This EV car maker had a clean earnings beat, a hint of profits, and the next model is still on track. I’ll map a simple plan for the stock, the key updates to wait for, and when it makes sense to add or sit tight.

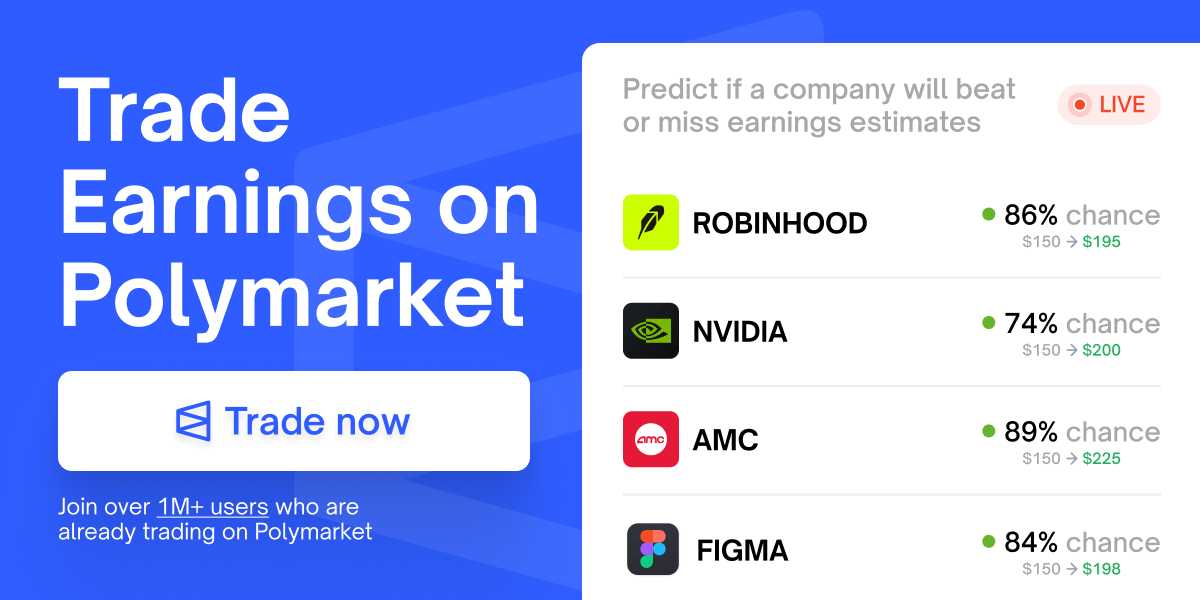

JUST IN: Earning Markets on Polymarket 🚨

Polymarket, the world's largest prediction market, has rolled out Earnings Markets. You can now place a simple Yes/No trade on specific outcomes:

Will HOOD beat earnings?

Will NVDA mention China?

Will AMC beat estimated EPS?

Profit directly from your conviction on an earnings beat, regardless of the immediate stock movement.

Why trade Earnings Markets?

Simple: Clear Yes/No outcomes.

Focused: Isolate the specific event you care about.

Flexible: Tight control for entry, hedging, or exit strategy.

Upcoming markets include FIGMA, ROBINHOOD, AMC, NVIDIA, and more. Built for how traders actually trade.

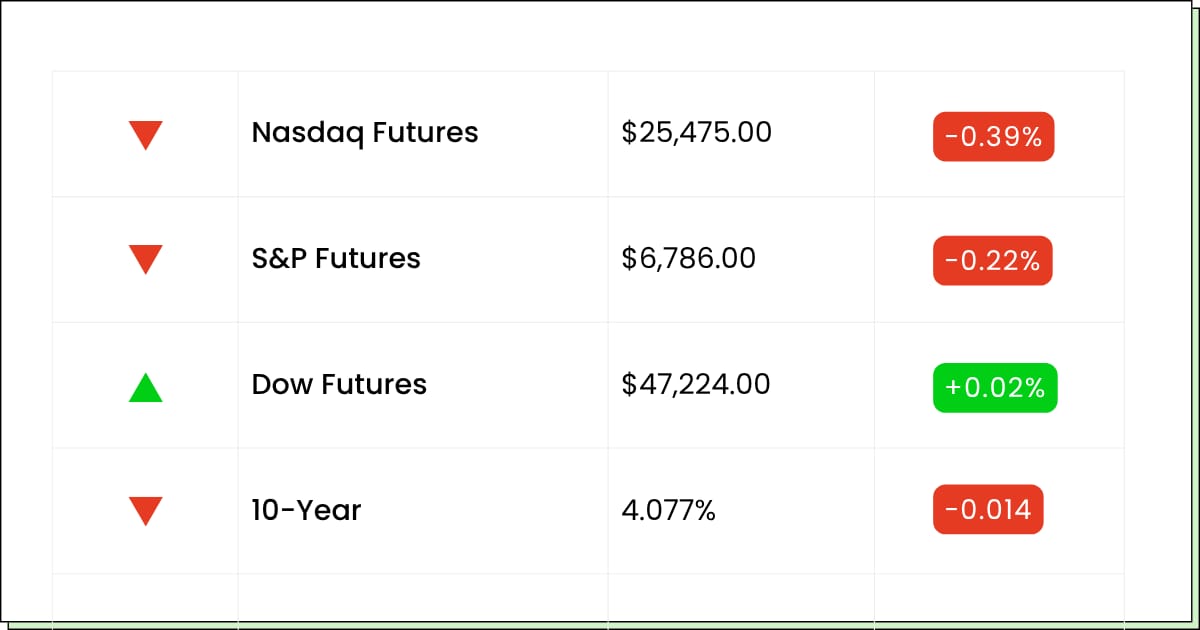

Futures at a Glance📈

Tech sets a cautious tone as chips slip after AMD and the AI trade takes a breather post-Palantir. Optimism is out there somewhere, but near-term nerves rule while traders watch ADP, mortgage apps, ISM, and indexes inch toward key averages as small caps lag.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Novo Nordisk [NVO]

McDonald’s [MCD]

Aftermarket Earnings:

AppLovin [APP]

Qualcomm [QCOM]

Arm [ARM]

Robinhood [HOOD]

DoorDash [DASH]

Economic Reports:

ADP employment (Oct): 8:15 am

S&P Global U.S. Services PMI – final (Oct): 9:45 am

ISM Services (Oct): 10:00 am

Technology

IBM Is Trimming The Crew To Make The Ship Go Faster

IBM is cutting a small slice of headcount this quarter, think tidying the garage, not demolishing the house. It’s the kind of move big, old, and newly-AI-hungry firms make when they want to fund growth without rattling the dividend jar.

The real test isn’t the layoff headline but whether software and AI keep pulling more weight while customers barely notice any wobble in service. If results stay steady and margins inch up, Wall Street calls it focus. If not, they call it oops.

There’s also the culture, morale, and execution. Trimming can sharpen the pencil, but it can also snap the lead if you push too hard. IBM’s job is to show more wins, fewer we’re working on it moments.

My Take For You: If you own IBM, keep it sensible and let the story play out. Collect the dividend, trim a little on big pops. If you’re window-shopping, wait for a red day or two and let the dust settle before you punch a ticket.

My Verdict: Steady eddy with AI upside. Fine to hold or buy on dips just don’t expect a moonshot retirement play.

Technology

Pinterest Drops the Casserole, Keeps the Guests

Pinterest found out that its stockholders prefer the perfect holiday, not just a good one. Guidance came in slightly light, EPS missed, and the stock dropped like a casserole at the potluck.

Under the hood, though, users hit a record 600 million, and the product keeps leaning into visual search and shopping. That combo doesn’t fix everything overnight, but it’s the right toolbox for a platform built around intent.

What’s going on is mix and timing. New users skew international, where monetization takes longer, and big-box advertisers are juggling tariffs and budgets. Meanwhile, Meta and friends are hogging attention.

None of this makes Pinterest broken, it makes it earlier in the journey. If execution holds and the shopping rails keep improving, RPM can catch up to MAUs.

For dip-hunters, this is kind of bruise that can pay if the company keeps stacking wins. The key is patience and a plan: don’t buy it because it’s cheaper today—buy it because the thesis still works tomorrow.

My Take For You: This looks like a buyable dip, and add on confirmation. Let levels guide you, not feelings.

My Verdict: Buyable pullback for steady hands.

Act Before Others (Sponsored)

Most traders miss the signs — he doesn’t.

While others chase hype, this veteran relies on a single indicator that’s quietly helped him spot breakout moves before they happen.

It flashed “buy” before one of this year’s top rallies. And now, it’s flashing again.

After 30 years of successful trading, he’s sharing how it works — and giving you free access to it today.

You won’t find it on TV or in any trading forum. It’s something most investors have never heard of.

See how this simple yet powerful signal could help improve your timing on every trade.

[Unlock the free indicator now]

Autos

Rivian’s Second Wind With A Gross Profit Cameo And A Bigger Sequel

Rivian gave investors something other than range anxiety. The company beat estimates and posted a rare gross profit, helped by its Volkswagen joint venture and growing software and services. The core car business still loses money, but the hole is getting smaller, which is exactly how turnarounds usually look before they suddenly seem obvious.

There’s a plot here. Keep the cash pile healthy, ship the R2 on time, and let scale do the shouting. Tariff noise and supplier headlines haven’t knocked the timeline, and management says the cost hit per vehicle is coming down.

Markets love progress more than perfection, and this is the first stretch that looks like both.

Still, this is an early-stage story in a moody sector. EV demand zigs and zags, incentives change, and every launch has gremlins. Trade the stock like a trail you haven’t hiked, start slow, watch your footing, and don’t pretend there aren’t cliffs around the bend. If execution keeps clicking, the market will notice.

My Take For You: This looks like a good time to build a starter position on dips and let the R2 milestones be your guide. Holders can trim into rips and reset risk.

My Verdict: Cautiously optimistic, with training wheels still on.

Poll: Which one’s a bigger financial green flag in a partner?

Movers and Shakers

Lumentum Holdings [LITE]: Premarket Move: +15%

Record revenue and an AI tailwind have this laser-and-optics shop glowing like a fresh neon sign. Guidance came in hot, and the crowd is treating it like a backstage pass to the cloud build-out.

Just remember, this one sprints great on green lights, but is unforgiving on potholes.

My Take: Treat it like a momentum trade with guardrails. Starter size, trail a stop under yesterday’s range, and pay yourself on strength.

Axon Enterprise [AXON]: Premarket Move: −19%

Revenue beat, guidance up, yet profits whiffed and the stock face-planted. Investors love the software story, but a messy cost line turned the victory lap into a shoelace trip. Good company, rough quarter, and the tape is in a mood.

My Take: Let it settle. If it builds a base later today, buy, but if sellers keep swinging, keep your powder dry and revisit when margins stop wobbling.

CAVA Group [CAVA]: Premarket Move: −9%

The fast-casual favorite trimmed its outlook as younger diners ghost a bit, and the market sent back the bowl. Growth is still there, just less spicy, and traffic needs a refill before sentiment does.

My Take: Watch for a calming drift and improving tone. If it stabilizes, you can scale in slowly but if it keeps slipping, save the appetite for a cleaner setup.

Rare Market Moves (Sponsored)

Some stocks don’t just rise — they explode.

A new report reveals 5 stocks with the potential to gain 100%+ in the next 12 months, backed by strong fundamentals and bullish technical signals.

Past picks from this team have soared +175%, +498%, even +673%.¹

This free report gives direct access to the names and tickers — no fluff, just high-upside plays.

Available free until midnight tonight.

Everything Else

Novo’s obesity engine kept humming as Wegovy/Ozempic demand lifted Q3 and guidance.

Shell-shocked Dems are split between a message reset and digging in for a Trump rematch.

DC brinkmanship grinds on, with shutdown talk and filibuster fights crowding the to-do list.

Louisville’s airport halted ops after an aircraft incident, with authorities confirming casualties.

BP prevailed in a sprawling LNG dispute, beating a billion-plus claim as arbitrators sided with its contract reading.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.