Good morning. It's October 29th, and today we'll take a look at solid earnings reports from Pfizer and McDonald’s, with PayPal struggling to retain revenue growth as profitability takes center stage at the payments giant.

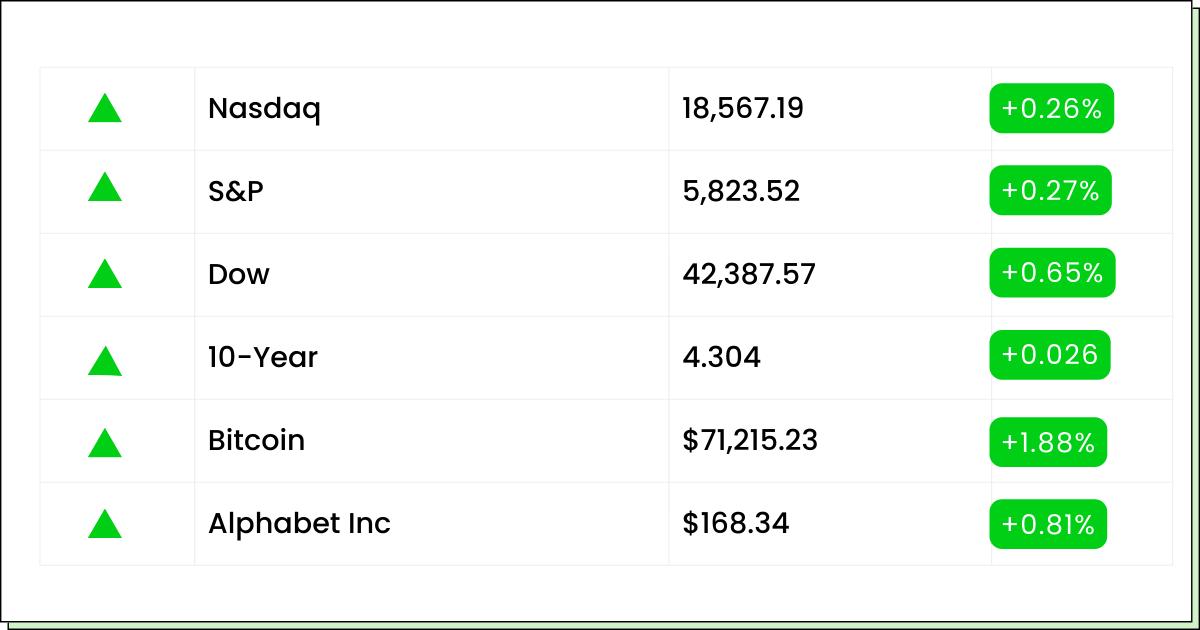

Previous Close 📈

Stocks closed higher on Monday, with the Dow snapping a five-day losing streak and the Nasdaq Composite recording its eighth gain in the last nine sessions.

Investors welcomed a drop in oil prices after Israel's weekend airstrikes on Iran did not impact energy facilities.

Futures

U.S. stock futures are relatively flat today as Wall Street anticipates a wave of Big Tech earnings. Dow futures are up 8 points, with S&P 500 and Nasdaq 100 futures showing minimal movement.

Clean Energy

A newly public NASDAQ company is catching the eye of investors by tackling a massive waste issue—and turning it into profit.

This small-cap stock is leading an innovative solution in clean energy, converting millions of tons of waste shingles into valuable oil and sustainable resources.

With its unique technology and plans to scale operations, analysts are beginning to see serious growth potential.

As regulations favor green solutions, this stock might just be at the starting line of a high-reward journey in the renewable energy sector.

What to Watch

A wave of earnings reports are due today before the market opens, including McDonald's (NYSE: MCD), Pfizer (NYSE: PFE), American Tower Corporation (NYSE: AMT), and PayPal Holdings (NASDAQ: PYPL).

Later in the day, Alphabet Inc. (Google) Class C (NASDAQ: GOOG), Visa (NYSE: V), Advanced Micro Devices (NASDAQ: AMD), Stryker (NYSE: SYK), Chubb Limited (NYSE: CB), and Mondelez International (NASDAQ: MDLZ) will announce their results.

On the economic calendar, the S&P Case-Shiller Home Price Index for August will be released at 9:00 a.m. ET, followed by Consumer Confidence data for October and Job Openings for September, both scheduled for 10:00 a.m. ET.

Fast Food

McDonald's Reports Strong Q3 Results as E. coli Investigation Continues

McDonald's reported a stronger-than-expected financial performance in Q3, despite lingering concerns over a recent E. coli outbreak. The company reported revenue of $6.87 billion, slightly above Wall Street's $6.81 billion prediction. Earnings per share also beat expectations at $3.23, just above the anticipated $3.20.

Despite the positive results, the stock is nearly 2% below its previous close in premarket trade.

U.S. same-store sales edged up by 0.3%, aided by promotions like the $5 meal bundle and increased digital and delivery orders, while guest traffic saw a minor decline. However, international sales dipped, with same-store sales down 1.5%, partly due to market challenges in Europe and the Middle East.

CEO Chris Kempczinski highlighted McDonald’s focus on affordability and value, noting that consumer spending trends remain cautious.

The company remains under scrutiny as it investigates the source of the E. coli outbreak, which has affected 75 people and caused one death.

McDonald’s has paused onion sourcing from Taylor Farms in Colorado, suspecting it as the outbreak's origin, while other fast-food chains, like Burger King, have taken similar preventive measures.

Payments

PayPal Misses Q3 Revenue Target, Revises Q4 Forecast as Profit Takes Priority

PayPal forecasted a modest revenue increase for Q4, below analyst expectations, as it prioritizes profitability over rapid growth in its quarterly earnings release this morning.

Under CEO Alex Chriss’s leadership, the company is reorienting its focus to high-margin areas like branded checkout, reducing emphasis on lower-margin units, including its Braintree service.

This efficiency-driven approach has led to strategic job cuts and investments in automation and AI.

In Q3, PayPal's revenue rose 6% to $7.85 billion, just shy of the estimated $7.89 billion. However, robust consumer spending allowed PayPal to raise its 2024 earnings forecast for the third time this year, now expecting profit growth in the “high-teens” range.

Adjusted Q3 profits climbed 14% to $1.23 billion, or $1.20 per share, up from 98 cents the previous year. PayPal’s stock is trading at 1% below its closing price in premarket trade.

PayPal aims to secure its competitive position against rivals like Zelle and tech giants Apple and Alphabet through new partnerships with industry players such as Amazon, Shopify, and Fiserv.

While these collaborations and innovations like the “Fastlane” checkout feature have spurred a 36% increase in PayPal’s share value this year, analysts suggest these are long-term strategies.

Pharmaceuticals

Pfizer Shares Rise as COVID Drug Sales Exceed Projections, Forecasts Raised

Pfizer raised its annual profit outlook this morning, boosted by stronger-than-expected sales for its COVID-19 antiviral, Paxlovid.

The company’s shares are climbing 1.6% in premarket trading, reflecting investor optimism as Pfizer works to navigate declining demand for COVID-related products.

In Q3, Pfizer’s Paxlovid generated $2.7 billion, significantly surpassing analyst expectations of $456 million. Sales for the COVID vaccine Comirnaty, produced with BioNTech, also exceeded projections, bringing in $1.42 billion against an expected $870 million.

Consequently, Pfizer raised its 2024 revenue forecast for these COVID drugs to $10.5 billion, up from an initial $8.5 billion estimate.

Pfizer’s adjusted earnings reached $1.06 per share, surpassing the 62-cent consensus. Additionally, the company raised its annual profit forecast to a range of $2.75 to $2.95 per share, an increase from its previous guidance of $2.45 to $2.65.

Facing pressure from activist investor Starboard Value, which seeks stronger profitability, Pfizer has focused on cost-cutting measures and strategic acquisitions like its $43 billion purchase of cancer drugmaker Seagen. These steps aim to stabilize the company's financials and address concerns over management accountability.

Election Edge

With the election fast approaching, markets are bracing for waves of volatility and unpredictability. While many are focused on the results, informed investors know the real opportunity lies in the market movements that follow.

Today at 2 pm, legendary investor Alex Green is unveiling a time-tested strategy that’s turned past elections into substantial gains.

This approach has historically delivered impressive returns—752% during Obama’s first year, 3,413% under Trump, and 2,067% with Biden.

This isn't about picking sides; it’s about positioning yourself to profit from the upcoming shifts, no matter who wins. Alex will outline the exact sectors and stocks primed for the biggest moves post-election.

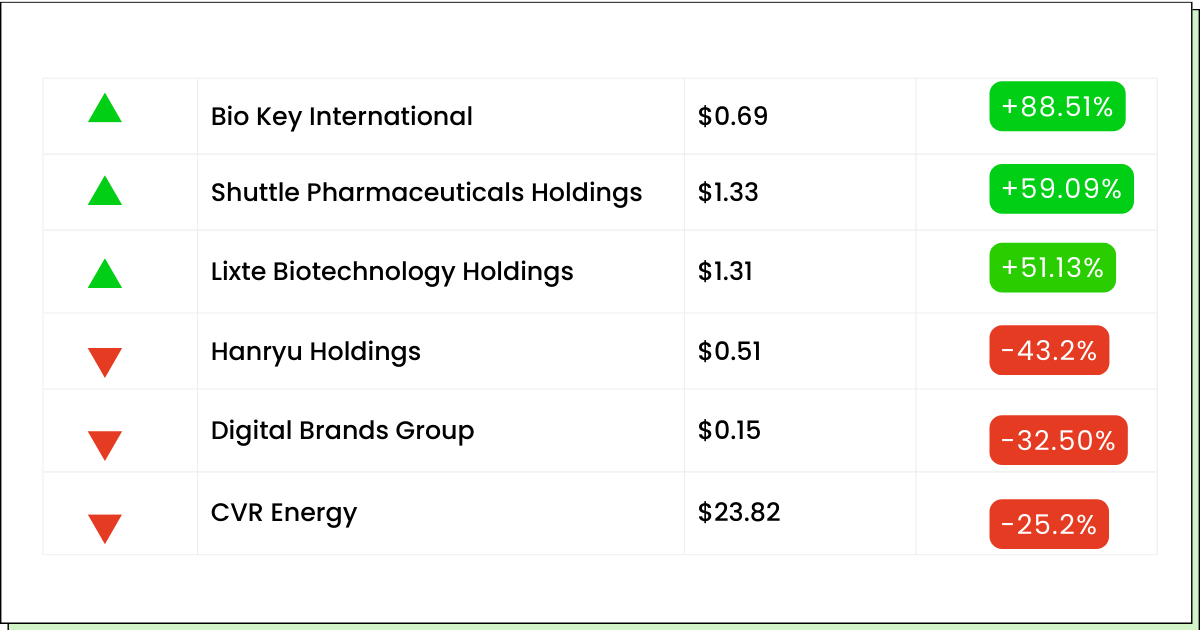

Movers and Shakers

BIO-key International [BKYI] - Last Close: $0.69

BIO-key International's stock is rallying by 83% in premarket trade today.

The firm secured a $910,000 contract to upgrade a financial services client’s biometric identification technology.

This long-time customer will now use BIO-key’s "fingerprint-only" technology, which allows seamless customer verification with a simple fingerprint scan, eliminating the need for cards or account numbers.

Following the full deployment in 2025, BIO-key expects annual recurring revenue from this client to increase to $1.4 million, boosting investor confidence in the company's growth potential.

My Take: While cybersecurity is a hot industry right now, this stock has dropped nearly 75% YTD and is also struggling with profitabilty. It might be best to keep this stock on wait-and-watch mode for now.

Shuttle Pharmaceuticals Holdings [SHPH] - Last Close: $1.33

Shuttle Pharma is surging 62% before today’s opening bell.

The pharma company announced that it has completed site enrollment for its Phase 2 clinical trial of Ropidoxuridine, a radiation sensitizer for treating glioblastoma, a highly aggressive brain cancer.

The trial, now enrolling patients across six prominent cancer centers, aims to improve survival rates for patients with glioblastoma, a condition with limited treatment options and poor prognosis.

This progress is significant as Ropidoxuridine has received Orphan Drug Designation from the FDA, potentially leading to marketing exclusivity if approved.

My Take: SHPH’s shares are down 67% YTD. This is a low float stock with high volatility and poor fundamentals. It might be best to hold off and keep this in the wings for now.

V.F. Corporation [VFC] - Last Close: $17.03

VF Corp's stock is surging 22% in premarket trading.

Investors are reacting positively to its turnaround plan, which is showing early signs of success.

The company, known for brands like Vans, Timberland, and The North Face, has returned to profitability after two quarters of losses.

The revamp strategy includes refocusing on the core Vans brand, selling non-core businesses like Supreme, and targeting $300 million in cost savings by fiscal 2025.

This quarter, Vans sales declined by just 11%, a significant improvement from the 21% drop last quarter.

VF Corp also saw increased gross margins, with a focus on full-price sales and improving demand for its direct-to-consumer segment.

My Take: While it is still early days for the turnaround to take effect completely, VF Corp’s recent quarterly results are certainly promising. Keep your eye on this stock for future growth.

Green Energy

Imagine investing in a company that turns waste into a valuable resource—and it just went public on NASDAQ.

This innovative small-cap stock is leading the charge in renewable energy, transforming discarded roof shingles into sustainable oil.

Millions of tons of shingle waste is piling up yearly and this company’s technology could position it for explosive growth in an untapped $25 billion market.

With state and federal regulations prioritizing green solutions, this stock could be poised for significant returns as it pioneers waste-to-energy innovation.

Everything Else

Beijing considers a massive stimulus contingent on U.S. election outcome.

PetroChina saw profits drop in Q3 despite rising production, as the refining business struggles.

Trump-linked stocks surge following the latest rally, fueling DJT's five-week rally.

Delayed delivery of GE's F404 jet engines prompted penalties from the Indian government.

The transition to electric vehicles may cost the German car industry 186,000 jobs by 2035.

Vodacom's $745 million deal for Remgro fiber assets was halted by an antitrust body.

Bitcoin rallied past $70,000 amid optimism for the upcoming election.

HSBC posted an $8.5 billion profit, launching restructuring and a $3 billion share buyback.

BP saw profits plunge in Q3, impacted by lower oil prices and refining margins.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.