A CFO shakeup paired with surging AI cloud revenue has this stock buzzing again. After a triple-digit run this year, the question now is whether the fresh leadership spark keeps the rally alive or sets up a breather for patient buyers.

Proven Strategies (Sponsored)

The market’s wild swings—like a 427‑point drop one day and a 619‑point rally the next—are enough to make anyone’s head spin.

With Washington trade talks and Fed policy chatter fueling volatility, you need a proven playbook.

Grab our FREE e‑book, Mastering Options Trading: A Beginner’s Guide, and discover:

Market‑proof strategies for up, down, or sideways moves

Easy income tactics that work in any climate

Smart discount buys to snag top stocks at lower prices

Advanced setups favored by pros for rapid growth

Dividend‑option combos that lock in extra premium

Don’t let this chaos pass you by.

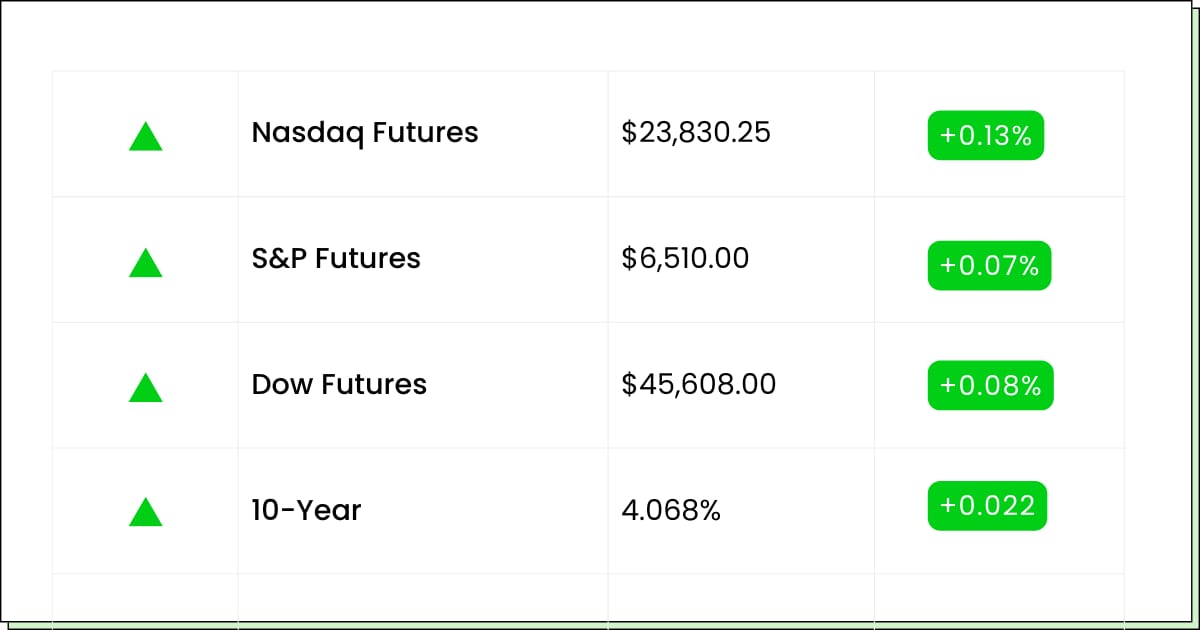

Futures at a Glance📈

Markets are nudging higher after the Nasdaq closed at fresh records. But with inflation reports looming this week, today’s calm could turn stormy fast.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Core & Main Inc. [CNM]

SailPoint Inc. [SAIL]

Korn Ferry [KFY]

Hello Group Inc. [MOMO]

Aftermarket Earnings:

Oracle Corporation [ORCL]

Synopsys Inc. [SNPS]

Rubrik Inc. [RBRK]

AeroVironment Inc. [AVAV]

GameStop Corporation [GME]

Economic Reports:

NFIB optimism index [Aug.]: 6:00 am

Cloud & AI Infrastructure

Nebius Signs a Mega-Deal, Then Hits Ludicrous Speed

Nebius (NBIS) just booked its first long-term hyperscale contract, and it’s a whopper. Up to ~$19B over five years to supply AI compute to Microsoft. Translation: the Amsterdam upstart isn’t just renting GPUs, it’s becoming part of the backbone for training the next wave of models.

Shares went vertical after hours and then some premarket, as traders did the math on reserved capacity, multi-tranche deployment, and follow-on deal potential. Financing chatter is live too, which makes sense when your order book suddenly looks like a Fortune 50 backlog.

Why it Matters: Demand for AI compute is a scarcity game. If you can source, stand up, and deliver reliable Nvidia-powered capacity at scale, you don’t just win revenue, you win optionality. Nebius now sits in the same “overflow” lane as other third-party capacity providers feeding hyperscalers and top AI labs.

Quick Hits:

Contract value through 2031 pegged at ~$17.4B, with an extra $2B option.

New Jersey deployment first, and multiple tranches roll this year and next.

U.S. footprint expanding (SF/Dallas/NY), positioning for more enterprise demand.

Investor Takeaway: Momentum is real; execution is the boss fight. If you’re chasing, do it on controlled pullbacks and watch delivery milestones like a hawk. A second blue-chip logo or faster tranche timing would be rocket fuel, but delays are the kryptonite.

Restaurants

Starbucks’ “Back to Starbucks” Is Brewing, But It’s a Slow Pour

Starbucks (SBUX) is a year into Brian Niccol’s reset, and the vibe is shifting—even if comps haven’t snapped back. Think cozier “coffeehouses,” simpler menus, faster pickup lanes, and the return of human touches (yes, Sharpie notes are back).

The PSL launch delivered the best U.S. sales week ever, staffing is getting a boost via “Green Apron Service,” and store refreshes plus loyalty tweaks are in flight. Still, traffic is lagging pre-Covid levels, labor investments are heavy, and investors want clearer financial mile markers before declaring victory.

Why it Matters: The turnaround bet is that hospitality + speed + product focus can re-ignite habitual visits without nuking margins. If Niccol can transplant his Chipotle-era discipline into cafes, with consistent service and smarter promos, mix and throughput should heal before Wall Street’s patience runs out.

What to Watch:

U.S. traffic and ticket improvement as hospitality rollout scales.

Loyalty program revamp (less couponing, more engagement).

China strategy (stake sale/partners) and store remodel cadence.

Investor Takeaway: This is a “buy progress, not perfection” story. If you’re tactical, trade around seasonal strength and margin update breadcrumbs. If you’re long-only, scale in on red and judge the plan by throughput gains, not headlines about cup-scribbles. The coffee is warming, but the mug isn’t piping hot. Not yet.

Market Insights (Sponsored)

Most portfolios deliver “average.”

But if you’re reading this, you’re not after average.

That’s why our team just unveiled 5 carefully selected stocks with the potential to deliver massive upside.

What sets them apart?

Fundamentals that suggest staying power

Past reports from this series have highlighted stocks that posted gains of +175%, +498%, and even +673%.

Now, it’s your chance to see the latest 5 picks—completely free.

[Click here to claim your copy before midnight tonight]

Extraordinary opportunities don’t come often. Don’t miss this one.

Digital Infrastructure

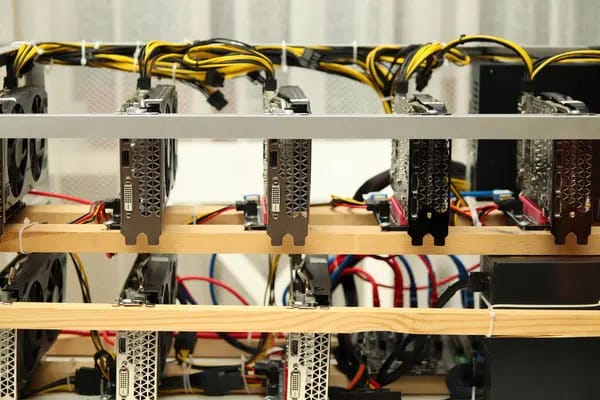

IREN Swaps CFOs, Doubles Down on the GPU Gold Rush

IREN (IREN) is evolving from “Bitcoin miner with big power contracts” into a hybrid AI-compute and data-center operator, and it just reloaded its finance bench to match. Anthony Lewis, ex-Macquarie co-treasurer and IREN’s recent Chief Capital Officer, steps in as CFO, while outgoing CFO Belinda Nucifora leaves after shoring up systems and GAAP reporting.

Under the hood, the business has real torque: triple-digit revenue growth, expanding AI Cloud sales, and thousands of megawatts of secured power that can be pointed at GPUs or hashes depending on economics.

Why it Matters: AI infrastructure is capex-heavy and timing-critical. A CFO fluent in funding stacks, liquidity, and structured deals can be the difference between landing multi-year GPU financings and missing the cycle. If IREN keeps scaling AI Cloud while keeping Bitcoin optionality, the multiple can re-rate off “pure miner” comps.

Quick Hits:

Current ratio ~4x; gross margin high-60s; strong one-year stock run.

Analysts lifting targets as AI revenue inflects; some caution on valuation.

810MW operating; ~2.9GW grid-connected power secured for growth.

Investor Takeaway: This is an execution trade with leverage to both AI demand and power arbitrage. Lean long on clear capacity adds and signed GPU deals, and fade spikes if financings slip or capex outpaces returns. In short: follow the megawatts and the milestones.

Poll: In 10 years, what will people use most for payments?

Movers and Shakers

Brighthouse Financial [BHF] – Premarket Move: +16%

Brighthouse is suddenly in play after reports that Aquarian Holdings is finalizing a $3B+ funding package to take it private. For years, the insurer has been public-market wallpaper, but a buyout bid now makes it hot property.

Watch if the deal terms hit this week, and expect more M&A chatter to fuel upside.

My Take: Trade it like an arb. There’s juice while headlines run, but don’t expect this to morph into a growth story.

TransMedics [TMDX] – Premarket Move: +10%

At Morgan Stanley’s healthcare conference, TransMedics laid out plans to triple organ transplants by 2030, complete with expanded logistics and trial catalysts. Traders clearly like the ambition.

Ground and air fleet expansion could be the swing factor on execution.

My Take: Story stock with legs. Momentum works here, but seasonality and clinical risk mean you trade it, not tuck it away.

Teck Resources [TECK] – Premarket Move: +12%

Mining’s crown jewel is back in the spotlight as Anglo American reportedly lines up a blockbuster takeover. Copper exposure plus strategic timing makes this one of the sector’s biggest stories in years.

The founding family’s stance is key. No green light, no deal, but it looks to be a mover here.

My Take: Play the rumor mill with tight stops. If it closes, you’ll wish you were long, if not, the hangover could be rough. I think this deal eventually goes through, though.

Defensive Winners (Sponsored)

The Fed is uncertain.

The Trade War is rattling markets.

Retail investors are panicking, but smart money is moving in.

They’re quietly loading up on 3 consumer defensive plays:

Utilities – Renewable energy leader at a 42% discount, 8% yield.

Staples – 18 household brands, 54-year dividend streak, sales up 19%.

Healthcare – Telehealth disruptor with 2,300+ hospital partners, 3x revenue growth.

This isn’t speculation - it’s the only survival strategy in today’s market.

Get all 3 tickers, growth catalysts, and buy zones in this FREE report: “3 Defensive Stocks to Own Now.”

Claim your free copy now before it’s behind a paywall.

Everything Else

AI startup Mistral bags a $14B valuation after ASML jumps in, proving chipmakers can’t resist a shiny new AI toy.

A former Meta employee sues, claiming WhatsApp has security holes big enough to drive a truck through.

A judge torched Anthropic’s $1.5B book settlement, saying “piracy with a payout” isn’t how copyright law works.

Ford recalls 1.5M cars with busted rear-view cameras, because apparently checking blind spots is optional.

Short sellers circle Kering, betting the incoming CEO will find out luxury fashion is harder than it looks on the runway.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.