Good morning. It’s November 21st, and today we’ll take a look at Deere & Co, PDD, and NVIDIA’s disappointing earnings reports, along with a tiny hospital supply chain stock that has doubled itself in premarket trade.

Previous Close 📈

The tech heavy Nasdaq retreated yesterday as investors digested NVIDIA’s latest earnings and reassessed the market’s high valuations. The S&P 500 remained flat, while the Dow was up marginally by 0.3%.

Futures

U.S. stock futures are trading lower today. Nasdaq-100 futures are down 0.3%, S&P 500 futures are below by 0.2%, and Dow Jones Industrial Average futures are also dipping by 25 points (0.1%).

Technology

A new player is shaking up the smartphone industry, turning what has always been a cost into a source of income.

With their innovative flagship product, consumers have already earned and saved over $325M, and the company’s growth speaks for itself.

From 2019 to 2022, they achieved an incredible 32,481% revenue increase, earning a spot as the fastest-growing software company on a leading industry list.

Now, their pre-IPO offering is live at just $0.25/share. With over 20,000 shareholders already jumping in during previous sold-out rounds, this is a rare chance to join early in what could be the next major disruption.

Investors who act now can even lock in 100% bonus shares before the raise closes for good.

What to Watch

Expect to see earnings statements from several big names before the market opens today, including PDD Holdings (NASDAQ: PDD), Deere & Company (NYSE: DE), Baidu (NASDAQ: BIDU), Warner Music Group (NASDAQ: WMG), and BJ's Wholesale Club Holdings (NYSE: BJ) in the morning.

After close of the day’s trade, Intuit (NASDAQ: INTU), Copart (NASDAQ: CPRT), Ross Stores (NASDAQ: ROST), Elastic (NYSE: ESTC), and Gap (NYSE: GAP) will also report their results.

Watch out for the numbers on the Initial Jobless Claims for November at 8:30 a.m. ET. At 10:00 a.m. ET, both Existing Home Sales for October and the Leading Economic Index for October will be published.

Agricultural Machinery

Deere's 2025 Outlook Misses Estimates as Farmer Spending Stalls

Deere & Co., the global leader in agricultural machinery, anticipates a tough 2025 fiscal year, projecting net income between $5 billion and $5.5 billion, below Wall Street’s expectations of $5.83 billion. This marks a significant decline from the nearly $7 billion earned in fiscal 2024.

The company earnings for the fourth quarter are better-than-expected, but despite this, the firm’s forecast is bleak as it is grappling with a prolonged downturn in farmer spending following record sales in 2022, driven by high crop prices after Russia's invasion of Ukraine.

The broader farm equipment industry has struggled, with competitors CNH Industrial NV and AGCO Corp. cutting their forecasts earlier this month as demand continues to wane.

Adding to Deere's challenges is the political uncertainty surrounding President-elect Donald Trump’s threats to impose tariffs on goods manufactured in Mexico and sold in the U.S., potentially impacting Deere’s supply chain.

CEO John May highlighted the company’s efforts to align its operations with the shifting market landscape. "Amid significant market challenges this year, we proactively adjusted our business operations to better align with the current environment," May said in a statement.

Deere’s shares are down 1.22% in premarket trading.

E-Commerce

PDD Reports Slower Growth, Shares Drop Over 9% in Premarket

PDD Holdings, the parent company of Chinese e-commerce platform Pinduoduo, reported third quarter revenue below market expectations, highlighting challenges in luring cost-conscious consumers amid economic uncertainties.

The company’s 44% revenue increase to 99.35 billion yuan ($13.72 billion) for the quarter ending September 30 is below analysts’ forecast of 102.65 billion yuan.

The miss reflects broader difficulties in China's retail landscape, with weakened consumer confidence stemming from high youth unemployment and a protracted property crisis.

Rivals Alibaba and JD.com have also reported sluggish sales growth in recent quarters. Pinduoduo, known for its low-cost model, has faced intensifying competition as rivals ramp up discounts, sparking a fierce price war.

Net income for the quarter is 24.98 billion yuan, up from 15.54 billion yuan in the same period last year, signaling resilience in profitability despite rising competitive pressures.

Shares of PDD are down 9% in premarket trading, underscoring investor concerns over the company’s ability to sustain growth in a challenging economic environment.

The company’s performance reflects the increasingly competitive dynamics of China’s e-commerce sector, where promotional offers alone may no longer suffice to drive consumer spending.

Semiconductors

Global Chip Stocks Dip as NVIDIA’s Q3 Results Trigger Market-Wide Caution

NVIDIA shares are down 1.7% in premarket trading today after the company’s third-quarter results failed to meet sky-high investor expectations, despite surpassing revenue and earnings forecasts. Revenue surged 94% year-over-year to $35.08 billion, outperforming the $33.16 billion estimate, while adjusted earnings per share hit $0.81, also beating predictions.

However, the market reaction was lukewarm as NVIDIA’s revenue growth decelerated compared to previous quarters. Earlier this year, NVIDIA posted revenue growth of 122% in Q2 and over 260% in the first two quarters. This slowdown raised concerns among investors who have become accustomed to NVIDIA’s breakneck pace of expansion, particularly in the AI and high-performance chip segments.

The ripple effects of NVIDIA’s dip are being felt across the semiconductor industry, with major players like Intel, Qualcomm, AMD, and Micron all seeing declines in premarket trading. European and Asian semiconductor firms, including ASML, TSMC, and Foxconn, are also facing similar trends.

NVIDIA’s dominance in AI chips remains unchallenged, and analysts are optimistic about the launch of its next-generation Blackwell chip. CEO Jensen Huang highlighted robust demand for the new product during the earnings call, suggesting a strong pipeline ahead.

Technology

The marketing industry is being transformed, and one AI startup is leading the charge. Delivering 3.5X ROI to Fortune 1000 clients and backed by the likes of Adobe Fund, Meta, and Google, this company is experiencing extraordinary growth.

Its valuation has skyrocketed from $5M to $85M in just three years, and revenue is doubling year over year.

But here’s the thing—while some investors are seizing this opportunity, most are missing out. AI innovation is reshaping industries at lightning speed, and those who act early often see the greatest rewards.

Sitting on the sidelines could mean watching this company’s growth story unfold without being a part of it.

At just $0.50 per share, with a 10% bonus for early investors, this is a rare chance to get in before the broader market catches on.

The traction is undeniable, and the potential for exponential returns is clear.

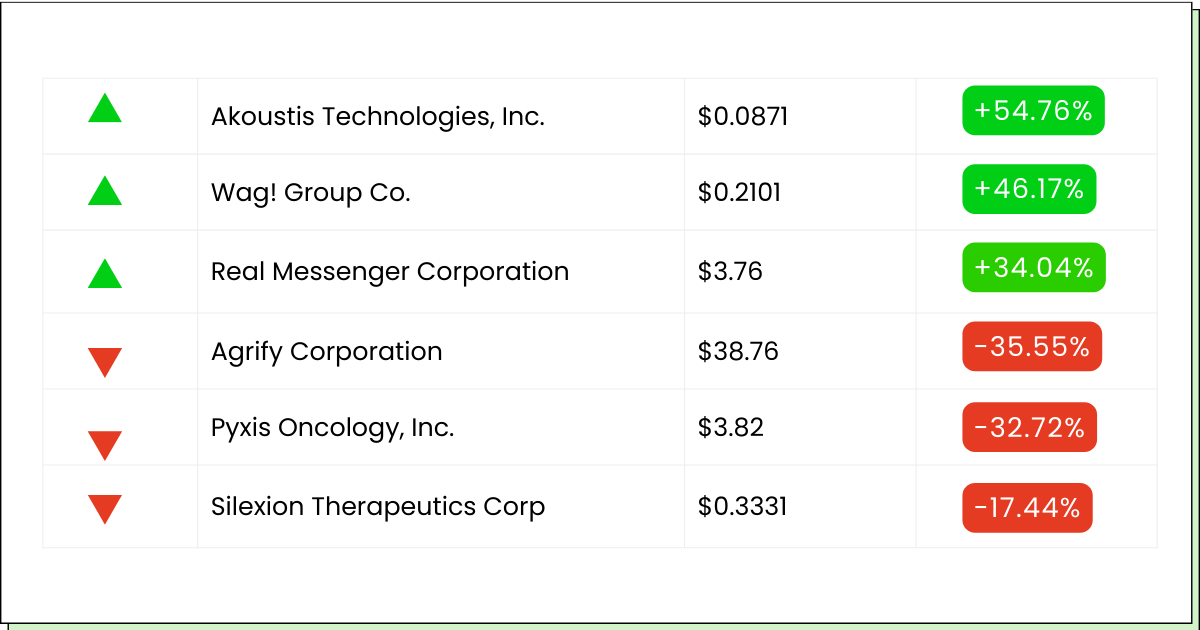

Movers and Shakers

Semler Scientific [SMLR] - Last Close: $59.27

Semler Scientific shares are surging by 23% in premarket trading.

Between November 6 and November 15, 2024, the company acquired 215 bitcoins for $17.7 million, averaging $82,502 per bitcoin.

This brings their total holdings to 1,273 bitcoins, purchased at an average price of $69,682 each.

As Bitcoin rapidly nears the $100,000 mark, Semler’s stock has grown 21.93% in the last 5 days.

Additionally, Semler Scientific recently raised $21.5 million through a controlled equity offering agreement with Cantor Fitzgerald & Co., allowing for the issuance and sale of up to $50 million of its common stock.

My Take: The massive post-election Bitcoin rally has sent stocks like SMLR upwards big time. Keep your eyes on this stock for future growth.

Snowflake Inc. [SNOW] - Last Close: $129.12

Snowflake is surging by 22% in premarket trade today,

Its third-quarter fiscal 2025 earnings report released yesterday was beyond market expectations.

The company reported adjusted earnings of 20 cents per share, surpassing analysts' estimates of 15 cents, and generated revenue of $942 million, up from $734 million the previous year.

Product revenue, a key metric, rose 29% to $900 million, exceeding the anticipated $848 million.

For the upcoming quarter, Snowflake forecasts product revenue between $906 million and $911 million, higher than the consensus estimate of $882 million.

Additionally, the company raised its full-year product revenue guidance to $3.43 billion from $3.36 billion.

My Take: While Snowflake’s strong financial results and optimistic projections are fueling today’s rally, the stock is down -31.73% YTD. It might be best to adopt a wait and watch approach for now with this one.

Scworx Corp. [WORX] - Last Close: $0.98

SCWorx Corp.’s stock price is rallying by 102% in premarket trading.

This surge follows the company's announcement that it has regained compliance with Nasdaq's periodic reporting requirements.

Earlier in 2024, the hospital supply chain firm had received multiple notifications from Nasdaq regarding delays in filing its annual and quarterly reports, which put its listing status at risk.

By submitting the necessary filings in October 2024, including the Form 10-K for 2023 and Forms 10-Q for the first and second quarters of 2024, SCWorx has addressed these compliance issues.

Nasdaq has since confirmed that the company meets its listing standards, effectively removing the threat of delisting. This resolution has likely boosted investor confidence, contributing to the sharp rise in the stock's premarket value.

My Take: Given the compliance history, it might be best to keep this stock on your wait and watch list for now.

Mobile Industry

For the first time in over a decade, the smartphone market is facing a disruption that could change everything.

This innovative company has developed a product that turns smartphones into income-generating devices, helping consumers save and earn over $325M to date.

Their growth is nothing short of remarkable—32,481% revenue increase from 2019 to 2022—and now, they’re offering a rare opportunity for investors.

Shares are available at just $0.25 in their pre-IPO raise, and those who act quickly can secure 100% bonus shares.

This is more than just an investment—it’s a chance to be part of the next major shift in the tech industry.

Everything Else

Trustar Capital raised $1 billion for a continuation fund holding its McDonald's China stake.

Starbucks considers a stake sale in China operations amid falling sales.

Key Cum-Ex informant Kai-Uwe Steck faces trial over €428 million tax fraud.

U.S. prosecutors accuse Indian billionaire Gautam Adani of bribery in solar energy contracts.

Baidu posted mixed Q3 results with strong net income growth but falling ad revenue.

Uber explores a partnership with Pony AI for self-driving technology outside the U.S.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.