A retail coffee giant is struggling with its fifth straight quarter of falling U.S. store sales, a construction giant warned of softer sales as demand dips, and a tiny biopharma is skyrocketing 130% on a $1.7B buyout deal. Here’s the latest on today’s market movers.

Uranium Demand (Sponsored)

On Behalf of Azincourt Energy Corp

With AI pushing power demand through the roof, nuclear is the only option.

Uranium demand is set to double. One junior may benefit most.

*Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Futures 📈

What to Watch

Earnings:

Microsoft Corporation [MSFT]: Aftermarket

Meta Platforms, Inc. [META]: Aftermarket

QUALCOMM Incorporated [QCOM]: Aftermarket

KLA Corporation [KLAC]: Aftermarket

Equinix, Inc. [EQIX]: Aftermarket

Economic Reports:

ADP employment [April]: 8:15 AM

GDP [Q1]: 8:30 AM

Employment cost index [Q1]: 8:30 AM

Chicago Business Barometer (PMI) [April]: 9:45 AM

Consumer spending [March]: 10:00 AM

Personal income [March]: 8:30 AM

PCE index [March]: 10:00 AM

Pending home sales [March]: 10:00 AM

Esports Market Watch (Sponsored)

This fast-moving digital media company—backed by the Dallas Cowboys’ owner—just acquired one of the most iconic gaming brands on the planet.

With projected revenues topping $100M and clients like Nestlé and GM, it’s building a next-gen platform that connects global brands to the hardest-to-reach audiences in Gen Z and Gen Alpha.

Their acquisition of a top-tier esports brand could be the turning point in the battle for youth attention.

Retail Coffee

Starbucks Shares Tumble as CEO Labels Q2 Results ‘Disappointing’

Shares of Starbucks (NASDAQ:SBUX) are down nearly 9% in premarket trading following a weak second-quarter earnings report that fell short of analyst expectations and underscored ongoing challenges in both U.S. and Chinese markets.

Comparable sales at U.S. locations are down 2%, marking the fifth consecutive quarter of negative same-store performance.

While the average spend per transaction is up 3%, total foot traffic dropped 4% as consumers opted for cheaper alternatives like McDonald's and Dunkin'.

In China, Starbucks' second-largest market, sales were flat year-over-year, with a 4% increase in visits offset by a 4% decline in how much each customer spent.

That modest improvement beat analyst expectations of a deeper decline but still signals cautious consumer behavior.

Adjusted earnings per share came in at $0.41, trailing Bloomberg’s consensus estimate of $0.49.

Revenue totaled $8.76 billion, missing projections of $8.83 billion. Operating margin dropped to 8.2%, falling short of the 9.5% analysts had forecast.

CEO Brian Niccol, who took the helm last year after leading Chipotle, admitted that the quarter’s performance was underwhelming but highlighted internal progress through the company’s “Back to Starbucks” plan.

That strategy includes streamlining the menu, accelerating service times, and boosting brand momentum in China.

Despite Niccol’s optimism, broader macroeconomic headwinds—particularly inflation, weaker global sentiment, and trade-related pressures like recent tariffs targeting China—continue to weigh on Starbucks’ recovery.

The company also faces internal hurdles, including unresolved labor negotiations and a workforce reduction earlier this year.

With 19% of its global store base in China, Starbucks remains heavily exposed to shifting geopolitical and consumer trends in the region.

Construction & Mining Equipment

Caterpillar Sees Profit Slide as Equipment Demand Softens

Caterpillar (NYSE: CAT) reported a decline in first-quarter earnings today morning as demand for its construction machinery softened, with the company warning that full-year revenue could be negatively affected by recently implemented tariffs.

The industrial giant’s quarterly adjusted earnings are down to $4.25 per share from $5.60 a year ago.

Revenue is down 10% year over year to $14.2 billion.

The slowdown in performance comes amid economic uncertainty, which has curbed large-scale construction activity and prompted dealers to reduce inventories in response to muted demand.

Caterpillar previously enjoyed a boost from the 2021 U.S. infrastructure law — a $1 trillion initiative under the Biden administration that spurred project spending.

However, recent macroeconomic pressures such as elevated interest rates and inflation have dampened both public and private sector investment momentum.

In an unusual move, Caterpillar issued two full-year guidance scenarios — one that factors in the effect of tariffs, and one that does not.

Under the more cautious forecast, annual sales are expected to come in slightly below 2024 levels, with tariffs cited as a key reason for the anticipated decline.

The company, often viewed as a barometer of global economic health, now faces growing challenges from shifting trade policies and financing costs.

With dealers adjusting their inventory strategies and infrastructure project pipelines moderating, Caterpillar’s near-term growth outlook remains clouded.

Energy Shift (Sponsored)

On Behalf of Azincourt Energy Corp

Drill campaigns. Uranium-bearing zones. And prime territory next to billion-dollar discoveries.

This stock is positioned to grow.

*Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Energy

Weak Refining Margins and Rising Debt Weigh on TotalEnergies' Q1 Results

Shares of TotalEnergies (NYSE: TTE) are down 1.2% today morning after the French energy major posted a weaker-than-expected first-quarter performance, citing a surge in debt and lower earnings across most business units.

Adjusted net profit for the quarter is at $4.2 billion, down 18% from the prior year and just shy of the $4.3 billion consensus estimate from analysts.

The company’s net debt more than doubled to $20.1 billion from $10.9 billion in the previous quarter.

TotalEnergies attributed the increase to seasonal working capital needs, which it expects to ease later in the year.

However, analysts are expressing concern about the scale of the debt jump, especially given that free cash flow, even before working capital adjustments, only totaled $2.5 billion.

This much free cash flow is insufficient to cover both dividend payments and planned $2 billion in share repurchases for the second quarter.

Despite a 4% rise in oil and gas output, earnings from the upstream segment slipped 6% due to softer crude prices.

The refining and chemicals division took the hardest hit, with profit down 69% year-over-year, largely driven by weak European demand and heightened global competition.

Marketing and services revenue also declined, dropping 6% annually and 34% sequentially, which the company linked to seasonal fluctuations.

One bright spot was the integrated LNG business, which saw a 6% annual gain, though earnings still dipped 10% from the fourth quarter.

The results contrast with peers like BP and Galp, both of which also reported significant drops in Q1 earnings.

TotalEnergies continues to straddle both traditional hydrocarbons and renewable energy expansion, maintaining its dual investment strategy amid challenging market dynamics.

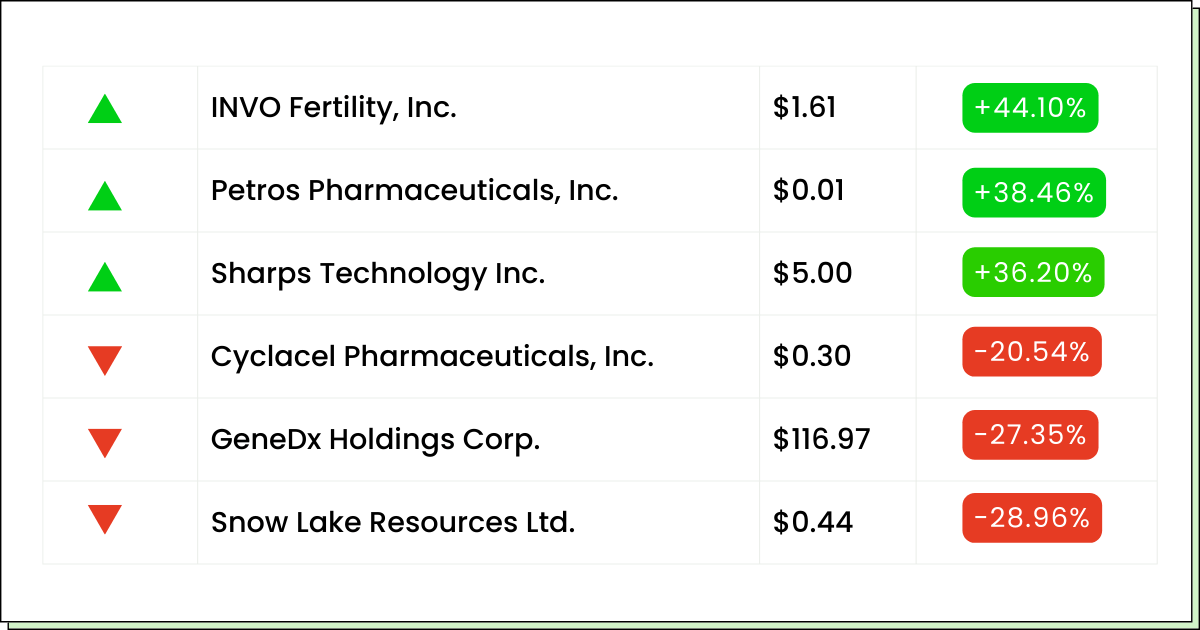

Movers and Shakers

WW International, Inc. [WW] - Last Close: $0.73

WW International is ad health and wellness platform that provides weight loss solutions.

Its shares are soaring nearly 19% after the company announced a new partnership with Eli Lilly’s LillyDirect pharmacy provider, Gifthealth. The deal will allow WeightWatchers Clinic members to access Zepbound—Lilly’s GLP-1 weight loss drug—in single-dose vial form, especially benefiting self-pay patients without insurance.

My Take: WW is capitalizing on the weight loss drug boom and aligning itself with Eli Lilly, a major player. If it can scale this partnership, the company could become a key access point in the future. Keep a close watch on how the integration goes.

ODDITY Tech Ltd. [ODD] - Last Close: $47.13

ODDITY Tech is a fast-growing beauty and wellness tech company leveraging AI and data science to personalize cosmetics and skincare solutions.

Its shares are jumping 17% in premarket trading after reporting stronger-than-expected Q1 results and raising its full-year outlook. Adjusted earnings of $0.69 per share topped the $0.62 analyst forecast, while revenue climbed to $268.1 million, beating estimates by nearly $8 million.

My Take: ODDITY is up 9% YTD and has shown impressive growth in both revenue and margins in the last few years, proving that tech-driven beauty has staying power. It could be a strong long-term prospect to keep on your radar.

Regulus Therapeutics Inc.[RGLS] - Last Close: $3.37

Regulus Therapeutics is a clinical-stage biopharma company pioneering therapies that target microRNAs. Its lead candidate, farabursen, offers hope for patients with autosomal dominant polycystic kidney disease (ADPKD).

Regulus shares are skyrocketing 130% after announcing a definitive agreement to be acquired by Novartis for $7.00 per share in cash, plus a contingent value right (CVR) worth an additional $7.00 based on future regulatory approval of farabursen. The all-cash deal represents a 274% premium to Regulus’ 60-day average share price, valuing the transaction at up to $1.7 billion.

My Take: This is a big win for Regulus and its investors. The deal validates microRNA-targeting as a viable therapeutic strategy, and with Novartis backing farabursen, approval odds—and market reach—just got a major boost.

Energy Sector Watch (Sponsored)

On Behalf of Azincourt Energy Corp

Uranium has doubled since 2020.

Saskatchewan’s uranium sales just hit $2.6 billion, up 62% year-over-year.

Cameco says the long-term outlook has never been stronger.

Now layer on the global demand curve:

30+ countries pledging to triple nuclear capacity

AI data centers expected to use 12% of US electricity by 2028

Germany reversing course and returning to nuclear

The setup is here.

And one company has plans to drill in the heart of it all: Canada’s Athabasca Basin.

With early uranium hits, expanding alteration zones, and proximity to NexGen and Cameco, this could be the next name to watch in the sector.

*Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Everything Else

Fast food promotions help Yum Brands hold steady despite an income drop.

Luxury cruise operator Norwegian Cruise Line faces headwinds as economic anxiety grows.

Super Micro’s surprise downward forecast cut sparks fears of cooling AI spending.

Booking tops Wall Street estimates but trims its full-year outlook amid global headwinds.

Visa's strong quarter was backed by record profits and a massive share repurchase plan.

Volkswagen’s profit tumbles as U.S. trade tensions complicate global car sales.

After a rough 2024, Stellantis holds back on forecasts as U.S. trade policy clouds outlook.

Barclays rides market turbulence to a profit surge despite global uncertainty.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.

*Standard message/carrier rates may apply.

Legal Stuff: Stocks featured in this newsletter are for entertainment purposes only. You should not base any investment decisions on information contained in my newsletter. Stocks featured in this newsletter may be owned by owners/operators of this website, which could impact our ability to remain unbiased. Please consult a financial advisor before making any trading decisions. I may earn a small commission from links placed inside these emails.