New trade curbs just shaved hundreds of millions off next year’s revenue forecast. The long-term growth story isn’t broken, but short-term bruises mean you’ll need patience before doubling down.

Emergency Briefing (Sponsored)

When you turn on the TV...

Every financial media outlet in America seems obsessed with rate-cuts...

What’s happening with China...

The current political situation...

And which direction the market is headed...

But one legendary market analyst says the mainstream has kept Americans clueless about the REAL storyline they should be paying attention to.

In fact, 99% of investors are set to miss out on one of the most significant opportunities in the market this year...

All from a government-mandated event he calls the “Pivot Point” happening on October 9th.

Looking back at peak historical data...

Investors could have had the opportunity to target gains as much as 533% in 1 week, 1,000% in 11 days, and even 3,700% within 11 days.

This government-mandated event is so important that the Monument Traders Alliance is hosting a LIVE Emergency Pivot Point Zero Hour Briefing on Wednesday, October 8th at 2 PM EST...

To reveal exactly how to target these 2,000% gains within weeks of the October 9th “Pivot Point”.

Click here to see the Emergency Pivot Point Zero Hour Briefing details.

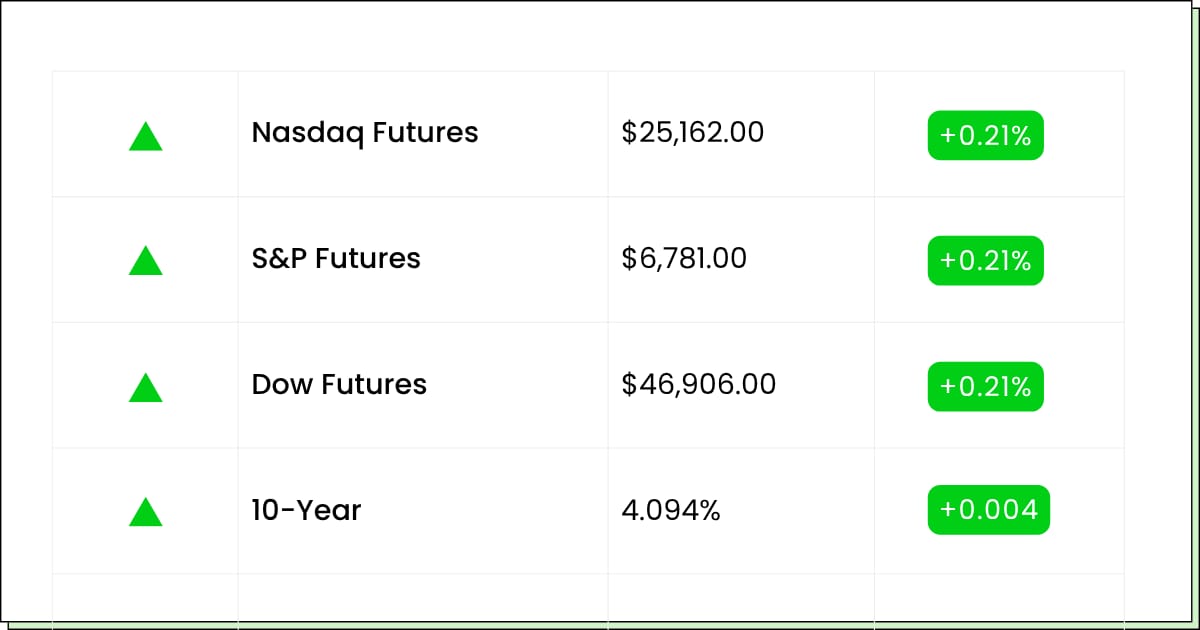

Futures at a Glance📈

Wall Street’s shaking off shutdown drama like it’s just background noise. Futures are pointing up as the AI trade keeps flexing, reminding everyone that robots don’t care about furloughed federal workers.

With jobs data blacked out and politicians still finger-pointing, traders are leaning into momentum and FOMO. Call it a market that runs on algorithms, not appropriations.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Today’s Earnings:

Lifecore Biomedical, Inc. [LFCR]

Art's-Way Manufacturing Co., Inc. [ARTW]

Economic Reports:

New York Fed President Williams Speech: 6:05 am

Chicago Fed President Goolsbee TV Appearance: 8:30 am

U.S. Employment Report (Delayed) [Sept.]: 8:30 am

U.S. Unemployment Rate (Delayed) [Sept.]: 8:30 am

U.S. Hourly Wages (Delayed) [Sept.]: 8:30 am

Hourly Wages Year over Year (Delayed): 8:30 am

Fed Governor Miran TV Appearance: 9:30 am

S&P Final U.S. Services PMI [Sept.]: 9:45 am

ISM Services [Sept.]: 10:00 am

Dallas Fed President Logan Speech: 1:30 pm

Fed Vice Chair Jefferson Speech: 1:40 pm

Fed Governor Miran TV Appearance: 3:30 pm

Media

Rumble Tries to Make Some Noise With Perplexity Deal

Let’s get ready to Ruumbbbleee! Rumble (NASDAQ: RUM) just gave traders a new storyline, announcing a tie-up with Perplexity, the AI-powered answer engine that’s trying to be Google with citations.

The partnership is supposed to juice video discovery on Rumble, bundle Perplexity Pro with Rumble Premium, and plaster ads for Perplexity’s new Comet browser across the site. Sounds futuristic, but the real play is obvious: Rumble needs eyeballs, and AI is the only way to sound cool in 2025.

The stock popped in premarket trading, and that makes sense, as investors love any press release with AI in it. But slapping AI on top of Rumble doesn’t change the fact that its platform is still niche compared to YouTube.

Discovery might get smarter, but monetization is still an uphill climb. The partnership feels more like a sugar high than a full meal. Fun today, but will it really change growth six months from now?

My Take For You: If you’re holding, take advantage of the bounce, but don’t size it like a core position. AI fairy dust only lasts so long.

My Verdict: Trade the rumor, not the platform. A rental at best, not a forever stock.

Materials

Rare Earth Wants a Presidential Plus-One

USA Rare Earth (NASDAQ: USAR) jumped after confirming it’s chatting with the White House. Investors loved it because rare earths are hot; they’re essential for EVs, turbines, defense, and basically every tech product politicians call strategic.

Add in Washington’s recent moves to stake companies like Lithium Americas and MP Materials, and you’ve got traders betting USAR could be next in line for Uncle Sam’s dance card.

The buzz is real: government partnerships can mean subsidies, contracts, or direct investments that supercharge growth. But let’s not confuse “we had a meeting” with “we’ve got a deal.”

These conversations can drag on for months, and nothing is guaranteed until signatures hit the page. Meanwhile, the fundamentals haven’t magically changed. Mining is still capital-intensive, timelines are still long, and commodity cycles can be brutal.

That said, the stock’s rally shows investors are chasing the headline, not the earnings. If Washington backs them, USAR could be a rocket. If not, you’re just holding a miner that got swept up in hype.

My Take For You: Trim profits if you’re already up, and wait for dips before adding.

My Verdict: Speculative trade only. Don’t bet the farm on political promises.

Breakouts Are Near (Sponsored)

Your portfolio might be doing fine.

But why stop at fine when you could aim for game-changing gains?

Our analysts have just released a new special report, highlighting 5 stocks with the potential to double.

These aren’t random picks.

They were hand-selected because they combine:

Proven fundamentals with long-term staying power

Technical strength suggesting momentum is building now

Past reports have pinpointed stocks before huge runs of +175%, +498%, even +673%.¹

This exclusive report is yours free—but only until midnight tonight.

[Click here now to download your copy instantly]

Why settle for average when extraordinary is on the table?

Semiconductors

Applied Materials Gets Hit With a Trade-War Speed Bump

Applied Materials (NASDAQ: AMAT) slid after warning that U.S. export restrictions will shave $600 million off 2026 revenue. Washington basically tightened the screws on Chinese chipmakers, blocking sanctioned firms from sneaking gear through affiliates.

That’s bad news if you’re AMAT, the go-to shop for the world’s fabs, since every curbed shipment means lost sales.

The stock took the news in stride, the stock dipped, but it’s not like AMAT’s business model broke overnight. This is still the hardware store for semiconductors, from AI to EVs to cloud infrastructure.

Demand for advanced manufacturing isn’t going away, and the industry still leans heavily on AMAT’s tools. Export bans sting in the short term, but they don’t erase the structural need for chips.

The bigger risk is geopolitical whiplash. Every new ban, blacklist, or tariff can clip near-term revenue. But longer term, AMAT’s positioning is strong, especially as U.S. and European fabs expand production capacity to reduce reliance on China.

My Take For You: If you’re long, stay put. This is turbulence, not a crash. If you’re new, wait for another dip to enter.

My Verdict: Buy weakness, not panic. The story is intact, even if Washington makes it messy.

Poll: If you had to invest in one fictional company, who would you pick?

Movers and Shakers

Fermi [FRMI]: Premarket Move: −1%

Fermi’s IPO popped like a champagne cork, opening nearly 50% above its pricing and running straight into AI hype territory. Everyone loves a shiny new ticker in the gold rush of data center land, especially one tied to big political names and big power plans. But this thing is basically still just a promise with some land and a pitch deck.

Think of it as buying the pickaxe store in the middle of a rush: tons of upside if the miners show up, but also a chance the town turns ghost before the bar even opens. Yesterday’s debut showed how thirsty the market is for anything touching AI infrastructure, even if it hasn’t actually sold anything yet.

My Take: Fun IPO pop to ride if you’re nimble, but don’t confuse vibes with revenues. Trade the excitement, don’t marry it until the financials hatch.

Bumble [BMBL]: Premarket Move: −2%

Goldman swiped left on Bumble, cutting it down to Neutral as the turnaround story keeps ghosting investors. Downloads are down, Tinder’s making a comeback overseas, and Hinge keeps eating into market share. Basically, Bumble’s stuck deciding if it’s a serious relationship app or just another fling in the crowded dating space.

The downgrade stings, especially since the stock has already taken a beating this year. But some analysts still see value if cost cuts stick and product tweaks can reignite growth. Right now though, it’s looking more like an awkward coffee date than true love.

My Take: If you’re already in, hold your nose and wait for the makeover. If not, no shame in waiting for a clearer signal before committing.

Quantum Computing [QUBT]: Premarket Move: +7%

Quantum stocks are buzzing again, with funds jumping in and traders piling on like they’ve discovered Schrödinger’s lottery ticket. QUBT is up big this year, insiders are cashing out chunks, and analysts can’t agree if it’s worth $5 or $25. Classic quantum: the stock is both overvalued and undervalued at the same time until you open the portfolio.

The hype is real with partnerships, new systems, and plenty of government interest, but revenues are still basically a rounding error. That hasn’t stopped it from moving like a meme stock strapped to a particle accelerator.

My Take: Fun if you want to play the momentum, but size it like an options lotto ticket, not your retirement fund. Quantum dreams can evaporate as fast as they spike.

Year-End Catalyst (Sponsored)

The clock is ticking.

2025’s final quarter could be the last big rally before the reset of 2026.

Markets are moving fast:

Fed signals hint at cuts

Oil shocks roil supply chains

AI & defense spending explode

We’ve zeroed in on 7 stocks primed to surge before year-end.

This isn’t noise, it’s your shot to finish 2025 ahead of the crowd. But wait too long, and Wall Street takes it first.

[Claim Your Free “Top 7 Stocks for Q4 2025” Guide Now]

Everything Else

A massive fire at a California refinery lit up the skies and energy markets, proving once again that oil prices move fastest when refineries don’t.

Private equity is cashing out of AI at record pace, but mega-deals are fueling bubble fears. It’s all fun and games until valuations start floating higher than the cloud itself.

Asian markets shrugged at the U.S. shutdown, joining Wall Street’s rally. Apparently, politics in D.C. is just background noise when you’ve got earnings and AI hype to trade.

Beauty giant Coty is struggling to pretty things up, as its consumer line looks like a hard sell. Turns out, not every lipstick launch is a market makeover.

Elon Musk’s $1 trillion pay plan is facing pushback from investors and regulators. Because even for Elon, “trillionaire” sounds a little extra.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.