One under-the-radar name in clinical research has gone full meme mode with a blowout quarter and a 44% premarket pop. A legacy automaker is dodging tariffs with strategic factory shifts, and a $14B distributor is making moves with ex-Walmart leadership in tow. Here's what traders are watching now.

Undervalued Sector (Sponsored)

A well-known strategist just teased what could be one of the boldest calls of his 20+ year career.

He’s already helped everyday investors get in early on major winners — and now he’s set to reveal his next pick 100% free.

The opportunity? A perfect storm of market forces that could trigger massive upside in a single overlooked corner of the market.

The full breakdown drops July 24 at 2 p.m. ET — and it’s completely free to attend.

(By signing up, you agree to receive emails from OxFord Club. You can unsubscribe anytime. See our Privacy Policy.)

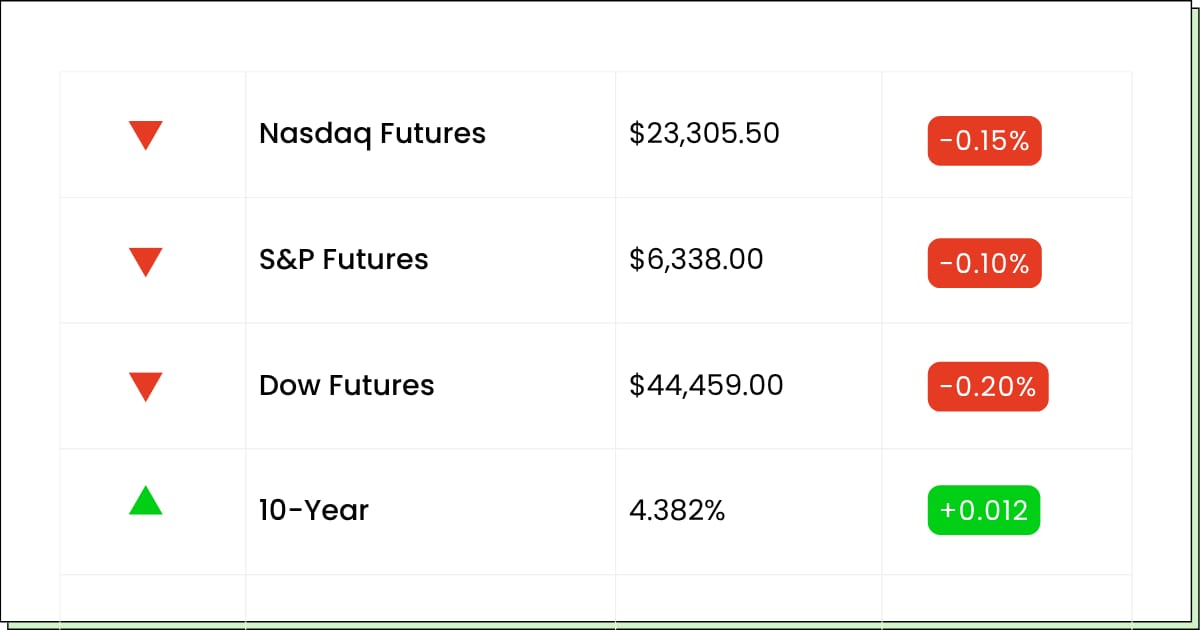

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Premarket:

Coca-Cola Company [KO]: Premarket

Philip Morris International Inc. [PM]: Premarket

RTX Corporation [RTX]: Premarket

Danaher Corporation [DHR]: Premarket

Lockheed Martin Corporation [LMT]: Premarket

Sherwin-Williams Company [SHW]: Premarket

Northrop Grumman Corporation [NOC]: Premarket

General Motors Company [GM]: Premarket

PACCAR Inc. [PCAR]: Premarket

MSCI Inc. [MSCI]: Premarket

Aftermarket:

SAP SE [SAP]: Aftermarket

Texas Instruments Incorporated [TXN]: Aftermarket

Intuitive Surgical, Inc. [ISRG]: Aftermarket

Chubb Limited [CB]: Aftermarket

Capital One Financial Corporation [COF]: Aftermarket

Canadian National Railway Company [CNI]: Aftermarket

Baker Hughes Company [BKR]: Aftermarket

CoStar Group, Inc. [CSGP]: Aftermarket

EQT Corporation [EQT]: Aftermarket

Enphase Energy, Inc. [ENPH]: Aftermarket

Economic Reports:

Fed Vice Chair for Supervision Michelle Bowman TV interview: 7:30 am

Fed Chair Jerome Powell opening remarks at banking conference: 8:30 am

Fed Vice Chair Michelle Bowman moderates panel at banking conference: 1:00 pm

Timing Advantage (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return—posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list—free.

Access the “7 Best Stocks for the Next 30 Days” now.

Autos

Tariff-Tested GM Delivers Strong Q2 As It Reshuffles Production Strategy

General Motors [GM] posted second-quarter results that outpaced analyst forecasts, despite ongoing concerns about rising costs tied to auto tariffs. The Detroit automaker reported adjusted earnings of $2.53 per share, beating the $2.44 consensus estimate. Revenue reached $47.1 billion, also above the $46.3 billion forecast, even as profits declined sharply year over year.

Net income came in at $1.9 billion, a 35% drop from the same quarter in 2024, reflecting higher input costs and early tariff impacts. Adjusted EBIT fell 32% to $3.04 billion. Despite those declines, GM reiterated its full-year guidance, which already includes a projected $4–5 billion hit from tariffs.

CEO Mary Barra emphasized GM’s efforts to “greatly reduce tariff exposure” through a mix of strategic investments and supply chain shifts. The company is moving some production of Mexican-built vehicles to U.S. plants and adding capacity in Michigan to offset pressure from President Trump’s 25% tariffs on imported vehicles and parts.

Investors are watching for signs of resilience as the second half of 2025 will be fully impacted by tariffs.

Meanwhile, GM’s EV outlook is facing uncertainty as federal tax credits for electric vehicles are set to expire after September, adding pressure to accelerate sales in Q3.

GM is doing a commendable job playing defense. They're managing costs, protecting guidance, and pivoting manufacturing to reduce exposure, all while tariffs and political risk grow louder.

However, the long-term story still hinges on the execution of EVs and how well they navigate shifting consumer demand. The fundamentals aren’t broken, but they’re being put to the test. Investors looking for stability may want to wait until tariff headwinds ease or EV clarity returns.

Shares are down about 3% in premarket trading.

Industrials

QXO Climbs 3% After High-Profile Hires Hint at Operational Reset

QXO Inc. [QXO] rose nearly 3% in early trading Tuesday following the announcement of two major executive hires aimed at overhauling its operations. The company has tapped Michael DeWitt, formerly of Walmart International, as Chief Procurement Officer, and Eric Nelson, formerly of Kraft Heinz, as CIO.

Both bring decades of experience in global supply chain, automation, and digital transformation.

The hires underscore QXO’s strategy to modernize procurement and IT as it aims to scale in the $800 billion building products distribution industry. CEO Brad Jacobs said DeWitt’s track record, saving billions through AI-driven sourcing tools, will be key to unlocking value as the company targets $50 billion in annual revenue over the next decade.

Despite the upbeat tone, investor response has been measured. QXO remains early in its turnaround, with questions about board experience, integration of recent M&A, and long-term profitability still looming. The average board tenure is under two years, and high executive compensation continues to draw scrutiny from some analysts.

Still, the stock’s recent gains suggest optimism about the new leadership’s ability to steer a successful transformation. With execution risks in play, investors appear cautiously hopeful that QXO’s digital pivot could mark an inflection point.

As one of the few publicly traded distributors focused on building products, QXO offers exposure to a fragmented but massive sector. If operational improvements materialize, today’s move could mark the early innings of a longer re-rating cycle.

Next AI Boom (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Healthcare / Meme Stocks

Medpace Rockets 44% As Earnings Trigger Meme-Stock Style Rally

Medpace Holdings [MEDP] stunned investors with a 44% premarket jump after blowing past Q2 estimates and issuing bullish full-year guidance. The contract research firm posted GAAP net income of $90.3 million, or $3.10 per share, topping the $2.97 consensus. Revenue came in at $603.3 million, a 14.2% year-over-year increase, exceeding expectations.

Retail traders took notice. According to Stocktwits, bullish sentiment reached extreme levels, with some users reporting 900% gains in options overnight. The stock’s momentum suggests a return of meme-stock mania in a market hungry for upside surprises.

Medpace’s performance was driven by strength in biotech and pharma services. New business awards totaled $620.5 million, with a healthy book-to-bill ratio of 1.03. Adjusted EBITDA rose to $130.5 million with stable margins at 21.6%.

For full-year 2025, Medpace guided revenue to be between $2.42 billion and $2.52 billion and EPS to be between $13.76 and $14.53. Both figures are well above analyst expectations. That guidance reflects confidence in continued sector demand, cost controls, and growth in trial execution across global markets.

Despite a sluggish start to the year, MEDP now appears poised for its strongest single-day gain ever. The move may signal broader upside potential for underappreciated healthcare names, especially those positioned to benefit from AI-driven efficiency and increasing R&D spending.

Whether this surge has staying power will depend on follow-through buying and Q3 execution, but for now, Medpace has reignited a sense of FOMO among growth investors, which could continue to move if bullish sentiment remains.

Movers and Shakers

Opendoor Technologies [OPEN] – Last Close: $3.21

Opendoor operates an online platform for buying and selling residential real estate using its iBuyer model. After staring down delisting warnings earlier this year, the stock has staged one of the most explosive meme-style rallies of 2025.

Shares surged 42% Monday and are tacking on over 13% premarket as a short squeeze meets renewed retail momentum. The rally appears to be fueled by Reddit-driven speculation, massive short interest (~25% of the float), and bold calls from hedge fund EMJ Capital, which projected positive EBITDA for the next quarter and set a $82 target on the stock. Volume yesterday reached 1.8 billion shares, more than 13 times its daily average, and triggered a temporary trading halt.

My Take: Opendoor is the latest meme revival story. While this move is driven by momentum, bulls are eyeing a real turnaround if EBITDA turns positive in August. Watch closely, volatility is the only constant here but there are gains to be had.

IQVIA Holdings [IQV] – Last Close: $158.96

IQVIA is a global healthcare data and clinical research powerhouse, helping biotech and pharma firms bring treatments to market faster. Its sprawling portfolio of services — from AI-driven analytics to clinical trials — makes it a bellwether for the life sciences industry.

Shares are up 8.5% in premarket trading after the company beat earnings expectations and posted impressive bookings growth in its core R&D business. Adjusted EPS came in at $2.81, well ahead of Wall Street forecasts, while revenue grew 5.3% year over year to over $4 billion. Notably, its R&D Solutions backlog grew 5.1% and bookings jumped 15% from Q1, which are key forward-looking metrics that signal accelerating demand. The company also returned $607 million to shareholders via buybacks and raised its full-year profit outlook.

My Take: This is a clean beat with improving forward momentum in drug development services, a rare combination in this market. IQV still trades well below its 52-week high, but if growth holds, it may finally be ready to regain investor favor. Solid long-term compounder.

D.R. Horton [DHI] – Last Close: $131.22

D.R. Horton is America’s largest homebuilder by volume and has long been a bellwether for the housing market. The stock is up nearly 8% in premarket trading after issuing solid guidance and showcasing strength despite a dip in quarterly earnings.

Net income fell 18% year over year, but the company maintained robust gross margins, a low debt ratio, and $5.5 billion in liquidity. Management also returned $1.3 billion to shareholders last quarter. The stock now trades at just under 10x earnings, catching the attention of value investors, especially as it joins the newly launched NYSE Texas exchange and extends key funding lines.

My Take: DHI is a value play in a tough housing tape. Despite the earnings drop, its cash position, dividend history, and buyback power make it a solid anchor in today’s volatile market.

Unseen Trends (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Everything Else

AstraZeneca plans $50B U.S. investment as drug tariffs mount.

Beijing gets breathing room after Nvidia’s return to China.

Trump considers cutting ties with SpaceX amid growing friction.

Morgan Stanley remains bullish as U.S. stocks show strength.

AI energy deals lift Constellation’s shares following Meta partnership.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.