoming economic data releases this week, including construction spending and job reports, which could influence market direction. Additionally, the holiday shopping season is underway, with expectations of record online sales potentially impacting retail stocks.

Gold

Spot gold has surged to an all-time high of $2,687 per troy ounce following a bold 50 basis point rate cut by the US Federal Reserve. This significant move has sparked widespread interest in the precious metal, as investors flock to gold as a hedge against economic uncertainty.

Experts suggest that this rally may just be the beginning. With inflation fears growing and a weaker dollar on the horizon, gold’s safe-haven appeal has never been stronger.

Historically, moments like these have presented some of the most lucrative opportunities for those positioned early in the market.

As the bullish trend continues, the question remains: will you take advantage of this potential breakout, or watch as prices climb even higher?

Disclaimer: The information provided in this email is for educational purposes only and is not intended as investment advice.

What to Watch

Alico (NASDAQ: ALCO) and Imperial Petroleum (NASDAQ: IMPP) will announce their quarterly earnings before the opening bell today.

Keep an eye on Zscaler (NASDAQ: ZS), Credo Technology Group Holding (NASDAQ: CRDO), and CleanSpark (NASDAQ: CLSK), who will report their results after the market closes.

On the economic front, the S&P final U.S. Manufacturing PMI for November will be released at 9:45 a.m. ET, followed by the ISM Manufacturing Index and Construction Spending data for October at 10:00 a.m. ET.

Automobiles

Tavares’s Departure Rocks Stellantis Amid Industry Challenges

Pictured: Carlos Tavares. Source: Ottaviani, CC BY-SA 4.0, via Wikimedia Commons

Stellantis NV, the global automaker behind Jeep and Peugeot, is grappling with a leadership vacuum following the unexpected departure of CEO Carlos Tavares on Sunday. The 66-year-old executive, renowned for his turnaround success at Renault and his initial progress at Stellantis, stepped down amid growing tensions over cost-cutting measures and their impact on the company.

US-listed shares of the firm are down 8.9% in premarket trading today.

Tavares, who implemented significant restructuring by consolidating vehicle platforms and trimming jobs, faced mounting criticism in recent months. Dealers in the U.S. accused him of undermining key brands such as Jeep and Dodge, while unions raised concerns over delays and quality issues in new model rollouts.

Despite the turbulence, Stellantis Chief Financial Officer Doug Ostermann noted “good progress” in reducing inventory and improving U.S. market share following a profit warning in September. Ostermann is expected to address these issues further during an upcoming Goldman Sachs autos conference.

The departure also complicates Stellantis’s relationship with Italy’s government, which has criticized the company’s production levels in the country. Sources indicate that Chairman John Elkann informed Italian Prime Minister Giorgia Meloni of Tavares’s resignation ahead of the announcement.

With significant industry upheaval and a critical market position at stake, Stellantis now faces the challenge of steadying its operations while searching for a new leader.

Semiconductors

AI Chipmaker Tenstorrent Raises $200M Backed by Bezos and Samsung

Source: Daniel Oberhaus, CC BY 4.0, via Wikimedia Commons

Tenstorrent, a Santa Clara-based AI chipmaker aiming to challenge NVIDIA's dominance in the AI space, has raised $200 million in a funding round, valuing the company at $2.6 billion. The round was led by South Korea’s AFW Partners and Samsung Securities, with participation from Bezos Expeditions, LG Electronics, and Fidelity.

The funds will enable Tenstorrent to expand its engineering team, enhance its global supply chain, and develop large-scale AI training servers to showcase its technology. Founder and semiconductor pioneer Jim Keller emphasized the company’s focus on open-source solutions and cost-efficient designs, steering clear of Nvidia's high-bandwidth memory (HBM) approach.

Tenstorrent is banking on RISC-V, an open standard logic processor, to drive its innovation and attract developers. Keller, known for his contributions to Apple, Tesla, and AMD, sees open-source platforms as key to fostering broader collaboration and scalability.

While Nvidia continues to rake in billions in data center revenue quarterly, Tenstorrent has secured $150 million in customer contracts and plans to launch new AI processors every two years. Its chips are currently produced by GlobalFoundries, with future iterations planned through TSMC and Samsung, including cutting-edge 2nm technology.

Other investors in the round include Hyundai Motor Group, Baillie Gifford, and the Healthcare of Ontario Pension Plan, underscoring growing global interest in disrupting Nvidia's stronghold in AI hardware.

Artificial Intelligence

Musk Accuses OpenAI, Microsoft of Antitrust Violations

Elon Musk has taken legal action to halt OpenAI's transition into a fully for-profit corporation, escalating his ongoing battle with the AI firm and its major backer, Microsoft.

On Friday, Musk’s legal team filed for a preliminary injunction in federal court, alleging antitrust violations and seeking to prohibit OpenAI from enforcing investment restrictions that could hinder competition.

The lawsuit accuses OpenAI and Microsoft of using their market influence to block investments in rival AI companies, including Musk’s startup xAI. Lawyers claim these practices amount to a “group boycott,” preventing competitors from accessing vital capital. The filing also seeks to prevent OpenAI from leveraging "wrongfully obtained competitively sensitive information."

OpenAI has dismissed Musk’s claims, with a spokesperson calling the allegations "utterly without merit." Microsoft, which has invested $14 billion in OpenAI, declined to comment.

OpenAI, originally a non-profit, transitioned to a capped-profit model in 2019 and is now moving toward becoming a fully for-profit public benefit corporation. Critics, including Musk, argue that this shift could concentrate market power and stifle competition in the booming generative AI sector, which is predicted to generate over $1 trillion in revenue within a decade.

This legal battle comes as Musk’s xAI gains traction, raising billions and releasing its Grok chatbot to compete with OpenAI’s ChatGPT. As the Federal Trade Commission monitors partnerships between AI developers and cloud providers, the stakes in this high-profile feud continue to rise.

Trading Outlook

With interest rates dropping and over $6.5 trillion in cash poised to flood the markets, 2025 is shaping up to be a monumental year for traders. But it won’t be business as usual.

The era of AI-fueled rallies is shifting as market experts predict a wave of “epic sector rotations” in the months ahead. Forgotten sectors are already showing signs of a major comeback, creating opportunities for bold traders to capitalize.

Pro-trader Nate Bear has identified a unique trade designed to target gains of 200%+ by riding these sector rotations.

He’s set to reveal this never-before-seen approach, complete with data-backed insights and the sectors and stocks he’s eyeing for December.

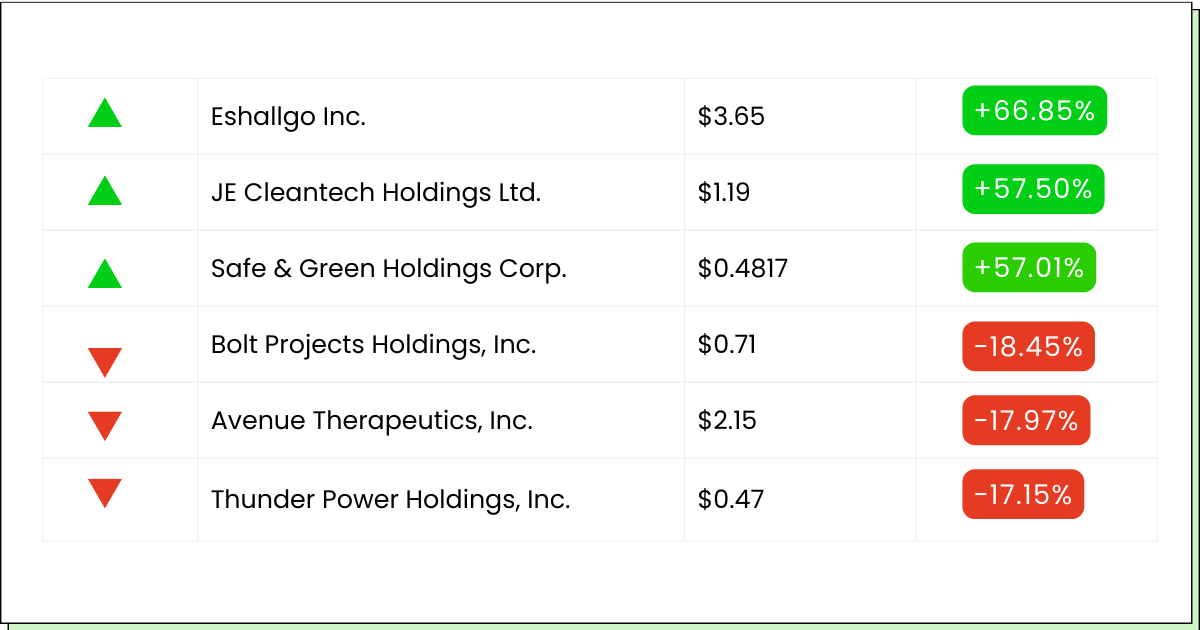

Movers and Shakers

Eshallgo [EHGO] - Last Close: $3.65

Eshallgo shares are rallying by nearly 65% in premarket trade today.

The office solutions firm had issued convertible debentures totaling up to $5 million, maturing on November 28, 2025, with an annual interest rate of 5%, increasing to 18% upon default.

The initial $1.5 million tranche was issued on November 29, 2024.

These debentures can be converted into Class A ordinary shares at a set price within the first 50 days, and thereafter at a price based on market value, subject to a minimum floor price.

This financing aims to support Eshallgo's growth initiatives, and the favorable terms may have positively influenced investor sentiment.

My Take: EHGO has risen 11.96% YTD and seems to have decent financial credentials. It might be a good stock to keep your eye on for the future.

JE Cleantech Holdings [JCSE] - Last Close: $1.19

JE Cleantech Holdings Limited's stock is soaring 68% in premarket trade following the announcement of a cash dividend of $0.09 per ordinary share.

This dividend rewards shareholders and reflects the company's strong financial position.

The dividend will be paid to shareholders of record as of December 10, 2024, with payment expected around December 20, 2024.

JE Cleantech's position in the precision cleaning and cleantech equipment industry further adds confidence to its outlook, driving the stock's substantial premarket gains.

My Take: JE Cleantech seems to have a positive track record on profitability, and the share has grown nearly 63% YTD, so this might be a good stock to keep on your radar.

KULR Technology Group, Inc [KULR] - Last Close: $1.16

KULR Technology Group's stock is up 45% in premarket trading and has surged 169.70% over the last five days due to a major contract awarded by the U.S. Navy to enhance its Internal Short Circuit (ISC) technology.

This contract focuses on developing high-temperature ISC cells, which improve safety and resilience for lithium-ion batteries in critical military and aviation applications.

The technology simulates extreme conditions more accurately, aligning with stringent FAA and EASA safety standards, a critical factor for the growing electric aviation market.

Originally developed with NASA and the NREL, KULR's ISC devices allow precise testing of thermal runaway scenarios, enhancing safety for batteries in high-stress environments.

This contract positions KULR as a key player in advancing battery safety, particularly in the aviation and defense sectors, boosting investor confidence and driving the stock's recent meteoric rise.

My Take: This could be a game changing moment for KULR, looking at the stock’s performance in the last five days. Keep this stock on your watch list for future growth.

Next Gold Rally

In times of market volatility and rising inflation, gold has proven to be a reliable safe haven. Its value tends to hold steady even when stocks tumble, offering stability and a hedge against the declining purchasing power of cash.

For investors seeking to diversify and protect their portfolios, gold can provide the security many are looking for. Gold IRAs, in particular, offer a way to invest in this timeless asset with the added benefits of tax advantages and long-term growth potential.

Top-rated Gold IRA providers are available to help both seasoned and beginner investors make informed decisions. Many of these providers offer valuable educational resources to guide those who are new to gold investing.

Disclaimer: The information provided in this email is for educational purposes only and is not intended as investment advice.

Everything Else

The U.S. chips crackdown intensifies with new rules targeting China's AI and semiconductor advancements.

Prosus plans $10 billion in investments with a focus on AI, fintech, and emerging markets.

President Biden defends the pardon of his son, citing an "unfair prosecution" and family loyalty.

Washington targets Southeast Asian solar manufacturers amid concerns over trade practices and China ties.

JPMorgan was penalized for overcharging clients in 24 bond transactions and admitted liability.

Slumping demand forces De Beers to lower diamond prices despite long-standing strategy.

PZU aims to consolidate its banking interests by divesting Alior Bank shares to Pekao in a $936 million deal.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.